Market Summary:

Markets entered a phase of risk off near the end of the New York session on Thursday on rising geopolitical tensions, as Israel’s President Netanyahu threated to work against ‘Iran and its proxies’. This prompted Biden to call Netanyahu and request civilian safety, in order for the US to continue supporting Israel.

- Wall Street indices were quick to turn lower, with the S&P 500, Down Jones and Nasdaq all forming prominent bearish engulfing days

- Oil prices rose for a sixth day, sending WTI crude oil above $86 for the first time in nearly six months, whilst the Japanese yen and US dollar attracted safe-haven bids

- The Japanese yen was the strongest forex and also supported by safe-haven flows, and BOJ governor Ueda’s threat to “respond with monetary policy” if FX moves impacted wages and inflation.

- USD/fell to a 4-day low and AUD/JPY reversed sharply lower after hitting my 100 upside target outlined earlier this week.

- The US dollar index fell for a third day, although support was found just above the 200-day MA and EMA before recouping some of its earlier losses, to close the day with a bullish hammer.

- AUD/USD reached and exceeded yesterday’s upside target around 0.6590, trading briefly above 66c before pulling back near the end of the US session. Given the strength of the rally and reversal, I now have a neutral bias until we head into next week

- Fed members continued to shed doubt over a June rate cut, with Barkin saying the central bank has “time for the clouds to clear” before easing, and Kashkari saying that rate cuts could be under threat if the slowdown if inflation continues to stall

- Gold snapped an 8-day bullish streak

Events in focus (AEDT):

- 23:30 – US Nonfarm payrolls report, Fed Collins speaks

- 23:30 – Canadian employment report

- 01:00 – Canadian Ivey PMI

- 03:15 – FOMC Bowman speaks

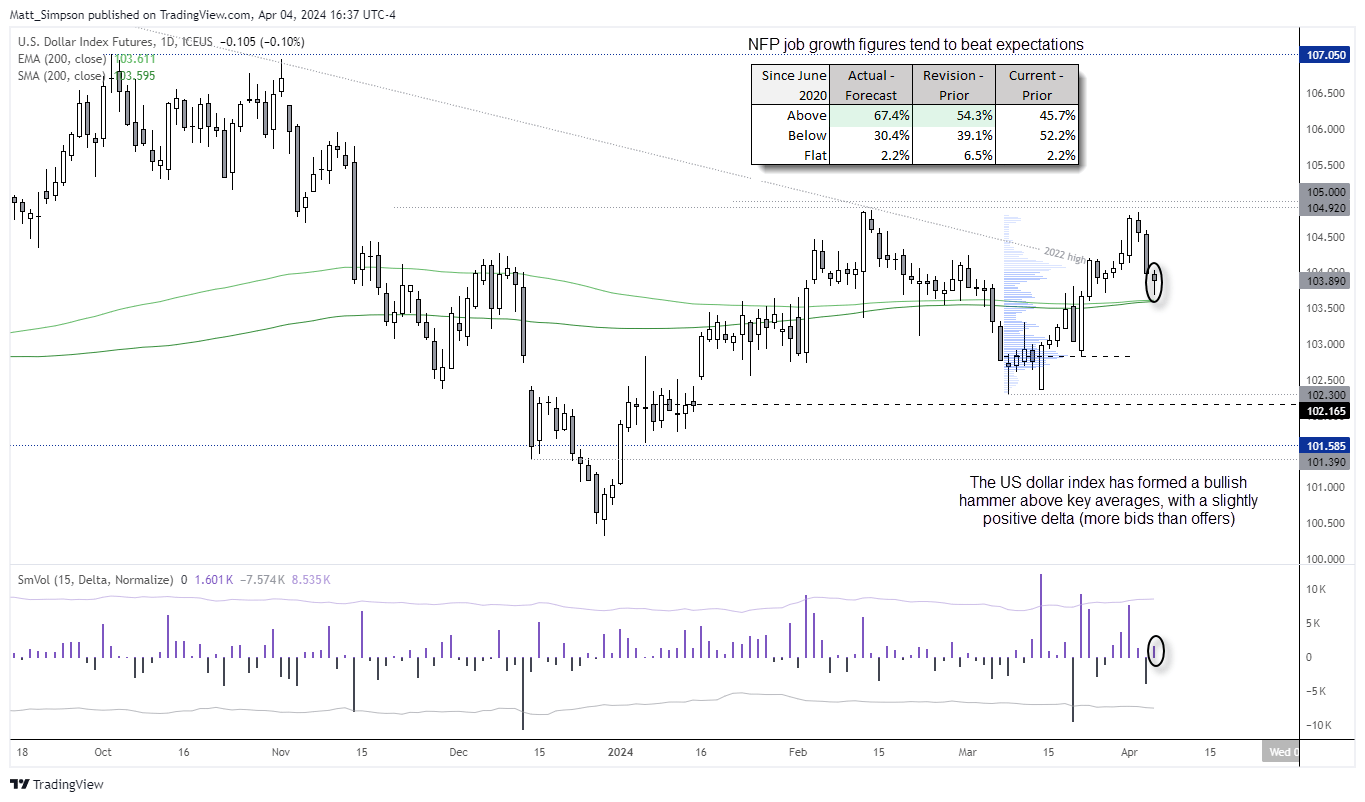

US dollar index technical analysis:

The dollar retraced lower for a third day, finding support just above the 200-day MA/EMA and closing the day with a bullish hammer. Volume delta was slightly positive which means there were more bids than offers, which further suggests the dollar is trying to form a swing low.

As noted in an article yesterday, NFP job growth has beaten analyst estimates 67.4% of the time since June 2020, and the previous figure has been upwardly revised 53.4% of the time. With odds of another NFP on side and the US dollar index holding above key support, the bias is for a bounce into the weekend. Of course, something to also keep in mind is for headlines surrounding a Middle East conflict. But for now, the US dollar remains supported.

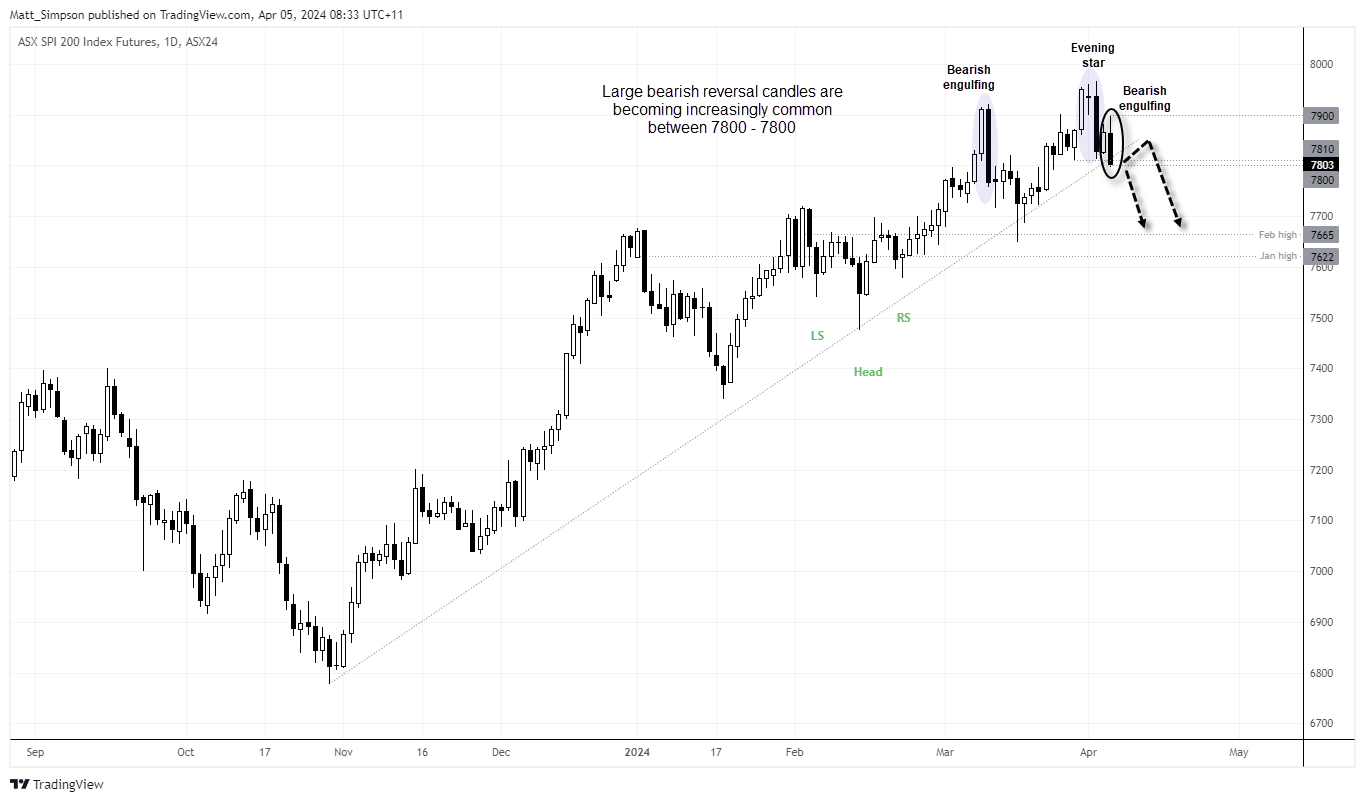

ASX 200 technical analysis:

Price action on the ASX 200 futures chart is appearing increasingly bearish. 7900 has been a challenging level for the ASX, given two bearish engulfing candles and a 3-bar bearish reversal (evening star) have formed around it. Yet Thursday’s price action has challenge the bullish trendline and is now considering a break below 7800.

Given the weak lead from Wall Street and relatively subdued reaction from the ASX futures market overnight, I suspect further downside could be due today. Bears could seek a break below 7800 or fade into minor rallies within yesterday’s range. The bias remains bearish whilst prices remain below 7900.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade