BoE financial stability report said that the majority of risks associated to cross border financial transactions have been overcome. This is some good news at least, although doesn’t relate to goods.

Can FTSE hold bullish trend?

Oil Cross $50, is there more upside to be had?

• Brent rises over $50 for the first time since March

• Covid vaccine rollouts boost hopes that demand for crude will build up in 2021 overshadowing near term demand concerns as covid cases surge and lockdown tightening particularly in US

• India’s biggest refiner is now operating at 100% capacity & Asian demand is strong.

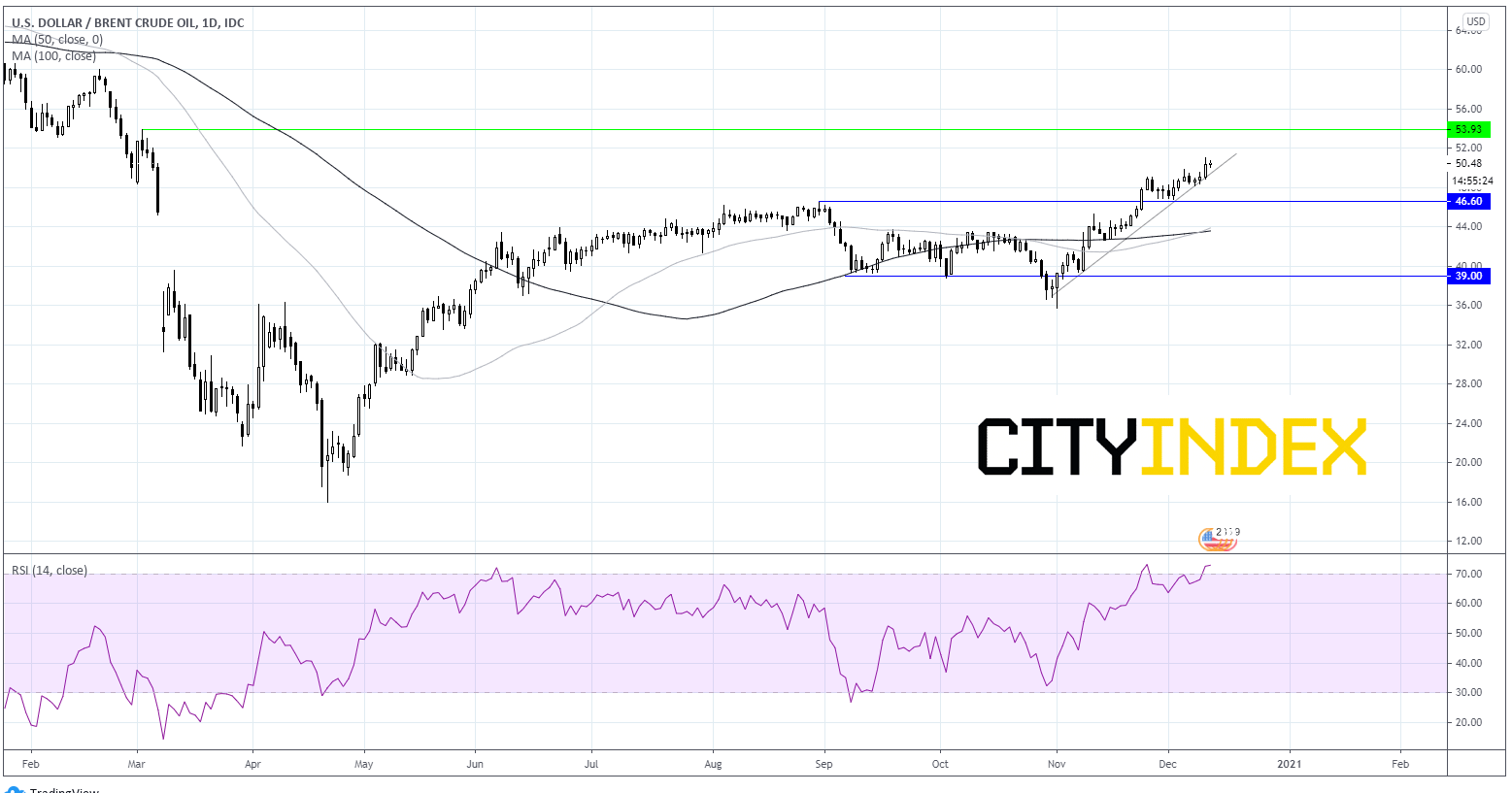

After a steep run up from the April low, Brent consolidate between the band of $46.60 - $39 for 6 months before another steep rally which kicked off in late October.

The price of oil has risen for 6 straight weeks, Brent crossed $50 per barrel trading at fresh 8 month high, although the rally is slowing in recent session.On the daily chart it trades above the ascending trend line dating back to late October, dip buying points to strength in the ascent. However, it is in overbought territory on the RSI, so another pull- back could be on the cards. Should the price meaningfully move below the ascending trend line at $49.50 then resistance turned support at $46.60 comes into play prior to a strong support at $44 the confluence of the 50 & 100 sma.On the flip sides, should the ascending trend line hold a move towards a fresh 8 month high at $54 could be on the cards.