- FTSE outlook: UK stocks continue to underperform European and US markets

- New records or multi-year highs for mainland European indices after S&P crossed 5K

- UK stocks at “record cheap” levels ahead of busy week of data

Most European markets were looking strong today after the S&P 500 closed at a new record high above 5,000 on Friday, boosted by the technology sector rally, amid AI optimism and mostly positive earnings results, and optimism over eventual Federal Reserve interest-rate cuts. In mainland Europe, investors are also optimistic that the European Central Bank is also getting closer and closer to cutting interest rates again, lifting the major indices to record or multi-year highs. Yet, the UK’s FTSE was showing no such desire yet again. But is that about to change soon?

New records or multi-year highs for European indices

In mainland Europe, investors are increasingly optimistic about the European Central Bank's nearing likelihood of implementing interest rate cuts once more.

The Netherlands Stock Market Index hit a new all-time high today; the German DAX and French CAC were both a spitting distance from hitting yet new records this year, and Italy’s FTSE MIB hit a new multi-year high today.

Ironically, the European indices like the DAX are rallying despite the consistent run of poor data for Germany. The Eurozone’s economic powerhouse may be nearing, if not already experiencing, a contraction phase. Yet stocks such as Infineon Technologies, Siemens Energy and Sartorius have helped to propel the DAX index to repeated all-time highs this year. Weakness in macro data has been shrugged off, as weak data only makes it likely that the ECB will soon start cutting rates again.

FTSE continues to underperform European and US indices

With the rest of European markets and shares on Wall Street hitting new record highs almost on a daily basis, you would think that this would have also helped the UK markets. Well, not quite!

The FTSE 100 was down about 0.2% this morning, once again underperforming other European markets. This time, it was hurt by AstraZeneca’s 2% drop, with the drugmaker reaching its lowest level since March 2022. Last week, the stock fell almost by 5.8% following its earnings results.

Still, there’s hope that the FTSE may be able to recover later in the day. Miners and energy stocks such as Glencore, Shell, BP and Anglo American were all trading higher.

JPMorgan: UK stocks at “record cheap” levels

Analysts at JP Morgan are bullish on UK stocks, a sentiment also shared among our team. JPMorgan analysts note that the UK has the highest dividend yield across major markets at 4.3% compared to about 2% for the MSCI World benchmark. The dividend yield is basically how much a company pays in dividends each year relative to its share price. Obviously, a weaker share price for UK stocks is helping to push this number up.

Until now, investors have largely shied away from UK stocks, preferring to hold the racier technology stocks in the US and Europe. China-focused stocks, of which there are plenty in the UK 100, have also underperformed, along with a weaker market there. Meanwhile, UK inflation is still very high at 4% compared to the rest of the major developed economies, which is keeping the Bank of England’s Monetary Policy Committee split in terms of the direction of interest rates.

FTSE outlook: Can UK stock market finally get its act together?

With signs that commodity prices like crude oil are starting show long-term bullish characteristics again, this should help energy stocks in the FTSE – although at the time of writing oil prices were lower on today’s session. China’s efforts to shore up its markets may also encourage investment in the UK benchmark. The FTSE may also find support once investors start rotating out of technology stocks and into value names. Perhaps, a weaker inflation report on Wednesday could trigger a more pronounced rally, although economists think prices have risen further in January.

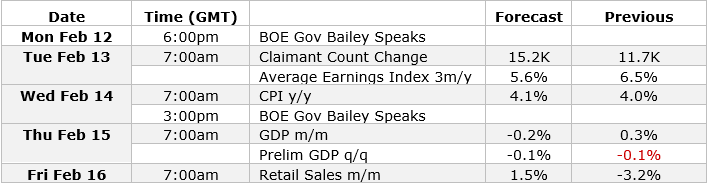

Big week for UK data

UK investors will be facing a busy week of data this week, with CPI, wages, employment, GDP and retail sales figures all due for release starting on Tuesday.

The FTSE could benefit if inflation turns out to be surprisingly weak, although economists think prices have risen further to 4.1% y/y in January from 4.0% in December.

Still, as the BoE and other major central banks turn to a cutting cycle for rates later this year, the FTSE outlook in the long-term is bullish, I reckon.

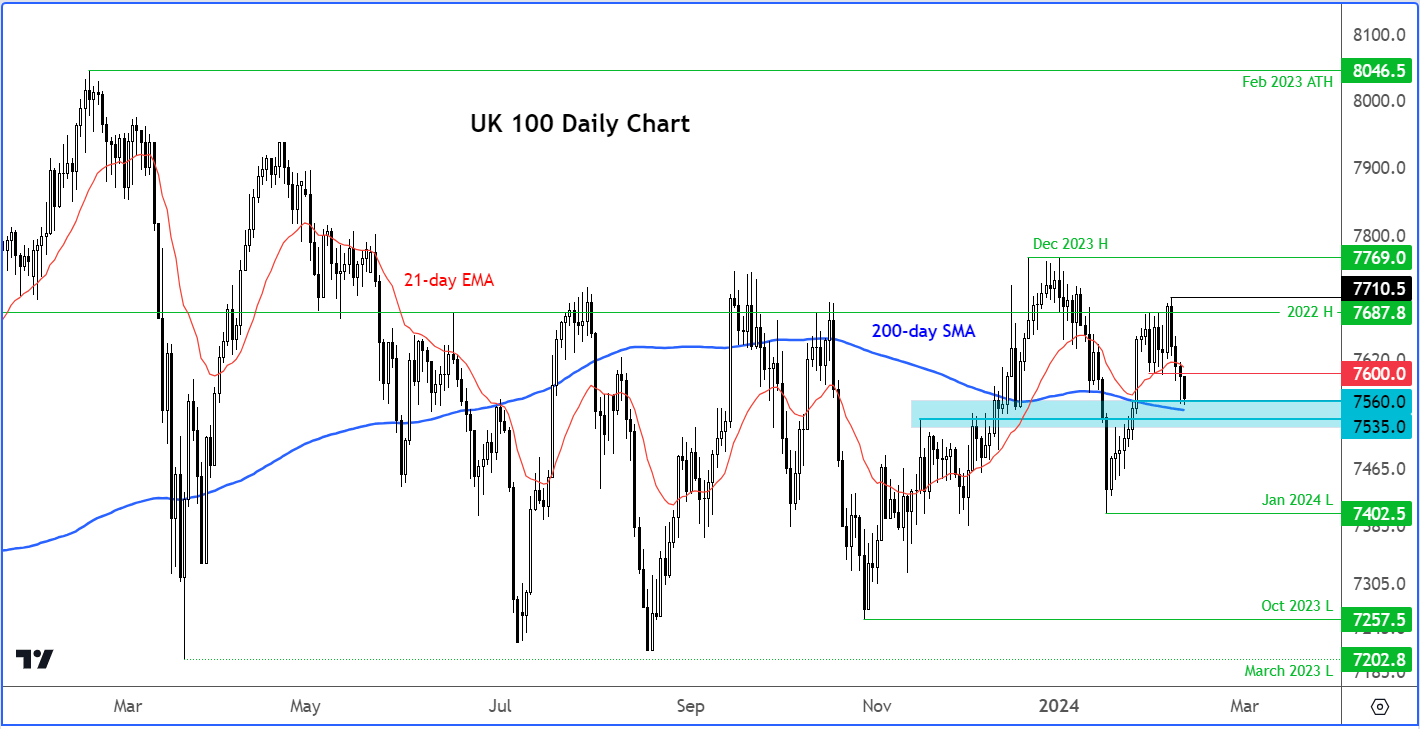

FTSE outlook: Technical analysis

Source: TradingView.com

After a two-week drop, the FTSE has further eaten into the mini rally that commenced on 17th January. But now, dip buyers could step in to stem the index’s decline given the above macro considerations. The area between 7535 to 7560 is a pivotal area, where old support and resistance meets the 200-day average. The formation of a nice bullish candlestick pattern here could be the trigger that the bulls are waiting for. Let’s wait for that confirmation first, though, as recent price action has been far from convincing for the bulls. Short-term resistance us seen around 7600, above which the long-term resistance area around 7680-7700 would then be back in focus.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade