US Auctions will be closely monitored this week!

This week, the US Treasury will be auctioning off the following:

- Tuesday: 3-year notes

- Wednesday: 10-year notes

- Thursday: 30-year bonds

In addition, the Treasury will also be issuing a few short-term duration bills (less than 1 year). There is also a good deal of corporate bond supply this week.

Recall on February 25th when the Treasury auctioned 7-year notes. It did not go well. As a result, bond prices moved lower (on less demand) and yields moved higher (yields move inversely to bond prices):

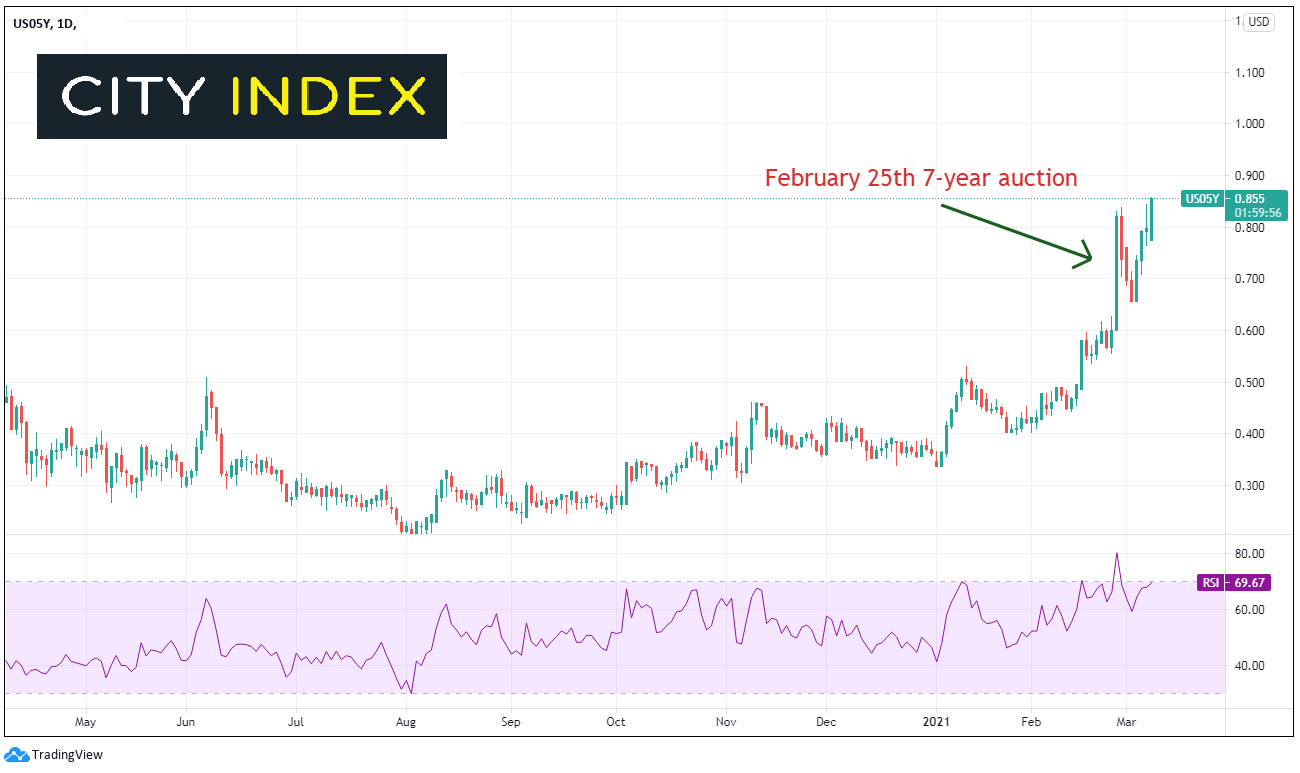

5-Year Yields

Source: Tradingview, City Index

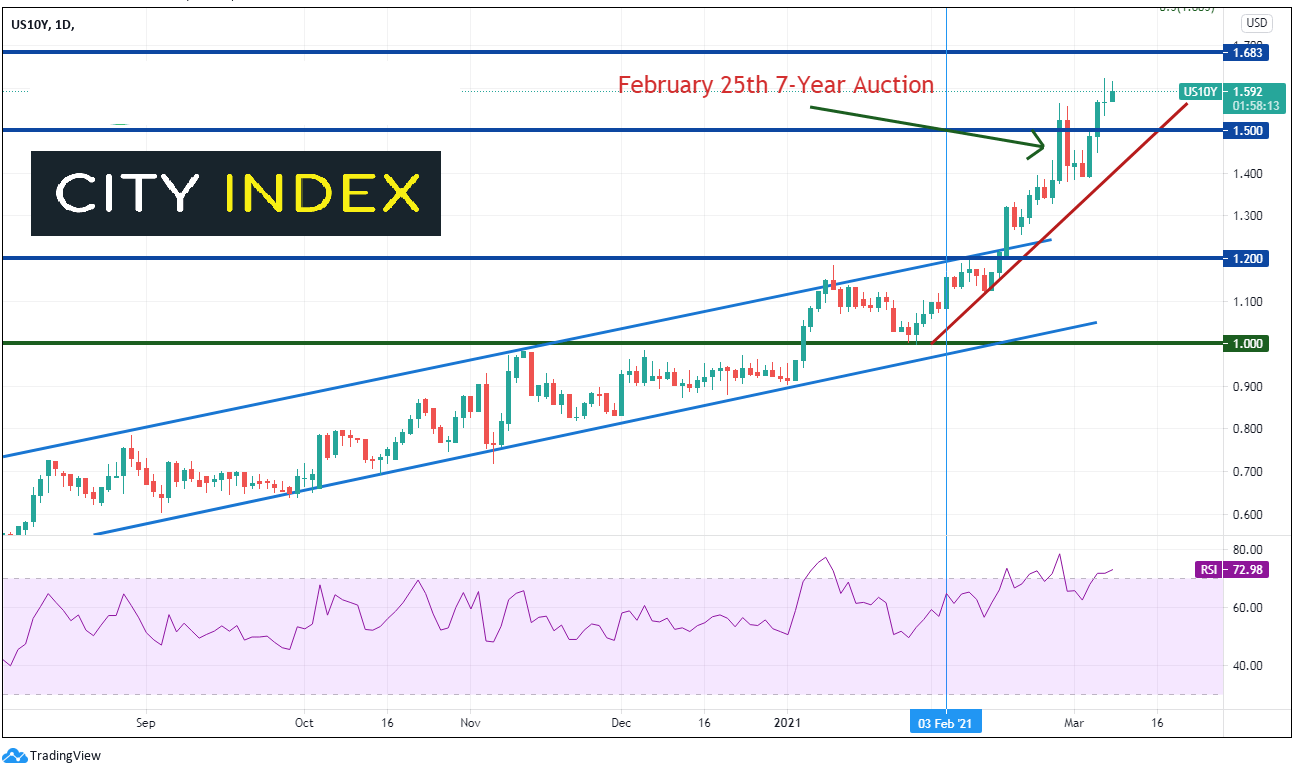

10-Year Yields

Source: Tradingview, City Index

Terms to know for the auction:

In addition to yields (which should be compared the previous auctions) There are several data points released after the results of the auctions are made available (usually a few minutes after 1:00pm ET). However, there are two important ones to pay attention to in order to determine if an auction went well:

1) Bid-to-Cover (from Investopedia): the dollar amount of bids received vs the amount of Treasury securities sold. Bid-to-Cover ratios typically exceed 2.0. A successful bid-to-ratio should substantially exceed the average of the 12 previous ones. A low ratio is an indication of a poor auction.

*The bid-to-cover from the 7-year auction on February 25h was 2.045, the lowest on record

2) Indirect vs Direct bidders (from Investopedia): An indirect bidder, commonly a foreign entity) bids throughs another party. A direct bidder purchases the Treasuries during the auction for themselves or their house account. Indirect bidders are often used as a proxy for demand by foreign investors.

*In the 7-year auction on February 25th, only 38.06% of the bidders were indirect bidders. This left direct bidders (mainly primary dealers) taking away the balance of the auction.

Market Reaction: With the weak 7-year auction on February 25th, the markets sold bonds, sold stocks, and bought US Dollars ( as yields went higher). Traders could expect a similar reaction this week if they auctions are poor. Therefore, US Dollar counter currencies should move lower verse the US Dollar if results are poor.

Learn more about forex trading opportunities.