When will NatWest report Q1 earnings?

NatWest is due to report Q1 results on Friday 29th April before the market open.

The background

NatWest, like Lloyds, is a domestically focused bank, and if Lloyd’s earnings are anything to go by then we can expect some upbeat numbers.

The results come after a significant milestone for the bank when, as a result of a buyback of its shares, the bank managed to reduce the government’s stake to below 50% for the first time since the Government bailout of £45.5 billion in 2008/9.

What to expect?

Expectations are for total income to rise to £2.7 billion, up from £2.65 billion in the same period last year. However, pre-tax profits are expected to slide by 20% to £755 million.

Last year’s total profits came in at £2.95 billion, up from a loss of £753 million in 2020. However, last year’s numbers were flattered by the release £1.28 billion in reserves, which were put aside to cover bad loans in the pandemic.

Bad loan reserves

This year reserves won’t be released. Instead, we are expecting to see a rise in reserves given the uncertain economic outlook. The rise in reserves would be a protection against potential loan losses as fears grow that the UK could be pushed into recession, particularly if the BoE continues hiking rates at its current pace in order to rein in 30-year high inflation.

Lending growth

With the BoE hiking interest rates across the past three MPC meetings, NatWest is expected to benefit from the higher interest rate environment, lifting net interest income expectations. Lending is expected to be strong in the quarter and mortgage lending robust. Net loans to customers are expected to be £358.3 million roughly the same as this time last year. Meanwhile, deposits are forecast to rise to £480.9 million, up from £453.3 million.

However, going forwards, lending criteria could well be tightened which could mean lower income from lucrative loans. The outlook for mortgages will be under the spotlight as the cost-of-living crisis and higher interest rates are expected to cool the housing market considerably.

Wealth Management

The results come just a few weeks after NatWest said that it was considering the takeover of wealth manager Tilney Smith & Williamson. The sale of the wealth manager is expected to ger underway in around 3 weeks’ time.

Where next for the NatWest share price?

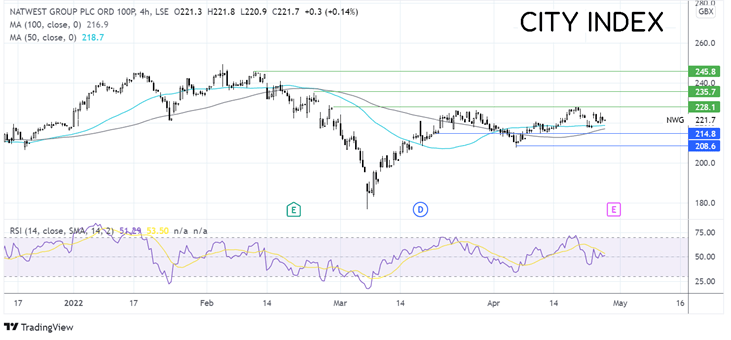

NatWest trades down 12% from its recent February high having recovered from a yearly low of 177p in March.

The share price extended its recovery to 228p before easing lower in a consolidation pattern. The price trades in a holding pattern capped on the upside by 228p and on the lower side by 216p. The RSI is neutral which means a break-out trade could work here.

Upbeat results could see the share price break above 228p, opening the door to 235p the late February high ahead of 245p the February 10 high.

On the downside, disappointing numbers or outlook could see the share price slip below the 50 & 100 sma and break below 214p, opening the door to 208p and a lower low.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.