Asian Indices:

- Australia's ASX 200 index rose by 79 points (1.21%) and currently trades at 6,618.90

- Japan's Nikkei 225 index has risen by 114.12 points (0.44%) and currently trades at 26,049.74

- Hong Kong's Hang Seng index has fallen by -129.25 points (-0.59%) and currently trades at 21,730.54

- China's A50 Index has fallen by -4.11 points (-0.03%) and currently trades at 14,889.78

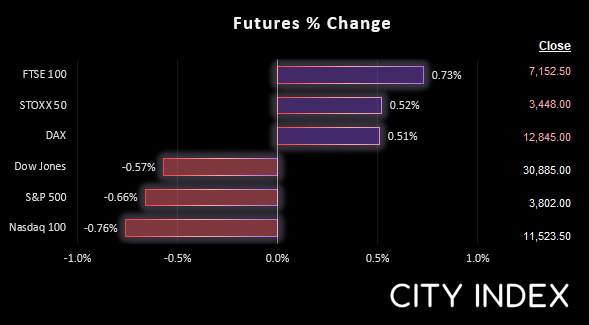

UK and Europe:

- UK's FTSE 100 futures are currently up 49 points (0.69%), the cash market is currently estimated to open at 7,217.65

- Euro STOXX 50 futures are currently up 13 points (0.38%), the cash market is currently estimated to open at 3,461.31

- Germany's DAX futures are currently up 54 points (0.42%), the cash market is currently estimated to open at 12,867.03

US Futures:

- DJI futures are currently down -183 points (-0.59%)

- S&P 500 futures are currently down -88.25 points (-0.76%)

- Nasdaq 100 futures are currently down -25.75 points (-0.67%)

China’s share markets were lower overnight on signs of rising covid cases in China. The ASX 200 rose around 1.5% with the ‘big four’ banks rising around 1.8% to 2.3% ahead of tomorrow’s RBA meeting, where they are expected to hike interest rates by 50-bp.

Volatility remained low across commodity and FX markets. And that could remain to be the case with the US on a public holiday. Copper prices traded in a tight range near last week’s 16-month low, USD/JPY is flat from the open but back above 135 after an initial move beneath it. Gold and silver are trading cautiously higher.

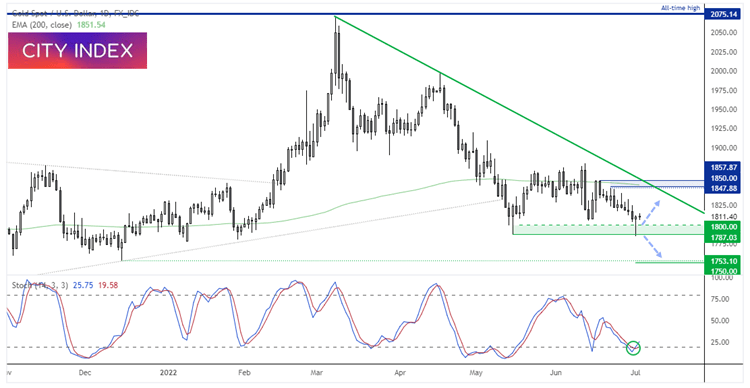

Gold (Daily Chart):

On Friday gold saw an initial break below $1800, only to see buyers step back in and reverse the days losses to close with a bullish pinbar at a key support level. We saw a similar move back in May which marked a swing low, so we’ll see if it has room to bounce over the near-term. From here we see the potential for a rise to the 1825 – 1830 area, but market positioning is not currently favourable for a strong rally. The reality is that managed funds and large speculators are increasing their short bets against gold, and if we see a close below $1800 then it could trigger another bout of selling.

FTSE 350 – Market Internals:

FTSE 350: 3973.44 (-0.01%) 01 July 2022

- 157 (44.86%) stocks advanced and 183 (52.29%) declined

- 3 stocks rose to a new 52-week high, 45 fell to new lows

- 18% of stocks closed above their 200-day average

- 80% of stocks closed above their 50-day average

- 3.14% of stocks closed above their 20-day average

- Outperformers:

- + 6.45% - discoverIE Group plc (DSCV.L)

- + 6.00% - Carnival PLC (CCL.L)

- + 5.96% - Wizz Air Holdings PLC (WIZZ.L)

Underperformers:

- -8.58% - Harbour Energy PLC (HBR.L)

- -7.68% - Chrysalis Investments Ltd (CHRY.L)

- -7.13% - Tullow Oil PLC (TLW.L)

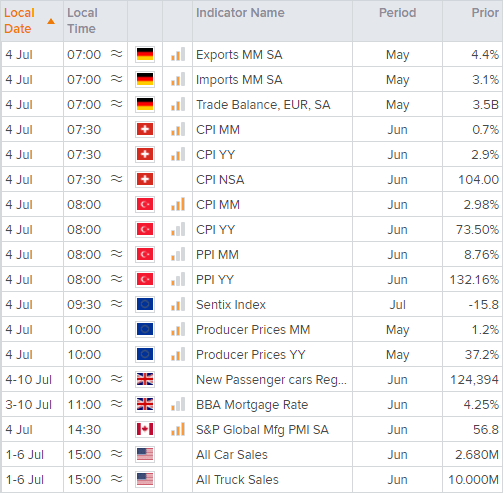

Economic events up next (Times in BST)

German trade kicks off economic data at 07:00 BST. Swiss CPI data is then released at 07:30 – and worth keeping an eye on to see if it continues to beat expectations, as this piles on the pressure for the SNB (Swiss National Bank) to continue hiking rates. No top tier US data is released due to the 4th of July celebrations.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade