- Optimism surrounding China’s GDP, retail sales and industrial output beats didn’t last long

- USD/CNH has broken downtrend resistance whole the A50 has simply broken down

- Chinese property prices continued to fall in September, according to government data

Yesterday I asked whether Chinese markets like the A50 and USD/CNH had reached a turning point in terms of investor sentiment, encouraged by data seeming to suggest the economy has turned the corner. Well, they say markets aren’t the economy, and so it has proven to be over the past 24 hours. The answer to the question is undeniably no with both markets resuming their unwind.

CNH. A50 weakness coincides with ongoing property market weakness

The latest weakness coincides with data from China’s National Bureau Statistics (NBS) showing new home prices fell 0.2% in September following a 0.3% decline in August, leaving nationwide prices down 0.1% from a year earlier. The softness, coming despite a raft of government incentives to bring-forward homebuyer demand, followed data on Wednesday revealing an unexpected double-digit decline in property investment over the past year, reflective of the government’s push to limit risks to the economy posed by heavily indebted Chinese property developers such as Evergrande and Country Garden.

However, when property investment was allowed to become such a substantial part of the Chinese economy in the decade following the GFC, investors remain concerned about potential for negative unintended consequences.

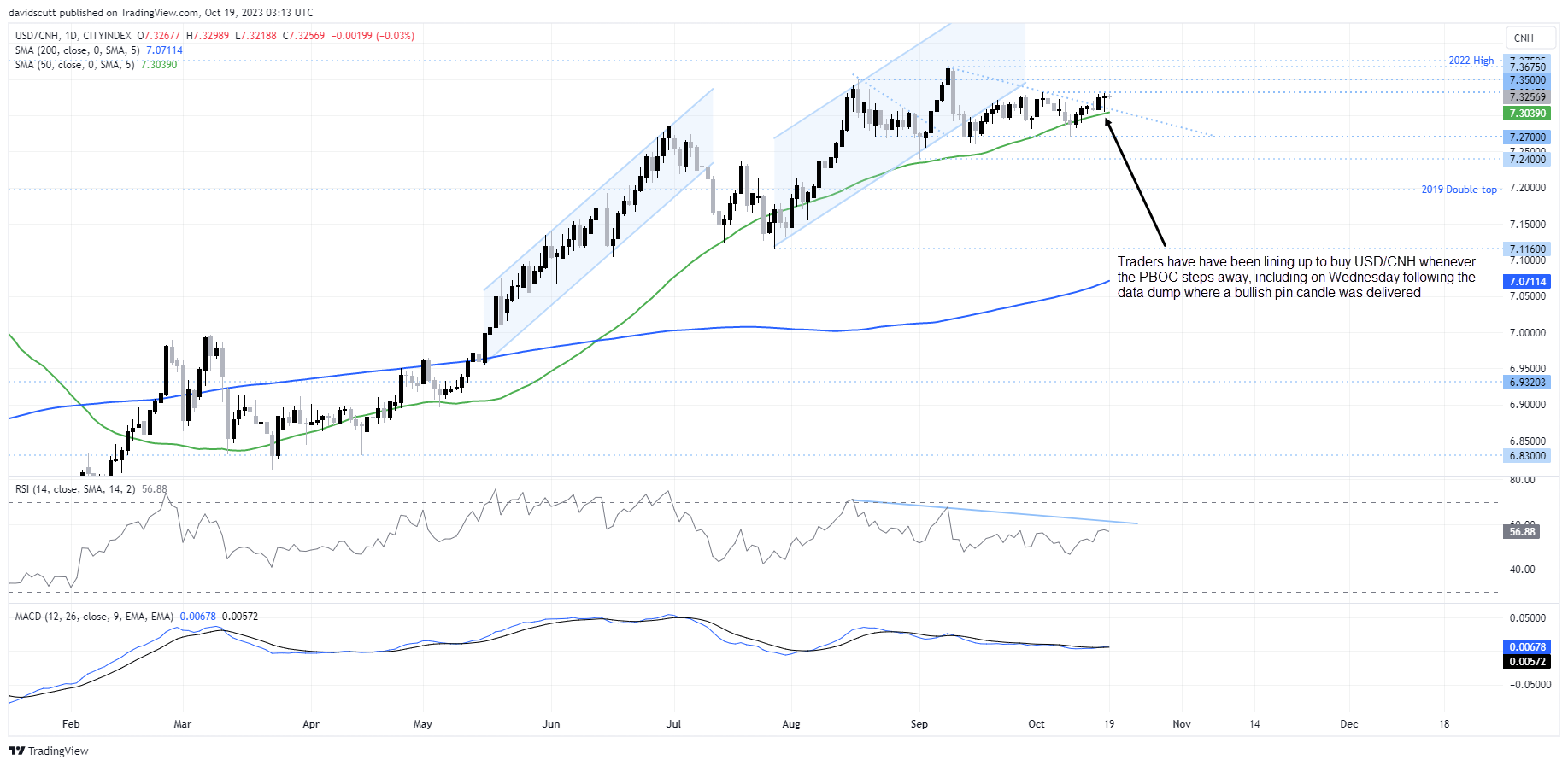

USD/CNH price action suggests sellers are in control

USD/CNH is bearing the brunt of that angst, continuing to hover near multi-year highs despite constant intervention from the People’s Bank of China (PBOC) to push against relentless market forces. Following China’s GDP and monthly indicators released on Wednesday, traders attempt to slam the pair back into its former triangle formation, succeeding briefly before stopping abruptly ahead of the 50-day MA. The subsequent unwind was ugly, ultimately producing a bullish pin par signaling USD/CNH buyers are in the ascendency whenever the PBOC steps back.

The pair is currently bumping up against resistance at 7.33170. Above that, 7.3500 is the next level to watch before we get to the 2022 high above 7.33750. On the downside, buying is likely to be found around the 50-day MA and again below 7.2700.

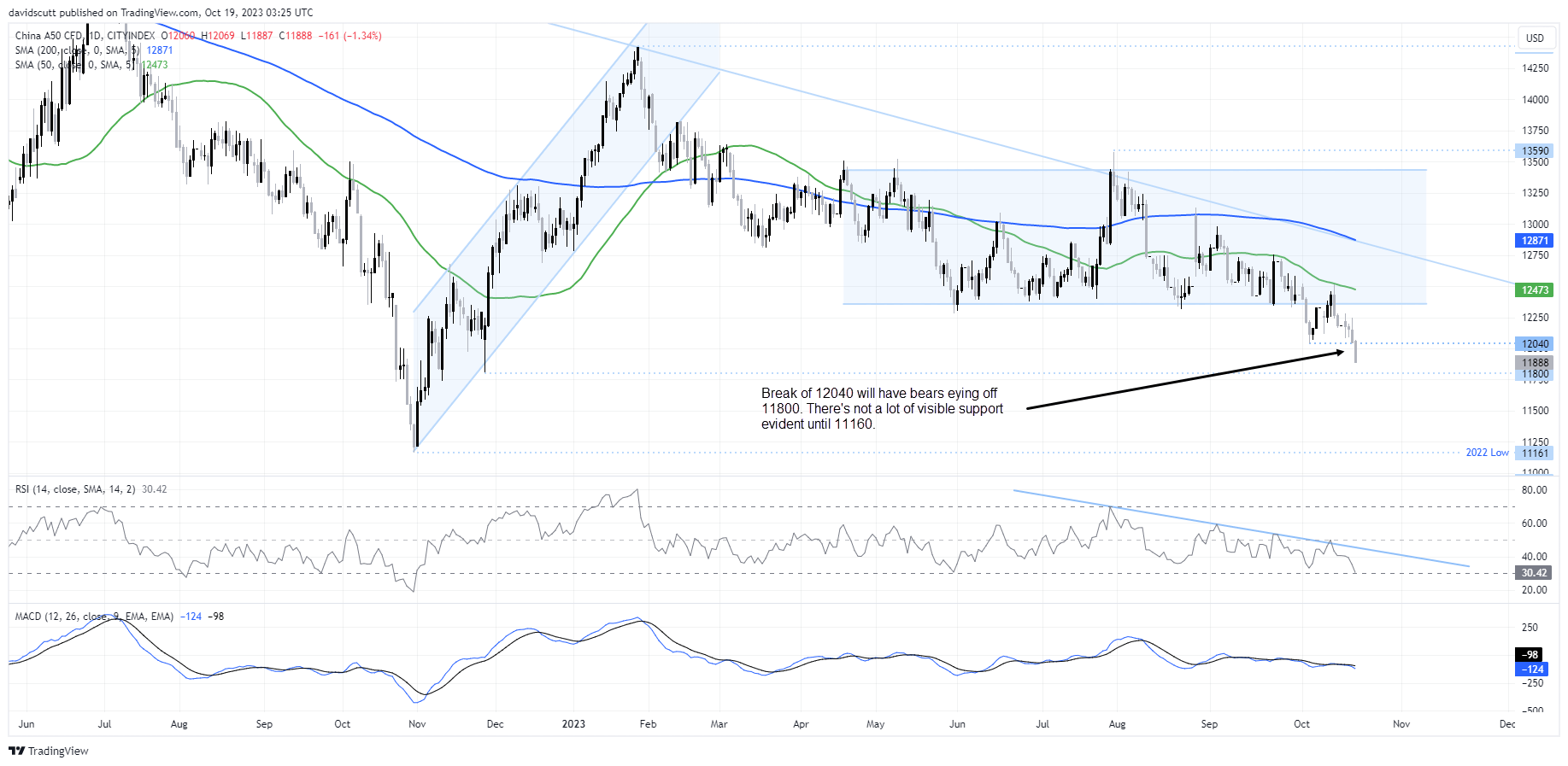

China A50 looks ugly

Like its currency, China’s bluechip stocks are also faring poorly, including the A50 which has broken down badly on the daily today. Through prior support at 12040, the index is moving towards 11800, where it bounced strongly late last year. After that, there’s not a lot of visible support evident until we get back to towards the 2022 low around 11160. On the topside, sellers may emerge at 12040 and again near 12350.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade