- USD/CAD analysis: Dollar finds support as Powell pushes back against dovish repricing

- US CPI and retail sales to come next week

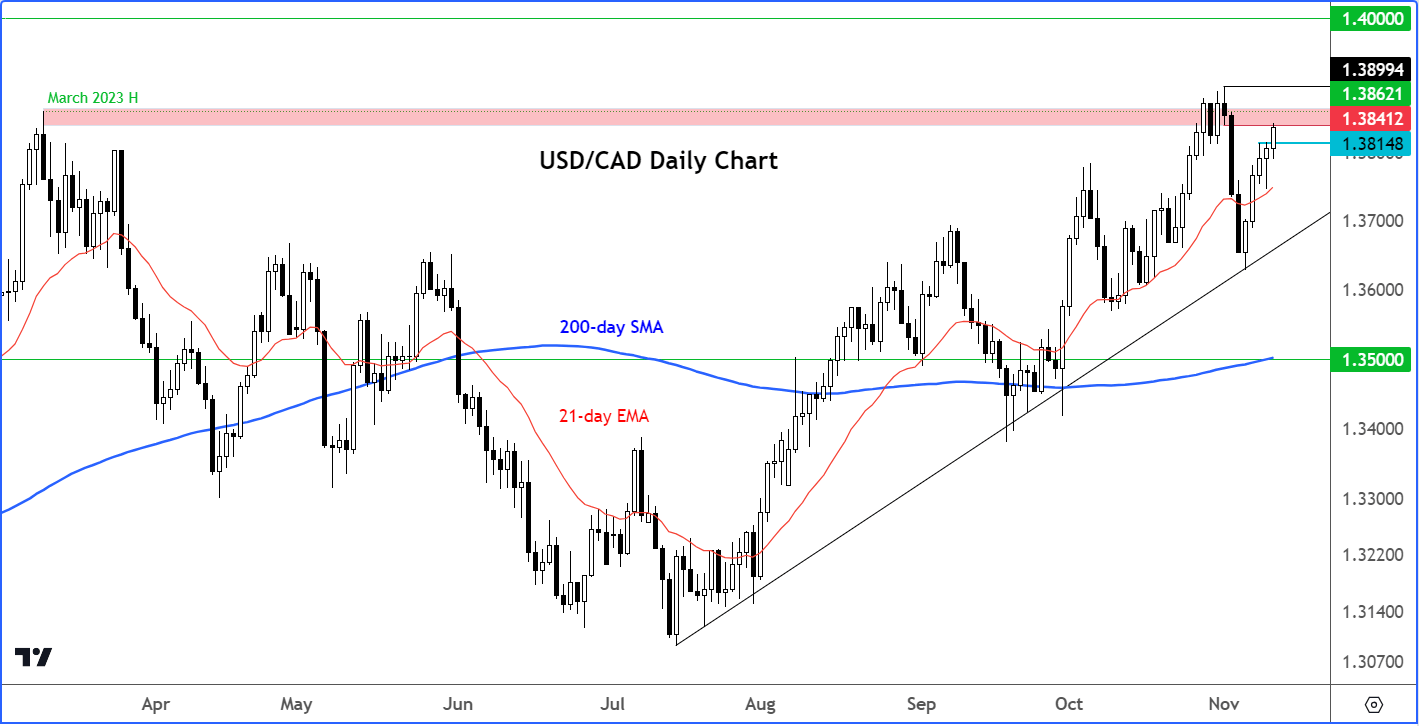

- USD/CAD technical analysis: Loonie arrives at key resistance zone circa 1.3850ish

The US dollar found modest further support on Friday following Thursday’s bullish reversal on the back of a soft 30-year Treasury auction and hawkish comments by Powell. The key question is whether those gains will last and on the evidence of today’s price action, I am not so sure. I don’t think the Fed Chair said anything out of the ordinary, although that’s not to say the dollar won’t necessarily rise further, if incoming data continues to surprise to the upside. I mean, you wouldn’t expect Powell to turn decisively dovish just on the back of a couple of weaker data points. Equally, with inflation remaining above-forecast for the past couple of months, he has to address the risks of it remaining elevated for longer, and the central bank’s readiness to act if required. Today’s main US data – the UoM’s consumer sentiment and inflation expectations surveys – provided a mixed picture. Consumer sentiment fell to 60.4 from 63.8 but inflation expectations rose to 4.4% from 4.2% previously, keeping the dollar on the front-foot. Next week we have important CPI inflation and retail sales data to look forward to.

USD/CAD analysis: Dollar finds support as Powell pushes back against dovish repricing

On Thursday we saw a rather soft 30-year Treasury auction while hawkish comments by Powell both helped to cause a rebound in US bond yields, which underpinned the dollar and undermined stocks. But so far in Friday’s session we have seen that move reverse a bit. Powell expressed the intention to proceed cautiously while being ready to implement policy adjustments to curb inflation if necessary. He said: “If it becomes appropriate to tighten policy further, we will not hesitate to do so,” in remarks at an International Monetary Fund conference in Washington on Thursday. Powell added that the Fed will “continue to move carefully, however, allowing us to address both the risk of being misled by a few good months of data, and the risk of over-tightening.” Following his sterner remarks, we saw the dollar come back noticeably as stocks and bonds turned lower, driving the two-year Treasury yields to above 5%. But on Friday, some of those moves reversed.

USD/CAD analysis: US CPI and retail sales to come next week

The week ahead is set to be a busier one, with key US CPI and retail sales data to provide fresh direction for the dollar and yields. US CPI will be released on Tuesday. For two consecutive months, it has surprised to the upside. In September, annual CPI remained unchanged at 3.7%, defying market expectations of a slight decrease following an even larger surprise the month before. Perhaps this is why the Fed Chair was more cautious when he warned of tightening monetary policy further if needed, with his comments providing the dollar and bond yields fresh bullish momentum. However, if we see a surprising weaker CPI print this time, then it will boost the “peak interest rates” narrative again and potentially hurt the dollar. Next week’s other key US data highlights include US retail sales, PPI and Empire State Manufacturing Index all on Wednesday, as well as US industrial production, jobless claims and Philly Fed Manufacturing Index on Thursday.

USD/CAD technical analysis

Source: TradingView.com

The USD/CAD was up for the fifth day this week, making back most of last week’s losses. However, it was now back inside the key 1.3840 to 1.3862 range, where it had found strong resistance back in March. This area is also the base of last week’s breakdown. So, we may see at least an attempt by the bears to hold their ground here.

However, if the bears fail to show up here and we close above the 1.3840-62 area then this could pave the way for follow-up technical buying pressure in the week ahead.

The underlying trend has been bullish with price holding above both the 21-day exponential and 200-day simple moving averages. In addition, we have an established bullish trend line connecting the major lows that have been created since rates bottomed in mid-July.

But the recent bullish reversal in stock markets and signs of peak US interest rates means there is now an increased risk of a bearish reversal. That said, the bears would be discouraged to see the USD/CAD come back this deep following last week’s big bearish engulfing candle. In other words, they needed to see some follow-through, but this has alluded them for now.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade