Asian Indices:

- Australia's ASX 200 index rose by 38.3 points (0.57%) and currently trades at 6,744.30

- Japan's Nikkei 225 index has risen by 67.52 points (0.25%) and currently trades at 2,938.79

- Hong Kong's Hang Seng index has fallen by -185.96 points (-0.84%) and currently trades at 22,043.56

- China's A50 Index has fallen by -7.64 points (-0.05%) and currently trades at 14,798.45

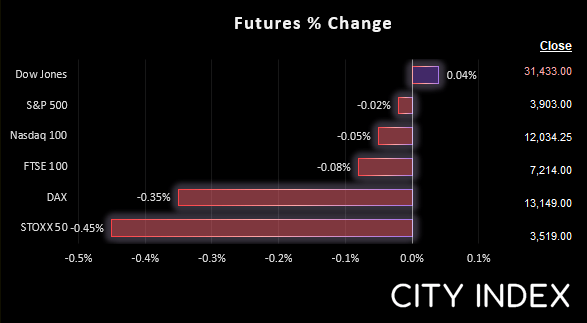

UK and Europe:

- UK's FTSE 100 futures are currently down -6.5 points (-0.09%), the cash market is currently estimated to open at 7,251.82

- Euro STOXX 50 futures are currently down -16 points (-0.45%), the cash market is currently estimated to open at 3,522.88

- Germany's DAX futures are currently down -46 points (-0.35%), the cash market is currently estimated to open at 13,140.07

US Futures:

- DJI futures are currently up 12 points (0.04%)

- S&P 500 futures are currently down -4.75 points (-0.04%)

- Nasdaq 100 futures are currently down -0.25 points (-0.01%)

After all of the excitement of late, I suspect we’ve entered a frustrating phase where markets are feverishly seeking a catalyst that doesn’t arrive. And that can see traders hand back profits made in during the previous spell of volatility.

So far this week we have seen Wall Street gap higher then lose those early gains, yet trade within tight ranges. Currency markets lack conviction in either direction, so until we see volatility return and breakouts succeed, the risk is for volatility to remain low.

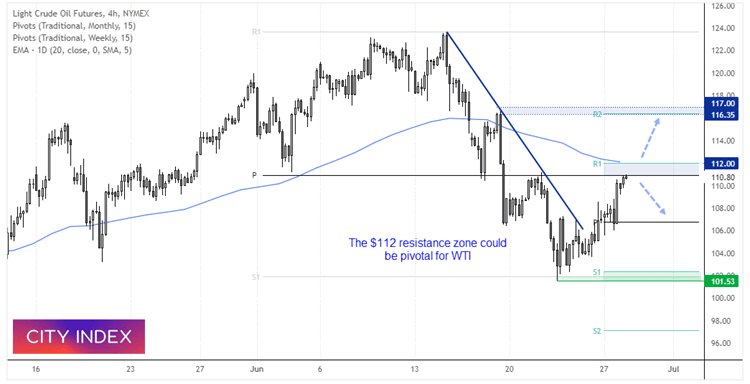

WTI (4-hour chart):

With that said, oil prices are perking up as the G7 vow to release fresh sanctions on Russia, aimed at curbing their oil export profits. WTI rose to a 5-day high overnight and is close to testing last week’s high (which is a bullish hammer). Prices are also testing the monthly pivot point after last week’s trendline break. A clear break above $112 also clears the weekly R2 pivot and 20-day eMA, which assumes bullish continuation. However, a bearish reversal pattern around or below current levels suggests a swing high is in place.

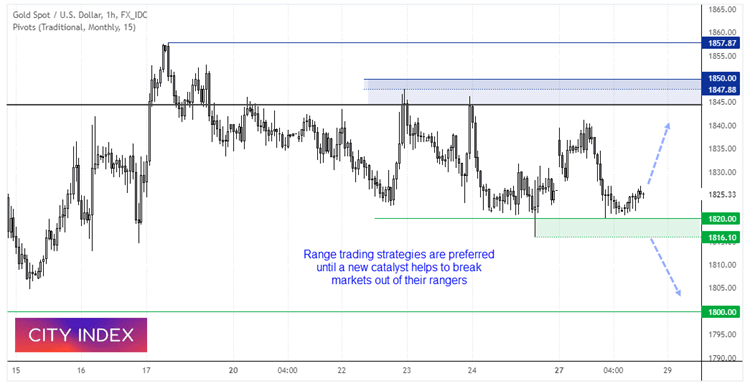

Gold (1-hour chart):

The ‘Russian gold ban’ was the catalyst that never was. Russian assets have been a no-go since Russia’s invasion, so the G7’s confirmation of a gold ban was a non-event. And that leaves gold where it began the week – in the middle of a choppy range.

Gold remains a traders market – which is vulnerable to false breaks and quick turnarounds on little news. This means range-trading strategies are preferred until we see a catalyst which instils some life back into markets. Key zones to watch reside around 1800, 1820, 1840 and 1845/50.

FTSE 350 – Market Internals:

The FTSE 100 didn’t quite reach 7300 yesterday, but it made a valiant attempt to reach it with a high around 7280. Given the several layers of resistance between 7298 – 7313, the reward to risk ratio appears inadequate for bullish setups around yesterday’s close.

FTSE 350: 4037.48 (0.69%) 27 June 2022

- 275 (78.35%) stocks advanced and 69 (19.66%) declined

- 5 stocks rose to a new 52-week high, 0 fell to new lows

- 19.66% of stocks closed above their 200-day average

- 49.57% of stocks closed above their 50-day average

- 8.26% of stocks closed above their 20-day average

Outperformers:

- + 7.91% - ICG Enterprise Trust PLC (ICGT.L)

- + 6.47% - abrdn Private Equity Opportunities Trust plc (APEO.L)

- + 4.97% - Chrysalis Investments Ltd (CHRY.L)

Underperformers:

- -3.02% - Helios Towers PLC (HTWS.L)

- -2.84% - Babcock International Group PLC (BAB.L)

- -2.41% - Aston Martin Lagonda Global Holdings PLC (AML.L)

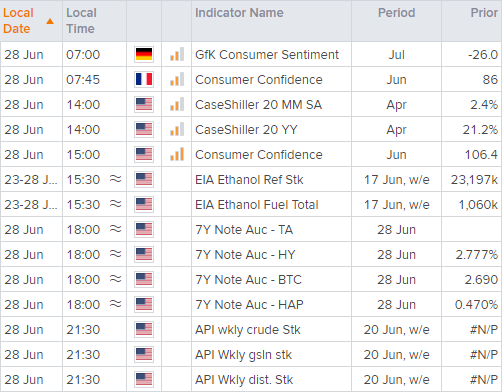

Economic events up next (Times in BST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade