Asian Indices:

- Australia's ASX 200 index rose by 11.3 points (0.16%) and currently trades at 7,296.20

- Japan's Nikkei 225 index has fallen by -54.57 points (-0.16%) and currently trades at 34,934.27

- Hong Kong's Hang Seng index has fallen by -116.5 points (-0.47%) and currently trades at 24,602.40

- China's A50 Index has risen by 20.17 points (0.13%) and currently trades at 15,099.90

UK and Europe:

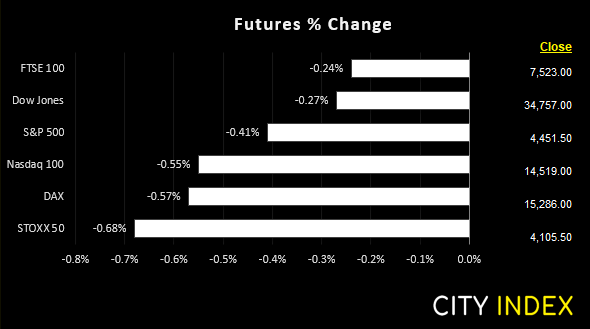

- UK's FTSE 100 futures are currently down -24 points (-0.32%), the cash market is currently estimated to open at 7,579.78

- Euro STOXX 50 futures are currently down -31 points (-0.75%), the cash market is currently estimated to open at 4,106.22

- Germany's DAX futures are currently down -96 points (-0.62%), the cash market is currently estimated to open at 15,274.30

US Futures:

- DJI futures are currently down -124 points (-0.36%)

- S&P 500 futures are currently down -89.25 points (-0.61%)

- Nasdaq 100 futures are currently down -21.5 points (-0.48%)

Safe havens are higher following reports from Russia’s state-backed media that Ukrainian forces fired mortar shells and grenades on the Donbas region of Ukraine.

But it is unlikely to be the report itself which has moved markets. Against the backdrop of previous intelligence reports that Russia was expected to fabricate reasons to attack Ukraine, the report could simply be such a tool which lays the groundwork to invade. Classic risk-off moves ensued late it he Asian session with equity index futures lower, gold and the yen higher. Traders are now waiting for any follow-through to see how this escalates.

The follow-up on this report from Russia or Ukraine is likely to be the key driver for sentiment today. For example, movements from the Russian military which suggest preparation for retaliation could weigh heavily on market sentiment. Or if Ukraine will deny the reports (quite likely) and Russia do not beat their war drum, we could see earlier losses could quickly evaporate and traders could refocus on economic date.

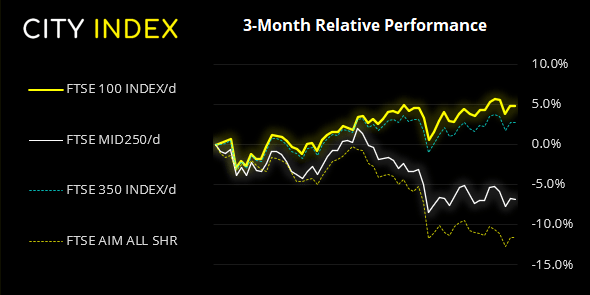

FTSE 350: Market Internals

FTSE 350: 4280.19 (-0.07%) 16 February 2022

- 136 (38.86%) stocks advanced and 198 (56.57%) declined

- 3 stocks rose to a new 52-week high, 7 fell to new lows

- 36.29% of stocks closed above their 200-day average

- 62.29% of stocks closed above their 50-day average

- 20% of stocks closed above their 20-day average

Outperformers:

- + 14.05% - Indivior PLC (INDV.L)

- + 5.05% - Polymetal International PLC (POLYP.L)

- + 4.30% - Hilton Food Group PLC (HFG.L)

Underperformers:

- -4.91% - PureTech Health PLC (PRTC.L)

- -4.45% - Darktrace PLC (DARK.L)

- -4.27% - Baltic Classifieds Group PLC (BCG.L)

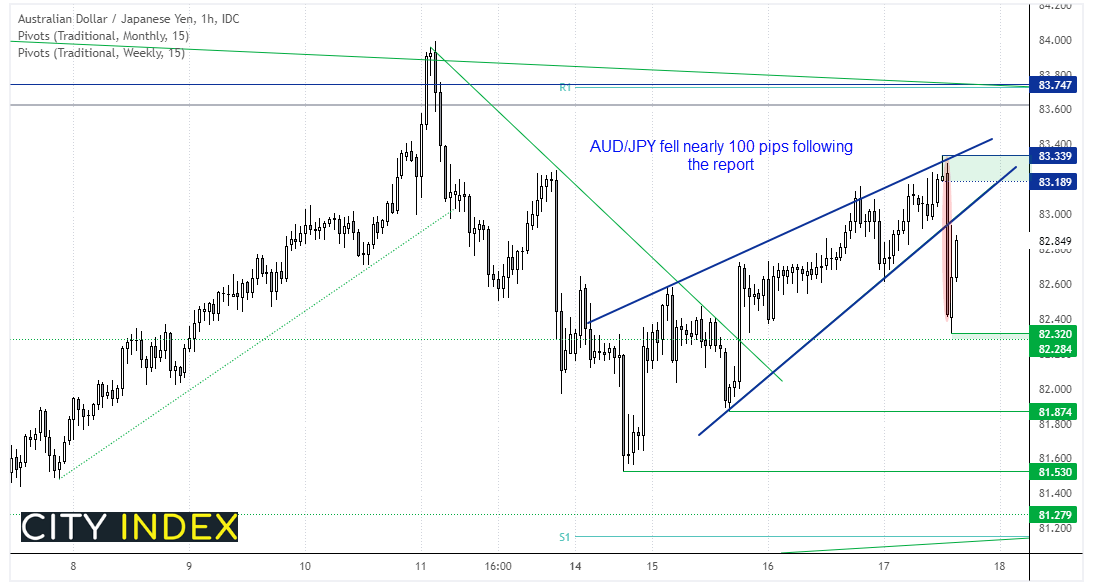

AUD/JPY breaks out of rising wedge pattern

AUD/JPY is a go-to pair to monitor risk appetite for currency traders. It fell around 100 pips after the report was released and may have confirmed a breakout of a rising wedge pattern. The pattern projects a target around the base (81.53) although support resides around 82.30 and 81.87. Prices are currently retracing against the initial leg lower as traders wait to see how the said reports play out. But for now we are keen to see if momentum turns lower once more, whilst prices remains beneath the 83.20 – 83.34 resistance zone.

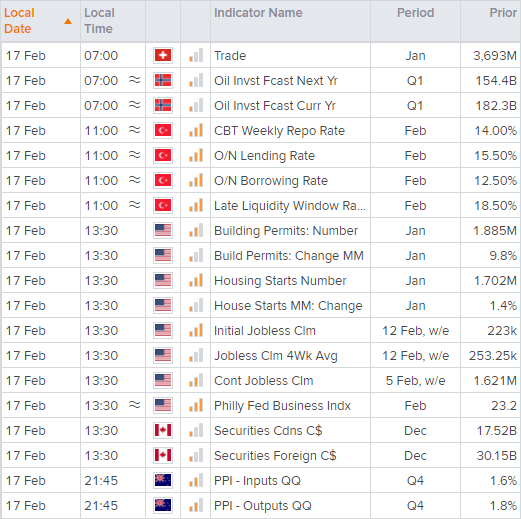

Up Next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade