Asian Indices:

- Australia's ASX 200 index rose by 23.7 points (0.35%) and currently trades at 6,782.90

- Japan's Nikkei 225 index has risen by 65.37 points (0.25%) and currently trades at 27,749.30

- Hong Kong's Hang Seng index has fallen by -154.49 points (-0.74%) and currently trades at 20,735.73

- China's A50 Index has fallen by -127.7 points (-0.9%) and currently trades at 14,038.05

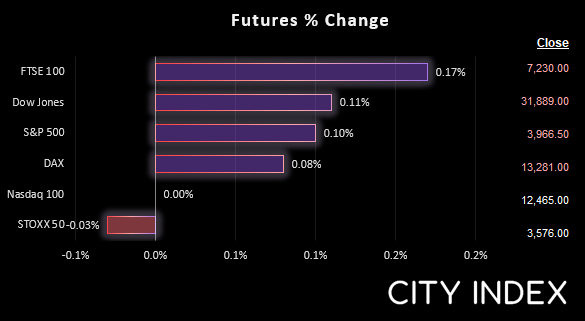

UK and Europe:

- UK's FTSE 100 futures are currently up 9 points (0.12%), the cash market is currently estimated to open at 7,273.31

- Euro STOXX 50 futures are currently down 0 points (0%), the cash market is currently estimated to open at 3,585.24

- Germany's DAX futures are currently up 8 points (0.06%), the cash market is currently estimated to open at 13,289.98

US Futures:

- DJI futures are currently up 27 points (0.08%)

- S&P 500 futures are currently down -3.75 points (-0.03%)

- Nasdaq 100 futures are currently up 3 points (0.08%)

The BOJ remain in a policy league of their own

The BOJ (Bank of Japan) kept their ultra-easy monetary policy unchanged, with interest rates at -0.1% and targeting the 10-year JGB yield around +/- 0.25%. Core CPI is now projected to rise to 2.3% from 1.9% for FY 2022, and to 1.4% from 1.1% in 2023. Yet growth forecasts have been downgraded to 2.4% due to rising commodity prices and supply constraints.

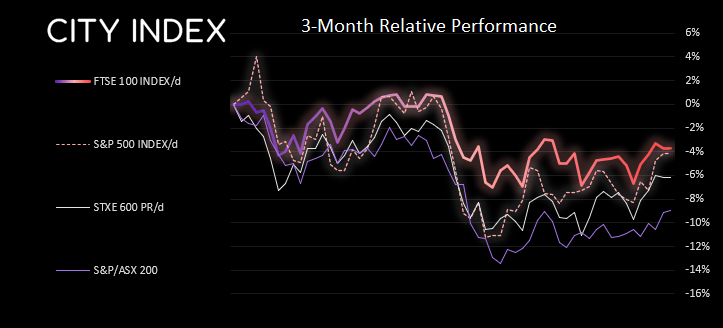

Stocks cautiously higher

Wall Street was higher for a second consecutive day yesterday on strong corporate earnings, although volatility was notably lower. US and European futures are slightly lower, but overall markets are in tight ranges ahead of today’s ECB meeting.

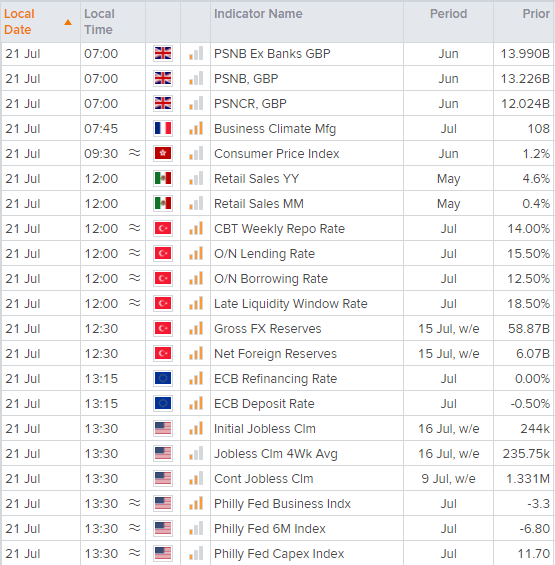

ECB meeting in focus today

The euro was the strongest major currency overnight on rising expectations the ECB will raise interest rates by 50-bp today. You can read the ECB preview for today’s meeting by my colleague Fawad Razaqzada. The central Bank of Turkey also hold a meeting although no change of policy is expected. At 13:30 BST we have weekly employment data for the US, and regional PMI data from the Philly Fed index which can be used to assess the ISM manufacturing report ahead of its release.

EUR/USD remains below its 20-day eMA ahead of the meeting, which means the US dollar index (DXY) has found stability above its 20-day eMA. USD/CHF is forming a potential bear flag on the 4-hour chart. Gold fell below $1700 on the prospects of more central bike hiking later today. WTI is trading just below $100 yet lacking the momentum to move decisively higher or lower. The US reported higher than expected stockpiles for last week.

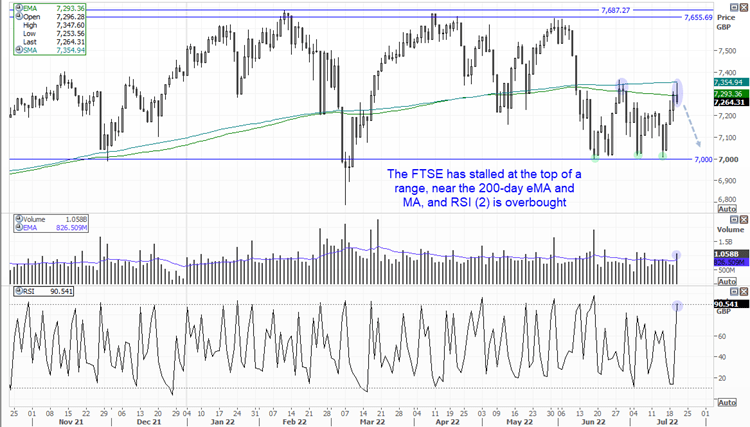

FTSE 100 daily chart:

The FTSE has been stuck in a wide range between 7,000 and 7,700 this year, although since June it has been in the lower half of that range. Whilst support has held three times recently, this week’s rally met resistance near the June high, 200-day eMA and 200-day MA. Furthermore, the RSI (2) is overbought, and yesterday’s small bearish candle was on high volume which suggests a ‘change in hands’ at resistance. The bias remains bearish below yesterday’s high and for prices to move lower back within the 7,000 – 7,350 range.

FTSE 350 – Market Internals:

FTSE 350: 4042.91 (-0.44%) 19 July 2022

- 211 (60.11%) stocks advanced and 123 (35.04%) declined

- 8 stocks rose to a new 52-week high, 0 fell to new lows

- 23.65% of stocks closed above their 200-day average

- 100% of stocks closed above their 50-day average

- 21.37% of stocks closed above their 20-day average

Outperformers:

- + 7.37% - Future PLC (FUTR.L)

- + 6.00% - Volution Group PLC (FAN.L)

- + 5.95% - Molten Ventures PLC (GROW.L)

Underperformers:

- ·-6.03% - Hochschild Mining PLC (HOCM.L)

- ·-3.83% - DS Smith PLC (SMDS.L)

- ·-3.51% - Currys PLC (CURY.L)

Economic events up next (Times in BST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade