Gold forecast $200 acting as a barrier for Gold

- Gold’s rally is running out of momentum

- Uncertainty over the Fed’s next move

- Gold double-top forming

Gold prices are edging higher on Thursday amid holiday-thinned trading, on US dollar weakness and as the bond markets remained closed.

The precious metal is struggling to extend gains above the key 2000 level amid some uncertainty around the Federal Reserve's future path for interest rates, which is making it difficult to push higher from here.

Gold has rallied hard over the last couple of weeks, rising almost 8% since the start of October, and has climbed 3% over the past two weeks alone. However, Gold’s rally does appear to be running out of steam,

The precious metal has been supported by expectations that the Federal Reserve's next move will be a rate cut rather than any further rate hikes. However, investors have dialled back expectations of a rate cut in 2024 following jobless claims data on Wednesday, which highlighted the resilience in the labour market.

The minutes of the November FOMC meeting were supportive of the view that the U.S. central bank could keep interest rates high for longer. Fed officials agreed that they would proceed carefully and only hike rates further if inflation proved to be persistently sticky or started to rise.

Holiday thin trading could continue tomorrow, with US markets open half day on Friday. However, there are still some data releases to watch, including US PMI figures. The services PMI is expected to ease slightly to 50.4 from 50.6 manufacturing is also expected to slip into a contraction of 49.8, down from 50. Weak data could fuel bets that the Fed could start cutting interest rates next year, making gold more attractive as it reduced the opportunity cost of holding the non-yielding precious metal.

News that Hamas and Israel may agree to a day ceasefire, which could start on Friday, raised hopes that progress is being made towards peace in the Middle East. Easing geopolitical risk in the Middle East sees safe haven flows unwinding, making it harder for the precious metal to push meaningfully above the 2000 level.

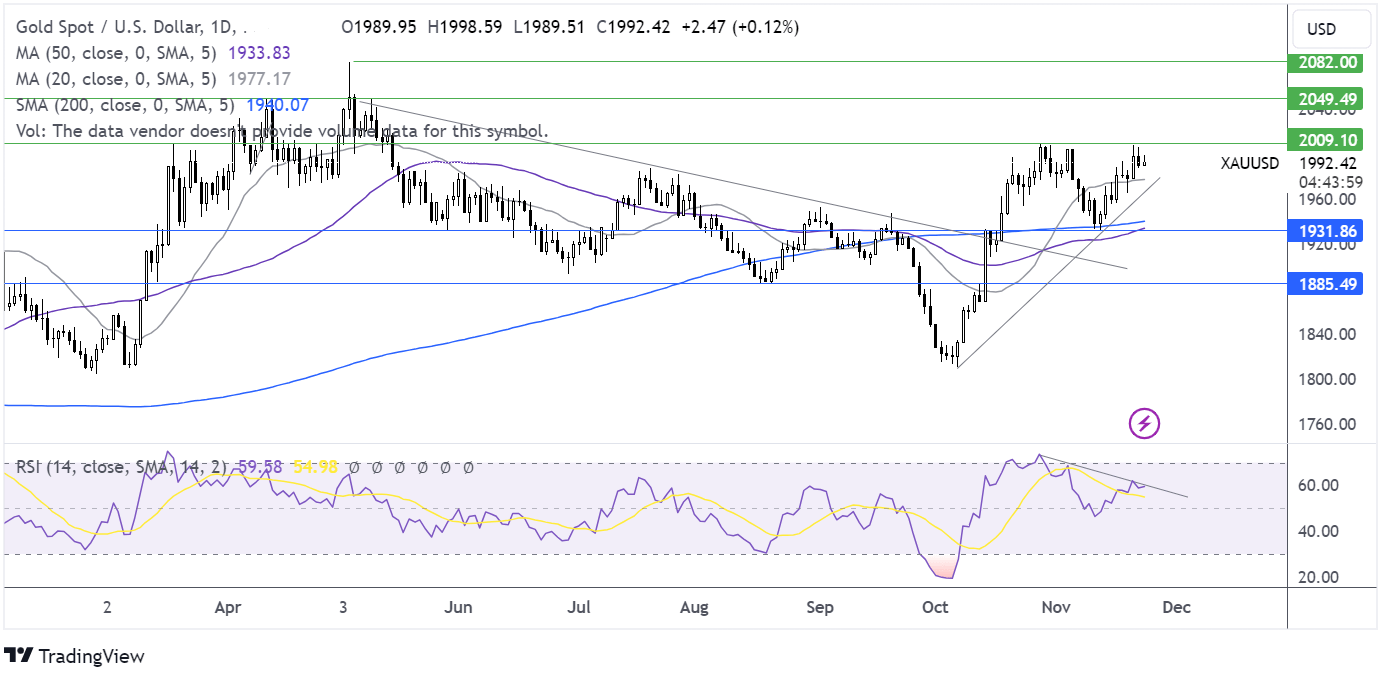

Gold forecast -technical analysis

After rebounding off the 200 sma, the Gold price has risen back towards resistance at 2009, in what appears to be a double top formation. A double top often points to a reversal.

If this is a double top that we are seeing, the price could rebound lower and look to test support at 1931 the November 13 low.

Meanwhile, should butyers achieve a close above 2009, the price could extend the bullish run towards 2050 the April high, before bring 2082, the all-time high into focus.