Asian Indices:

- Australia's ASX 200 index fell by -70.5 points (-1%) and currently trades at 6,976.40

- Japan's Nikkei 225 index has fallen by -349.25 points (-1.21%) and currently trades at 28,445.50

- Hong Kong's Hang Seng index has fallen by -96.43 points (-0.49%) and currently trades at 19,560.55

- China's A50 Index has fallen by -51.19 points (-0.37%) and currently trades at 13,641.61

UK and Europe:

- UK's FTSE 100 futures are currently down -12 points (-0.16%), the cash market is currently estimated to open at 7,521.79

- Euro STOXX 50 futures are currently down -1 points (-0.03%), the cash market is currently estimated to open at 3,657.22

- Germany's DAX futures are currently up 1 points (0.01%), the cash market is currently estimated to open at 13,231.57

US Futures:

- DJI futures are currently up 26 points (0.08%)

- S&P 500 futures are currently up 15.5 points (0.12%)

- Nasdaq 100 futures are currently up 2.5 points (0.06%)

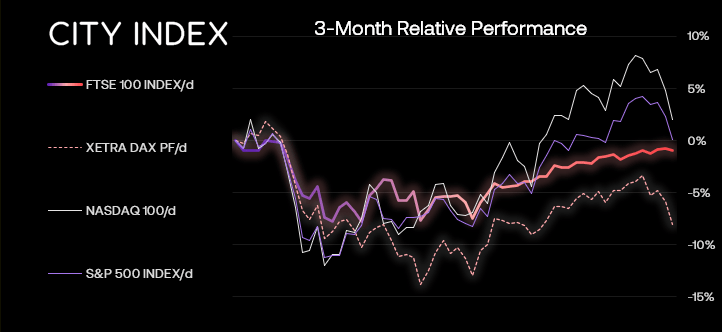

Rising benchmark gas prices have kept the euro and indices across the region under pressure with renewed fears of a recession. The DAX has continued to fall in line with last week’s bias, EUR/USD reached support levels previously mentioned and EUR/CHF saw the downside we anticipated yesterday. Asian equities have continued to move lower during risk-off trade.

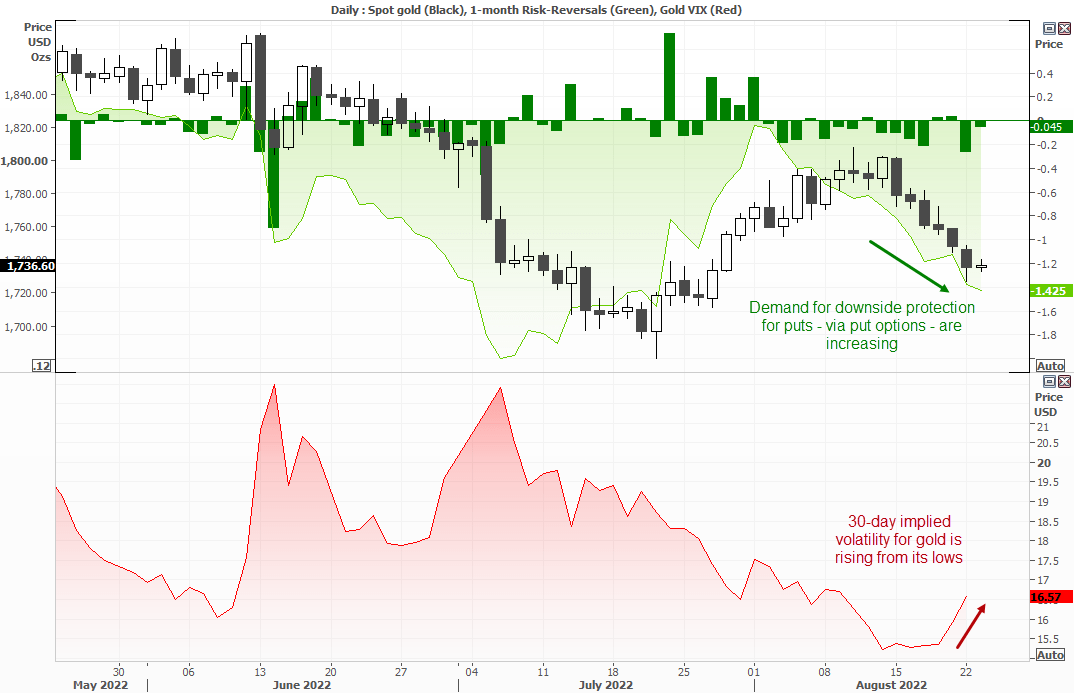

The Jackson Hole Symposium is the key focus for traders this week, with Core PCE inflation a close second. And gold will be highly sensitive to both of these events. Concerns that Jerome Powell will deliver a hawkish tone to his speech alongside a recession warning has seen the US dollar continue to surge and weigh on the yellow metal, as it gets dragged lower with metals and risk sentiment in general.

A clear indication that gold investors are concerned is that the CBOE gold volatility index (GVZ) and downside protection – via put options – are both on the rise. Against this backdrop then a bullish case for gold is a weak inflation print, and less hawkish than expected speech by Powell. And that’s not looking too likely, so I’m on guard for further losses and for gold’s potential to fall to $1700.

Flash PMI’s weaker in parts of Asia, focus now switches to Europe and the US

Australia’s economy contracted for the first time in a year, according to the S&P Global flash composite PMI. At 49.8, it is its lowest print since last August and the July figure was also revised lower to 51.1 from 50.9. The services PMI also contracted at 49.6 and, whilst manufacturing remained expansive at 54.5, it is its slowest rate of growth since August. Japan’s PMI’s expanded but at a slower rate. And that begs the question as to whether we will PMI’s across Europe and the US soften further later today.

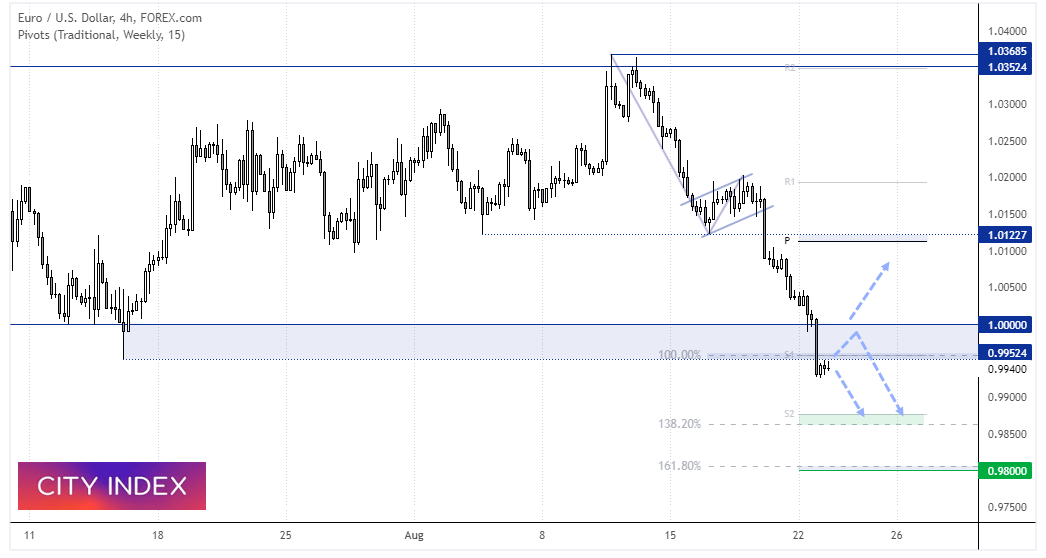

EUR/USD 4-hour chart:

EUR/USD has seen a daily close below parity for the first time since December 2002. It also has the potential to fall further should benchmark gas prices continue to rise and the US dollar remain bid. Under ‘normal’ conditions I’d be more mindful of the fact that prices are likely overextended to the downside, at least over the near-term. But given the macro backdrop can prompt such moves to remain in overbought or oversold levels longer than many would like, it remains plausible that the downside for the euro is not yet over.

However, we would prefer to see some more consolidation on the 4-hour chart, or even a retracement back towards parity, before reconsidering longs. The bias remains bearish below 1.000 and for a move towards the 0.9870 support zone. A break above 1.000 runs the risk of triggering stops and seeing a move higher.

FTSE 350 – Market Internals:

FTSE 350: 4173.06 (-0.22%) 22 August 2022

- 40 (11.43%) stocks advanced and 301 (86.00%) declined

- 5 stocks rose to a new 52-week high, 17 fell to new lows

- 30.86% of stocks closed above their 200-day average

- 99.71% of stocks closed above their 50-day average

- 2.57% of stocks closed above their 20-day average

Outperformers:

- + 2.81% - HALEON PLC (HLN.L)

- + 2.43% - Supermarket Income REIT PLC (SUPR.L)

- + 2.16% - Harbour Energy PLC (HBR.L)

Underperformers:

- -14.11% - Hammerson PLC (HMSO.L)

- -9.83% - Wizz Air Holdings PLC (WIZZ.L)

- -7.94% - TI Fluid Systems PLC (TIFS.L)

Economic events up next (Times in BST)

A host of national PMI reports will be released today, starting with Europe, UK, then on to the US. Prices rises across Europe saw the headline composite PMI for the Euro Zone contract in July, unexpectedly. And expectations are for a faster pace of contraction, given prices have only continued to rise since. PMI’s for the UK are expected to soften yet remain expansionary – but it could be wise to be on guard for a contraction here also.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade