Asian Indices:

- Australia's ASX 200 index fell by -87.3 points (-1.29%) and currently trades at 6,675.50

- Japan's Nikkei 225 index has fallen by -195.19 points (-0.71%) and currently trades at 27,116.11

- Hong Kong's Hang Seng index has fallen by -441.73 points (-2.49%) and currently trades at 17,298.32

- China's A50 Index has fallen by -132.86 points (-1.03%) and currently trades at 12,775.25

UK and Europe:

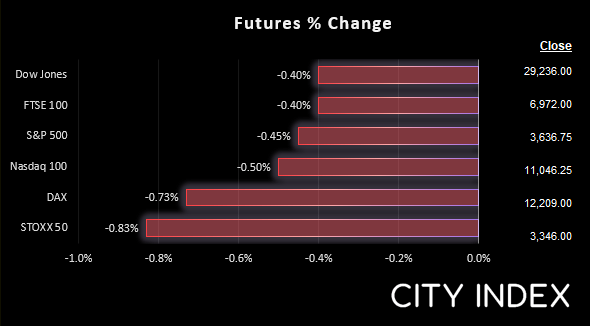

- UK's FTSE 100 futures are currently down -28.5 points (-0.41%), the cash market is currently estimated to open at 6,962.59

- Euro STOXX 50 futures are currently down -28 points (-0.83%), the cash market is currently estimated to open at 3,347.46

- Germany's DAX futures are currently down -90 points (-0.73%), the cash market is currently estimated to open at 12,183.00

US Futures:

- DJI futures are currently down -115 points (-0.39%)

- S&P 500 futures are currently down -55.5 points (-0.5%)

- Nasdaq 100 futures are currently down -16.25 points (-0.44%)

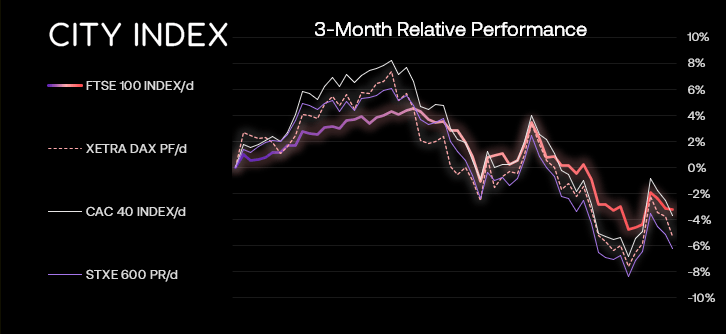

Sentiment remained sour during the Asian session, with equity indices across the region tracking Wall Street lower. The Hang Seng was the weakest performer and fell around -2.9% as trading activity picked up after the week-long celebration for ‘golden week’ in China.

Indices futures were also lower for the US and Europe. The S&P 500 and Nasdaq E-mini contracts touched a 5-day low.

The FTSE 100 meandered around 7,000 on Friday before closing the week just beneath it. Whilst sentiment is on the back foot, bearish volatility is relatively low so perhaps there is chance of a bounce in sentiment today.

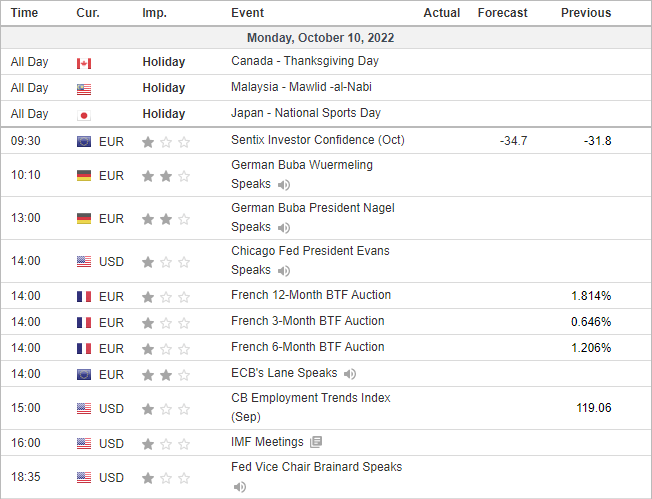

However, IMF meetings take place this week in Washington so any updates or comments form central bankers and officials have the potential to drive sentiment (one way or another).

Volatility was mostly calm for currency markets, although AUD is the weakest major and Aussie pairs in general look like they may want to push lower. AUD/USD has touched a new cycle low and trades at its weakest level since April 2020.

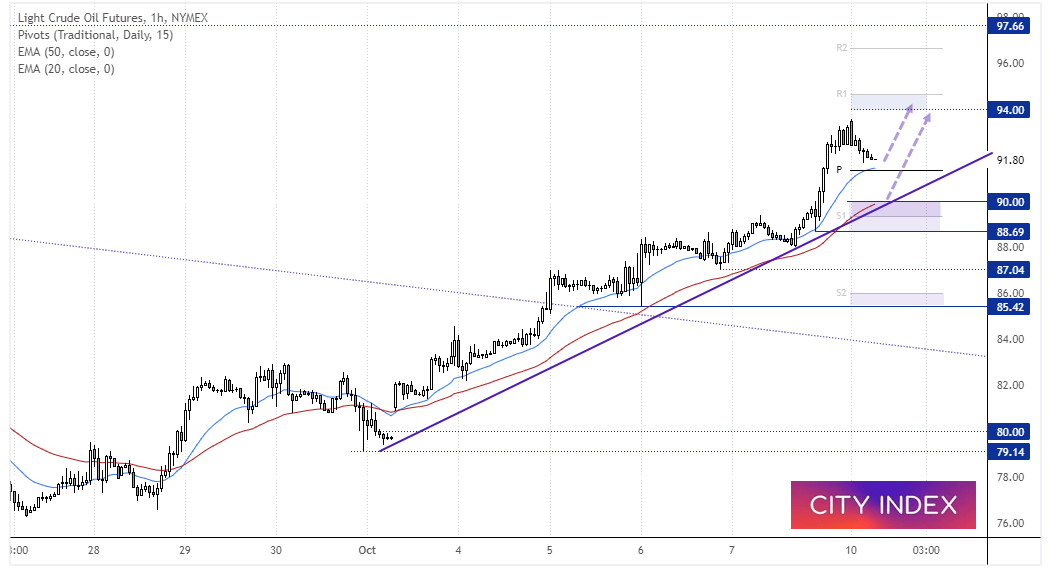

WTI 1-hour chart:

A strong bullish trend has developed on the 1-hour WTI chart. The 20 and 50-bar EMA’s have provided dynamic support throughout the trend and may provide bullish opportunities with a pullback towards them. The 20-bar EMA is near the daily pivot point and the 50-bar is near the $90 handle and daily 1 pivot. The next area for bulls to consider is around $94 or the daily R1 pivot.

FTSE 350 – Market Internals:

FTSE 350: 3848.86 (-0.09%) 07 October 2022

- 58 (16.57%) stocks advanced and 284 (81.14%) declined

- 4 stocks rose to a new 52-week high, 20 fell to new lows

- 16.57% of stocks closed above their 200-day average

- 27.43% of stocks closed above their 50-day average

- 3.14% of stocks closed above their 20-day average

Outperformers:

- + 15.40% - J D Wetherspoon PLC (JDW.L)

- + 3.65% - Centrica PLC (CNA.L)

- + 3.37% - BAE Systems PLC (BAES.L)

Underperformers:

- -16.62% - Marshalls PLC (MSLH.L)

- -10.94% - PureTech Health PLC (PRTC.L)

- -8.04% - Auction Technology Group PLC (ATG.L)

Economic events up next (Times in BST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade