- The US dollar index continues to struggle above 105

- With markets scaling back Fed rate cut expectations rapidly, there is little room for dovish surprises in upcoming US economic data

- Silver has rocketed above $26, a level it has failed at consistently over the past two years

The overview

After the rapid repricing of Fed rate cut expectations since the beginning of the year, US economic exceptionalism is now arguably already priced into the USD, leaving little room for downside disappointment in upcoming economic data.

With commodities rallying despite the stronger dollar, any signs of weakness could provide even stronger tailwinds for the complex. We look at silver following its bullish break on Tuesday.

The background

US dollar upside continues to be fueled by widening interest rate differentials with the rest of the world, reflecting the rapid unwind of market expectations for rate cuts from the Fed this year. But moving from more than seven cuts to less than three in just a few months suggests US economic exceptionalism has been largely factored in.

While that’s benefited the US dollar index up until this point, it also makes it more difficult for the economic data to impress, suggesting only a risk-off episode, an unlikely reacceleration in US growth or pronounced slowdown abroad will be sufficient to spark meaningful dollar upside from these levels.

With the US dollar index (DXY) sitting at an important level on the charts, and having repriced the US rates trajectory so aggressively, even minor disappointment may be enough to take some heat out of the big dollar.

The trade setup

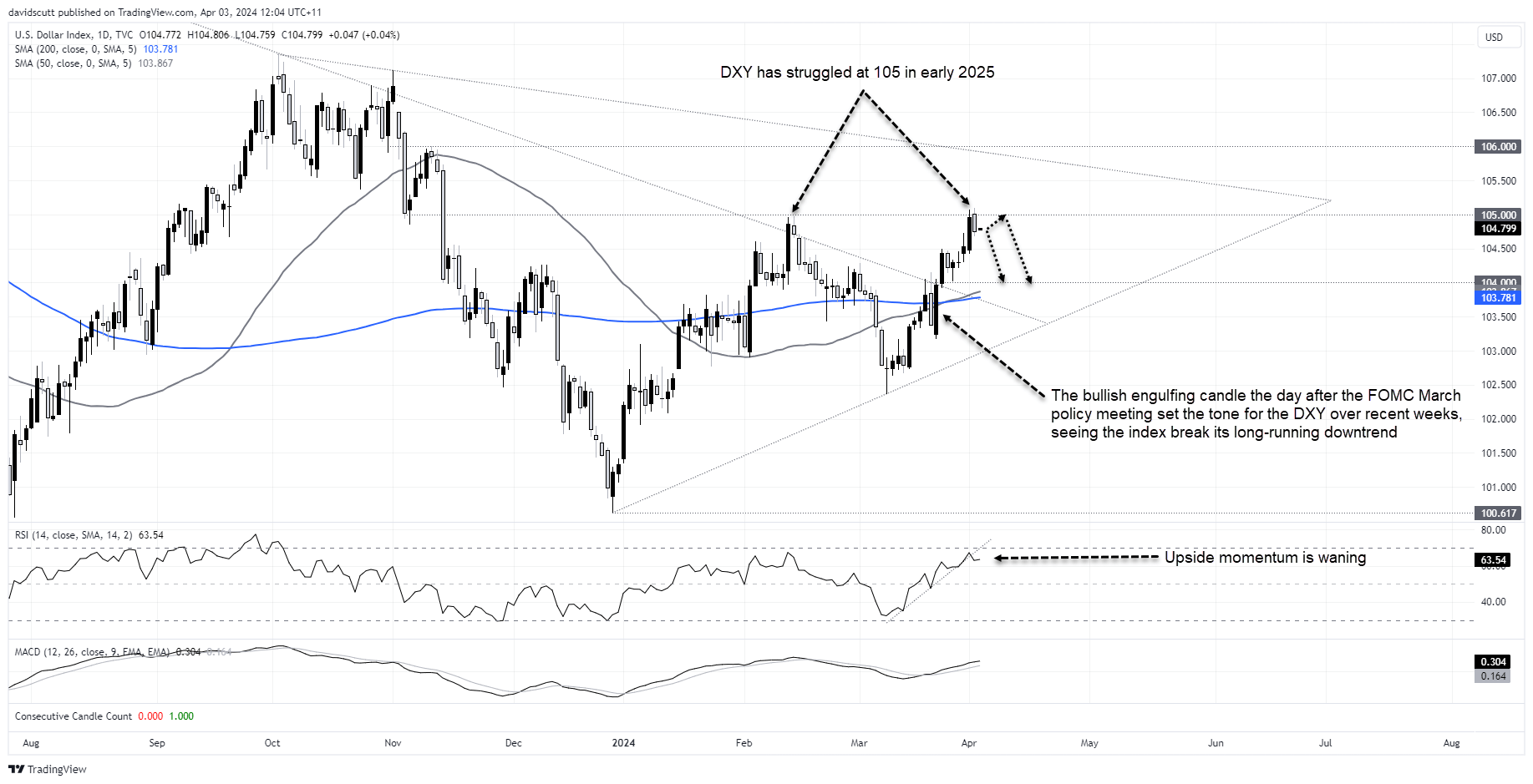

DXY struggles above 105 continue

Looking at the daily chart, the US dollar index has been trending higher since the beginning of the year, culminating in the DXY hitting fresh YTD highs on Tuesday before reversing towards the close. While the price action itself was not overly bearish, that’s four times the DXY has stalled or reversed around 105, explaining why it may be an important level for traders to watch.

Up until recently the DXY looked fantastic, breaking its downtrend from September 2022 convincingly with a bullish engulfing candle the day after the March FOMC meeting. But with plenty of good news priced into the buck, an inability to break convincingly through 105 may encourage traders to seek out near-term downside.

Having done some work either side of 104 in March, that looms as a potential downside target, especially with the 50 and 200-day moving average located just below. With RSI through its uptrend, that’s another warning sign the bullish thrust over the past few weeks is running out of steam.

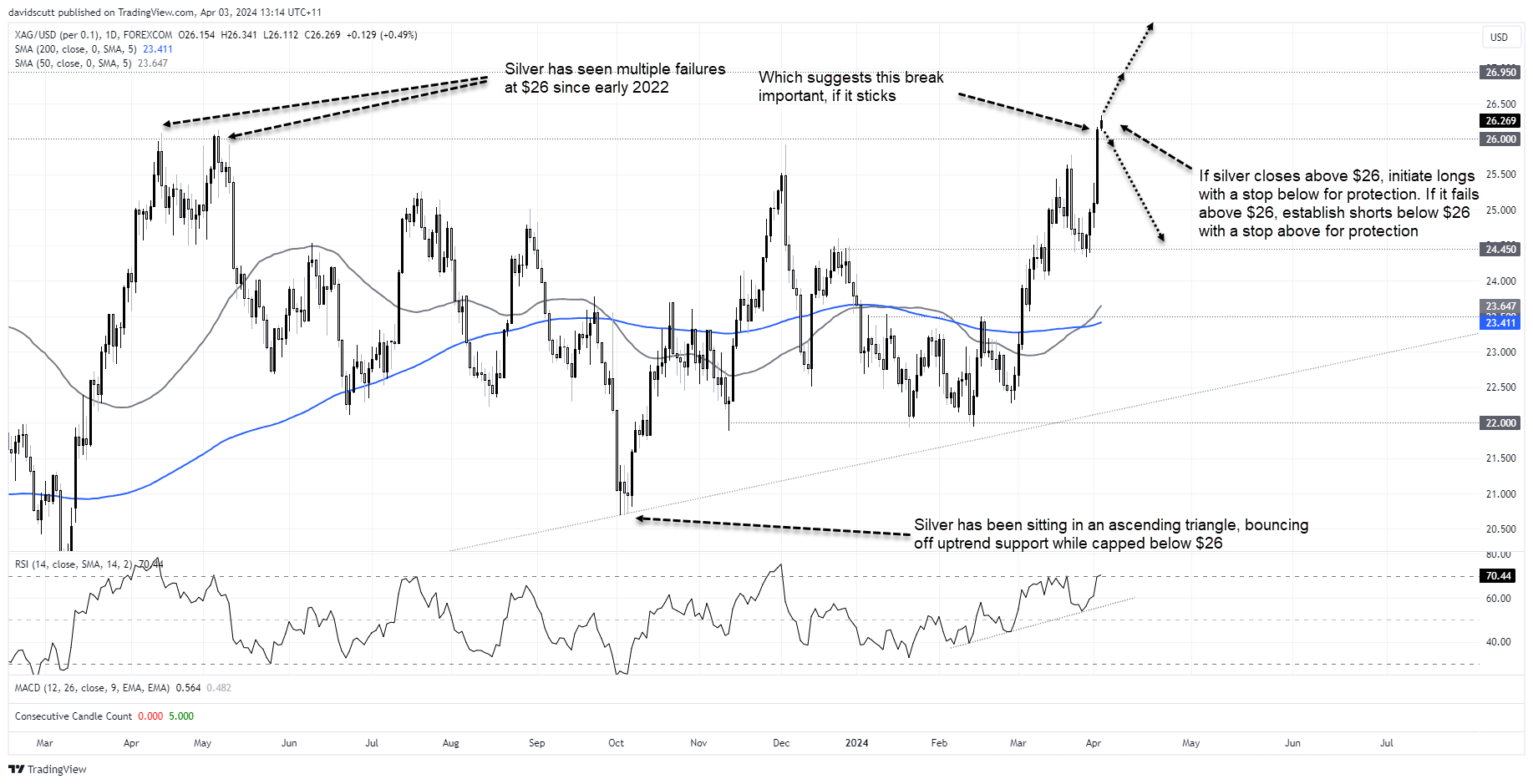

Silver on cusp of bullish breakout

With gold setting record highs on an almost daily basis, it’s noteworthy silver had a big spurt higher on Tuesday despite higher global bond yields and risk-off tone in riskier asset classes, taking the price back above $26, a level it has struggled to overcome in the past.

This break looms as significant, if it sticks.

Not only has silver had multiple failures above $26 over recent years but it’s also taken the price out of the ascending triangle it had been trading in since September 2022, pointing to the potential for some serious upside ahead.

The 2022 high of $26.95 looms as the first bullish target with resistance above $28.33 the next level after that. Those considering longs may want to see if the price close above $26 before initiating positions, allowing for a stop loss order top be placed below the level for protection. Even though the price is marginally overbought, as we’ve seen with other precious metal moves recently, that’s not necessarily an impediment to upside.

Should the price fail again at $26, the trade could be reversed with a stop above the figure and short position initiated below targeting a retracement to $24.45 or even $23.50.

The wildcards

It’s a busy economic calendar on Wednesday, providing ample opportunity to set the trajectory for the US dollar and silver price. US ISM services PMI and Eurozone inflation are the key events. If the former shows strength in prices paid, new orders and hiring intentions, it would be a dollar positive, and vice versus if weak.

The inflation print in Europe is expected to show the annual core reading easing a tenth of a percent to 3%. Downside risks appear more prevalent than upside based on national data received beforehand, meaning a result in line with expectations may boost the euro at the margin.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade