USD/CAD Key Points

- Another run of strong US data boosted the US dollar, while the Canadian dollar is struggling amidst falling oil prices.

- USD/CAD is testing 1-year highs in the mid-1.38800s.

- A bullish breakout here could expose the 2.5-year high at 1.3975 next.

USD/CAD Fundamental Analysis

It was another day, another run of strong US data yesterday.

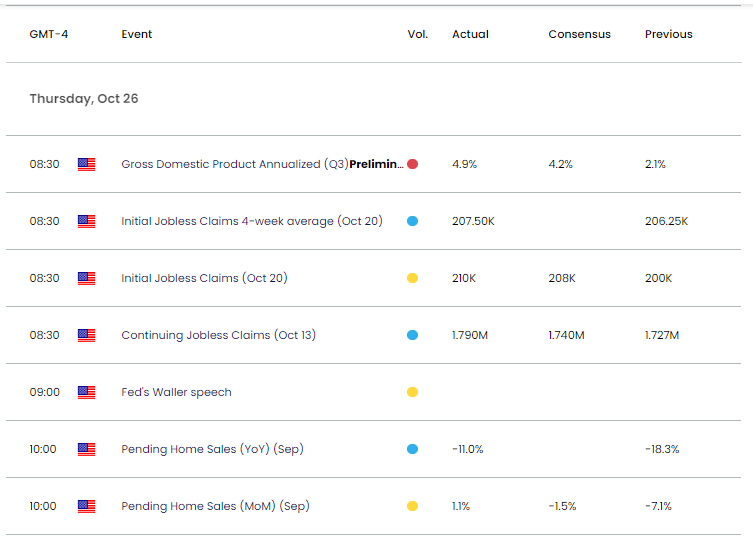

Yesterday morning’s US economic reports were almost unanimously stronger than anticipated, highlighted by 4.9% q/q annualized growth in Q3 GDP, an unexpected 0.5% m/m rise in Durable Goods Orders, and a 1.1% m/m uptick in Pending Home Sales.

Source: StoneX

Not surprisingly given the strong data, the US dollar was the strongest major currency on the day. Meanwhile, the Canadian dollar saw little in the way of economic releases, but another round of selling in oil, Canada’s most important export, pushed the loonie to the bottom of the relative strength tables.

Traders are increasingly skeptical that we’ll see another interest rate hike out of the Federal Reserve this cycle, but they’ve essentially priced out any more increases from the Bank of Canada entirely; Whether this flicker of hope for a widening interest rate spread between the US and Canada grows or gets snuffed out will be a key driver of how USD/CAD trades over the rest of the year.

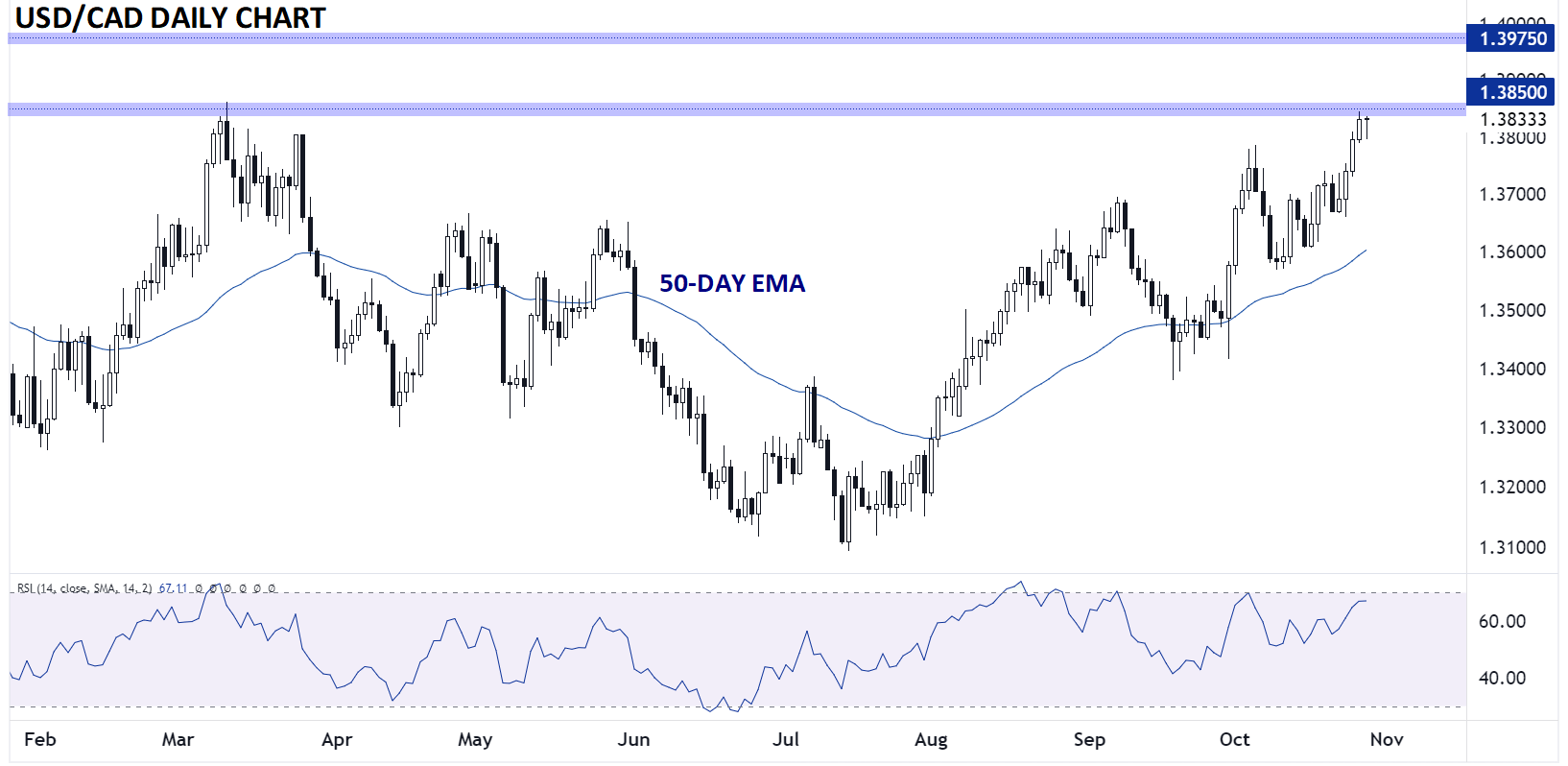

Canadian Dollar Technical Analysis – USD/CAD Daily Chart

Source: TradingView, StoneX

As the chart above shows, USD/CAD has rallied each of the first four days so far this week to trade above 1.3800, essentially the pair’s highest level since last October. For now, there is a potential bearish divergence with the 14-day RSI that could hint at a near-term top around previous resistance in the 1.3850 level, but a strong bullish break above that area would likely erase the divergence.

A move above 1.3850 could expose the 2.5-year high around 1.3975 next, whereas a bearish reversal could take rates down toward the mid-1.3700s without interrupting the medium-term bullish trend.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX