Nasdaq 100 Key Points

- The Nasdaq 100 is up nearly 50% year-to-date, defying expectations that it would struggle amidst higher interest rates.

- Nvidia reports earnings after the bell today, with traders expecting $3.36 in EPS and $16.1B in revenue.

- NDX is testing year-to-date highs near $16K while NVDA is poised to open at a fresh record high above $500.

Nasdaq 100 Fundamental Analysis

So much for rising interest rates killing the growth-heavy Nasdaq 100 this year!

As we so often see in markets, textbook-style explanations don’t necessarily play out as expected. Heading into this year, higher interest rates were expected to weigh on the primarily growth-focused stocks that make up the Nasdaq 100, whereas more value-oriented stocks were the obvious outperformers given the better near-term prospects for profits.

Instead, the Nasdaq 100 has put together an incredible first 11 months of the year, with the tech-heavy index surging by more than 46% since January 1st. By comparison, the more balanced S&P 500 and Dow Jones Industrial Average are trading up “only” 18% and 6% so far in 2023. The big rally has been supported, at least to an extent, by the fundamentals, with the aggregate Nasdaq 100 EPS coming in at $862 through October, up more than 30% from the start of the year.

Now, ahead of the US holiday, the last of the “Magnificent 7” stocks that have driven much of the rally reports earnings, and expectations are high for chipmaker Nvidia. Demonstrating the incredible growth that’s possible only in technology stocks, Nvidia is expected to report $3.36 in EPS on $16.1B in revenue; these figures would be up roughly 470% and 170% from the equivalent quarter last year!

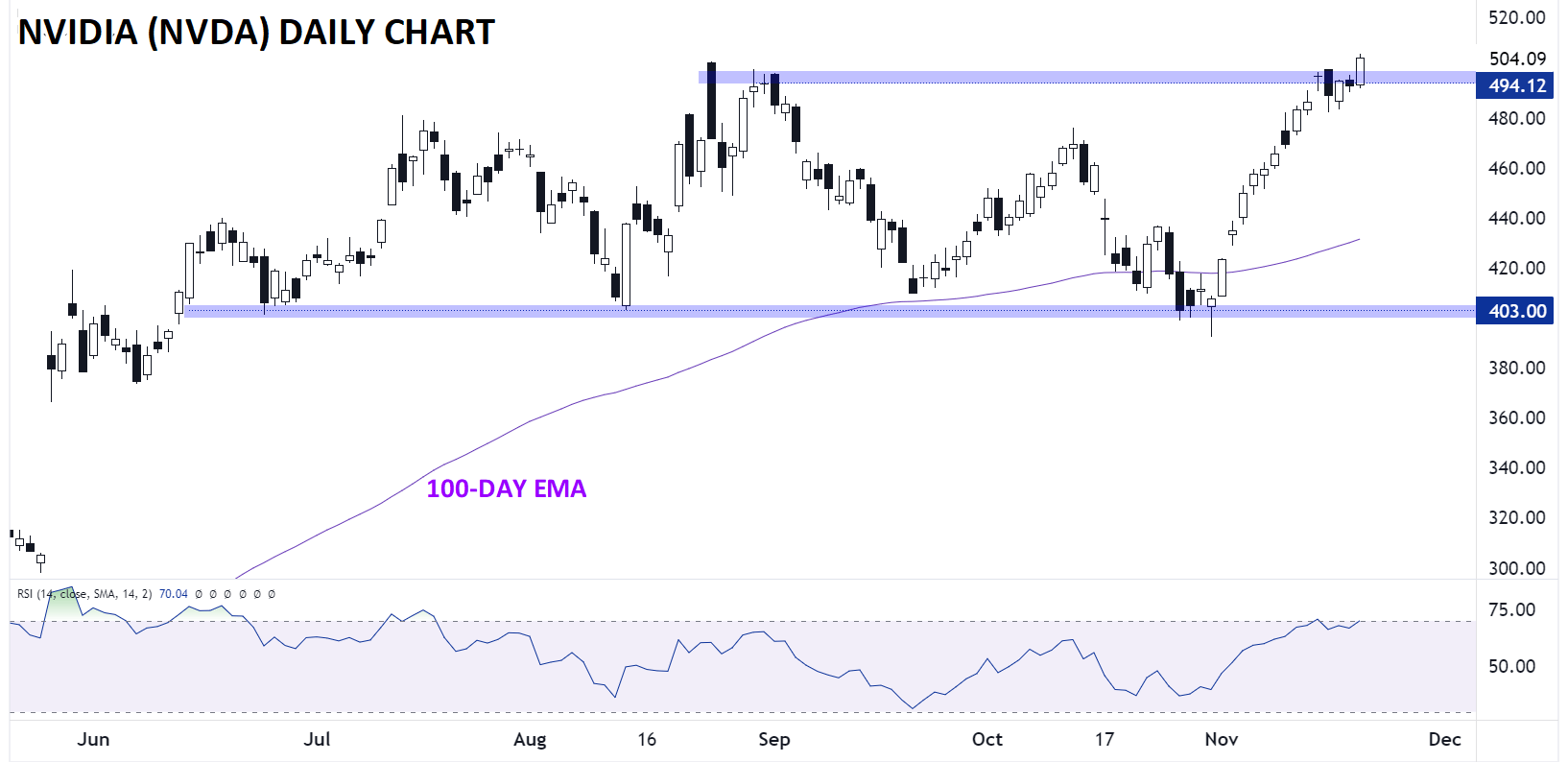

Nvidia Technical Analysis – NVDA Daily Chart Ahead of Earnings

Source: TradingView, StoneX

Looking first at NVDA itself, the stock burst out to a fresh record high above $500 yesterday, extending its impressive surge after a failed head-and-shoulders pattern late last month. With expectations running high ahead of the earnings report and the stock at record highs, it’s more difficult than usual to offer actionable technical insights, but suffice it to say that if NVDA can hold its breakout above $500 through the week, that would be a very bullish development and could open the door for the posterchild of the AI rally to extend its gains toward $600 as we head into 2024.

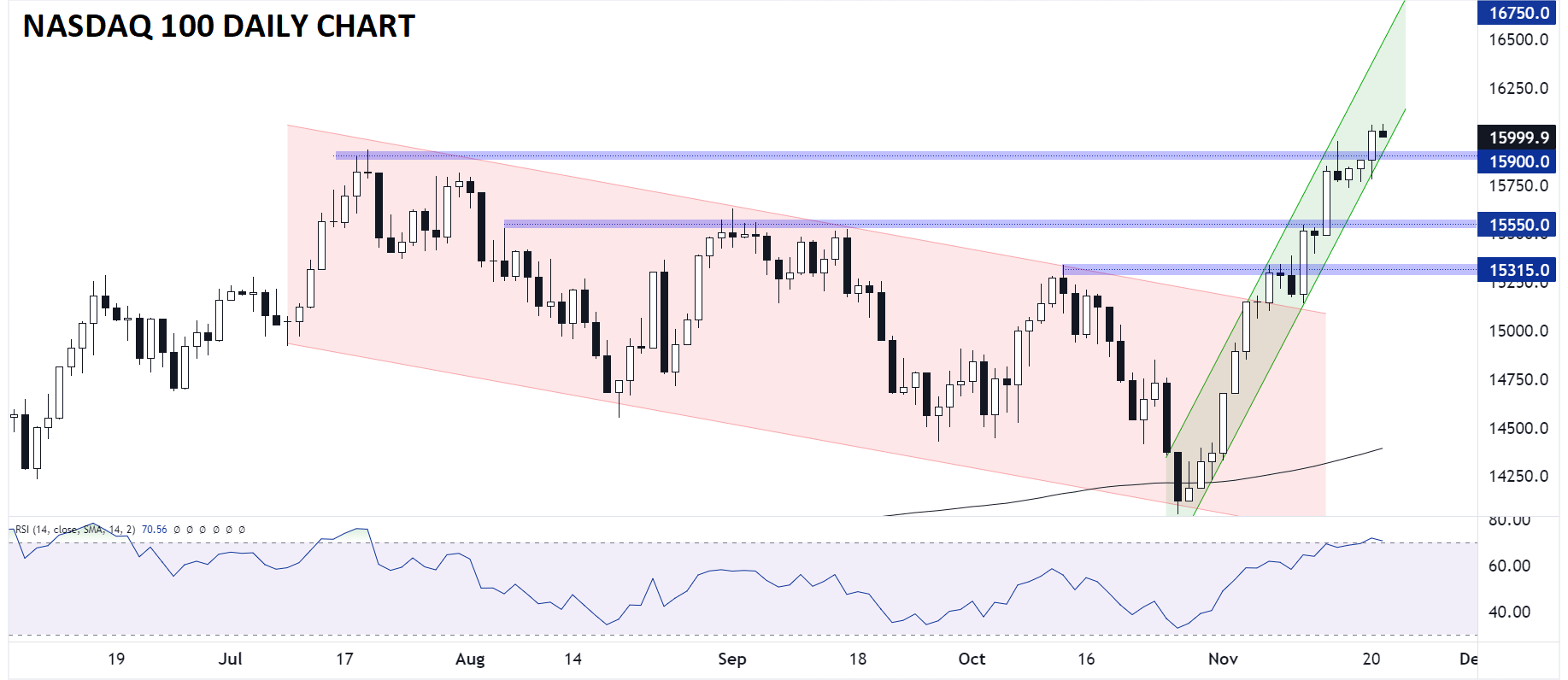

Nasdaq 100 Technical Analysis – NDX Daily Chart

Source: TradingView, StoneX

Meanwhile, the broader Nasdaq 100 is trading in lockstep with one its most iconic holdings. As the chart above shows, NDX remains within a tight bullish channel after clearing the July highs at 15,900. For the rest of this week, the key factor to watch will be if the index can hold above that key level. If buyers continue to support NDX through this week, traders may turn their eyes toward the all-time record highs around 16,750 as we head into December.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX