Crude oil falls as demand concerns weigh

- Oil falls after losses last week

- Demand concerns for the US and China weigh on the price

- Oil sellers need to break below 74.65 to extend the selloff

Oil prices are falling at the start of the week after booking losses of over 4% last week, which marked the third straight weekly decline amid concerns of slowing demand in the US and China.

Oil prices gained nearly 2% on Friday after Iraq vocally supported oil cuts by OPEC+. However, this wasn't sufficient to offset losses during the rest of the week.

Data from China raised concerns that the economic recovery is running out of momentum. Despite economic stimulus, China fell back into deflation, showing that demand remains weak. Meanwhile, China also asked for less supply from Saudi Arabia, the world's largest exporter, for December.

Meanwhile, the US Energy Information Administration (IEA) also said last week that crude oil demand will likely fall and forecast that per capita US gasoline consumption could drop to its lowest level in two decades.

On the supply side, US energy firms cut the number of oil rigs for a second week to the lowest level since January 2020, according to the Baker Hughes rig count.

OPEC+ will meet on November 26th. Should pressure remain on oil prices, expectations could rise that Saudi Arabia and Russia will continue voluntary supply cuts into next year.

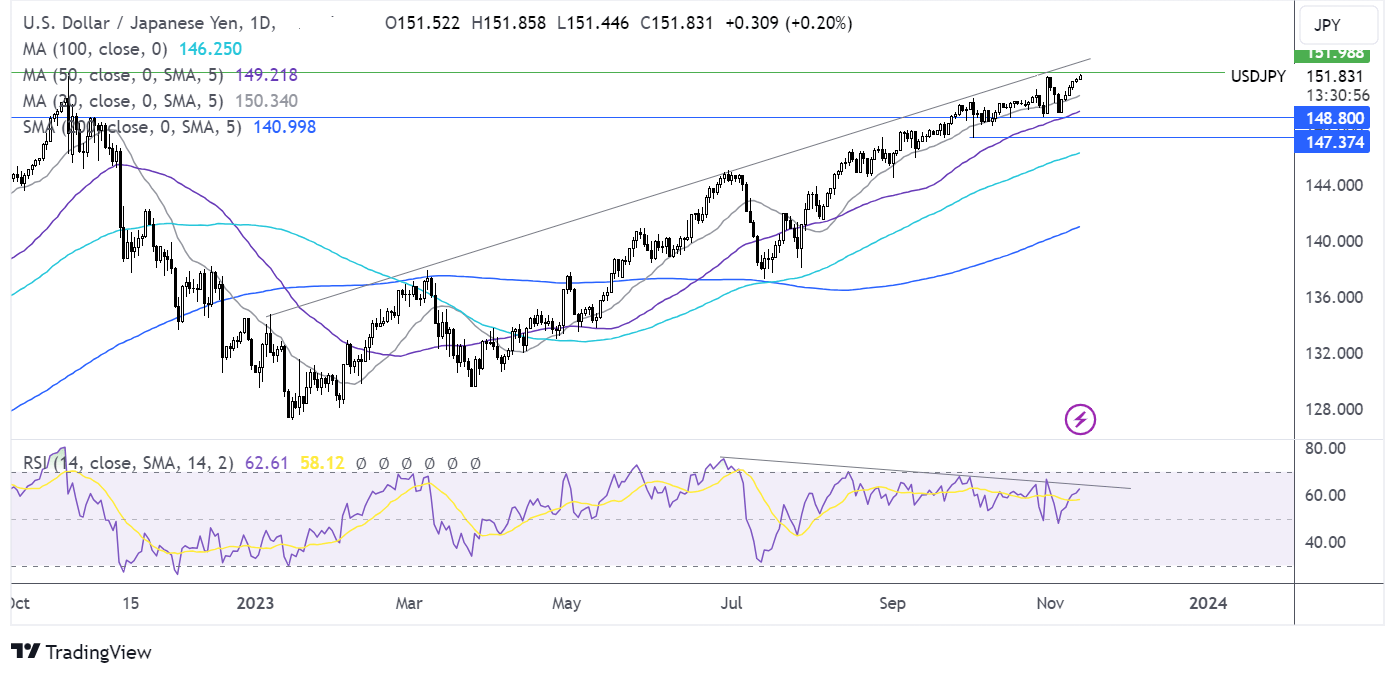

Oil forecast – technical analysis

Oil prices fell below 80.00 dropping to a low of 74.65 last week and is now consolidating around 76.00. The price fell below the 200 sma, and the RSI is below 50, supporting further downside. Sellers must break below 74.65 to extend losses towards 72.50 the January and February low, ahead of 70.00.

Buyers will look to rise above the 200 sma at 78.20, with a rise above here opening the door to 80.00 the psychological level and 82.00, the confluence of the 20 and 50 sma.

USD/JPY rises to a yearly high

- USD rises, tracking yields higher

- Japanese PPI cools to 0.8% YoY down from 2.5%

- USD/JPY grinds to 151.77 a 2023 high

USD/JPY has risen to a yearly high as traders shrug off news that Moody's rating agency downgraded the US credit rating to negative, instead tracking treasury yields higher ahead to US inflation data tomorrow. The data could provide further insight into whether the Federal Reserve has more work to do in its fight against inflation.

Tomorrow's CPI data comes after the Federal Reserve policy meeting at the start of November, which was perceived to be more dovish than expected. Although, Federal Reserve chair Jerome Powell, last week suggested that the fight against inflation may not be over and that the Fed may still need to tighten monetary policy further.

Today, the US economic calendar is relatively quiet, with attention on Federal Reserve speaker Lisa Cook, who could provide further insight into the Fed's thinking.

Meanwhile, the Japanese yen has weakened to its lowest level this year after producer prices dropped to a two-year low

Japanese producer prices fell to 0.8%, below the 0.9% expected, and down sharply from the 2.5% in September.

Cooling producer prices suggest that inflation for materials is easing, which would support the BoJ’s ultra-lose monetary policy.

The BoJ Governor, Ueda, gave mixed messages last week. He talked about proceeding cautiously on exiting the central bank’s ultra-accommodative monetary policy, saying that an exit from negative rates would be a serious challenge. However, he also played down the need for wage growth to support a pivot, suggesting that the BoJ could be moving closer to the exit from negative rates.

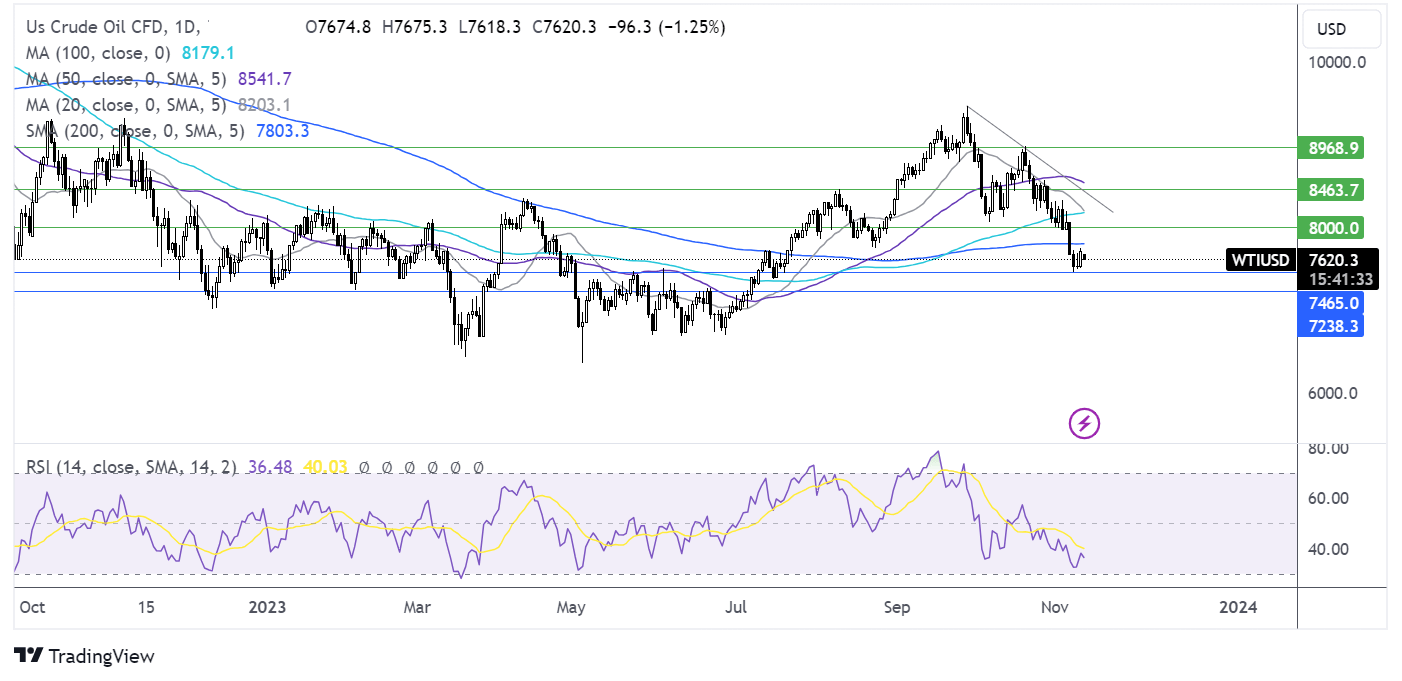

USD/JPY forecast – technical analysis

USD/JPY has maintained its resilient uptrend, grinding above 151.70 the previous 2023 high, opening the door to 152.00 round number, ahead of 152.75 the rising trendline resistance.

However, it is worth noting the bearish divergence on the RSI which suggests that the move higher is running out of momentum.

Support can be seen at 150.34 the 20 sma, a break below here opens the door to 149.20 the 50 sma and November’s low.