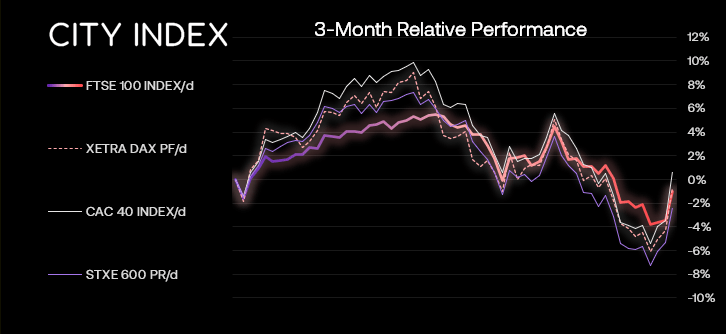

Whilst futures markets point towards a retracement against yesterday’s gains across European cash markets, we’re looking for support to hold and break above yesterday’s highs.

Asian Indices:

- Australia's ASX 200 index rose by 111.7 points (1.67%) and currently trades at 6,811.00

- Japan's Nikkei 225 index has risen by 116.07 points (0.43%) and currently trades at 27,108.28

- Hong Kong's Hang Seng index has risen by 933.73 points (5.47%) and currently trades at 18,013.24

- China's A50 Index has fallen by -48.18 points (-0.37%) and currently trades at 12,908.11

UK and Europe:

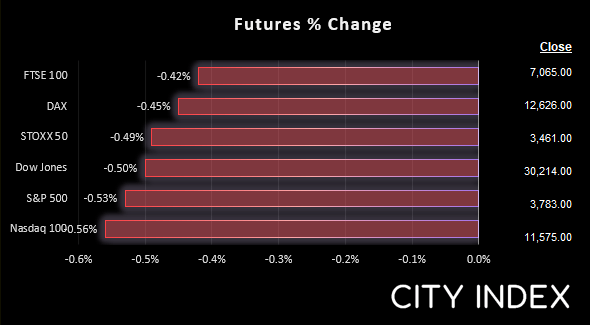

- UK's FTSE 100 futures are currently down -29.5 points (-0.42%), the cash market is currently estimated to open at 7,056.96

- Euro STOXX 50 futures are currently down -17 points (-0.49%), the cash market is currently estimated to open at 3,467.48

- Germany's DAX futures are currently down -57 points (-0.45%), the cash market is currently estimated to open at 12,613.48

US Futures:

- DJI futures are currently down -152 points (-0.5%)

- S&P 500 futures are currently down -66.5 points (-0.57%)

- Nasdaq 100 futures are currently down -20.75 points (-0.55%)

Asian equities tracked Wall Street higher on hopes that central bank interest rate hikes may be less aggressive going forward than originally feared. That said, RBNZ provided a hawkish 50bp hike and even contemplated a 75bp, whilst signalling more hikes were to come. European and US futures have pulled back against yesterday’s gains by around -0.4% to -0.5%.

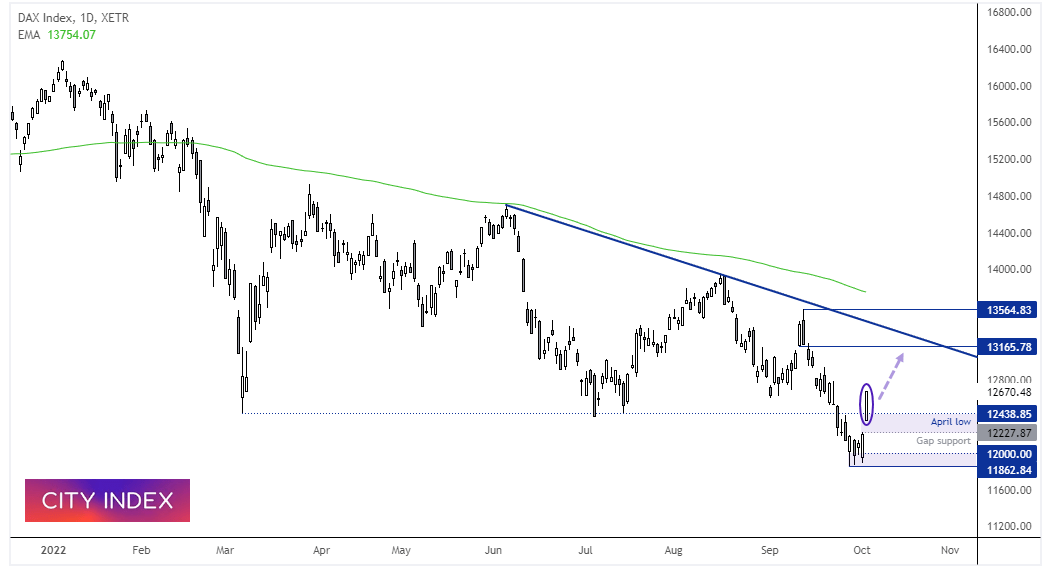

DAX daily chart:

Global equities have posted two strong days of gain and, given their trajectory from recent swing lows, it’s possible we could be in for a third. The DAX was no exception with Monday’s bullish engulfing candle on Monday closing above 12,000, gapping higher on Tuesday to then close at the high of the day. A direct break of yesterday’s highs assumes bullish continuation towards 13,000 – although should prices pull back we’d look for evidence of support above the April low, yesterday’s low or gap support.

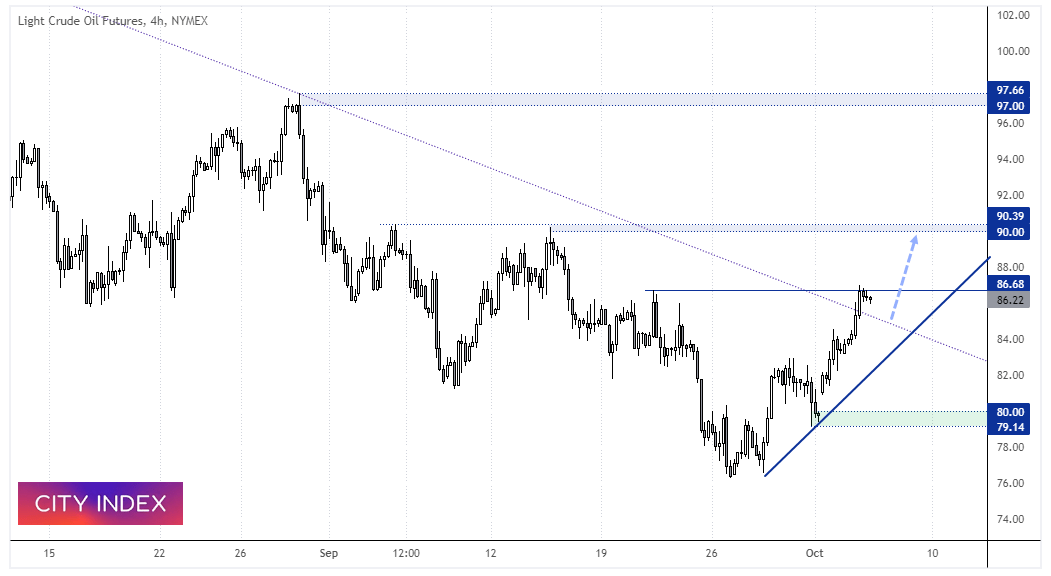

WTI 4-hour chart:

Focus shifts to the OPEC meeting at 11:00 where expectations are for as much as a 2 million barrels per day production cut (original reports suggested 1 million barrels per day). Whilst expectation need fulfilling and prices have been rising ahead of the meeting, 2 million bpd is not a small amount and could further support prices if OPEC delivers. But the reverse is also true, so should they surprise with no change (although unlikely) then it could easily weigh on prices.

A strong bullish trend is developing on the 4-hour chart, and prices are holding above trend resistance. Yet the 86.68 highs are capping further gain in Asia, but we’d welcome any pullback towards trend support in anticipation of its next leg higher. The resistance zone around 90 is the initial target.

FTSE 350 – Market Internals:

FTSE 350: 3779.32 (-1.77%) 29 September 2022

- 32 (9.12%) stocks advanced and 316 (90.03%) declined

- 1 stocks rose to a new 52-week high, 97 fell to new lows

- 13.68% of stocks closed above their 200-day average

- 78.92% of stocks closed above their 50-day average

- 0% of stocks closed above their 20-day average

Outperformers:

- +9.43% - HICL Infrastructure PLC (HICL.L)

- +3.96% - PureTech Health PLC (PRTC.L)

- +3.05% - Diversified Energy Company PLC (DEC.L)

Underperformers:

- -34.75% - Synthomer PLC (SYNTS.L)

- -14.74% - Mitchells & Butlers PLC (MAB.L)

- -12.76% - Barratt Developments P L C (BDEV.L)

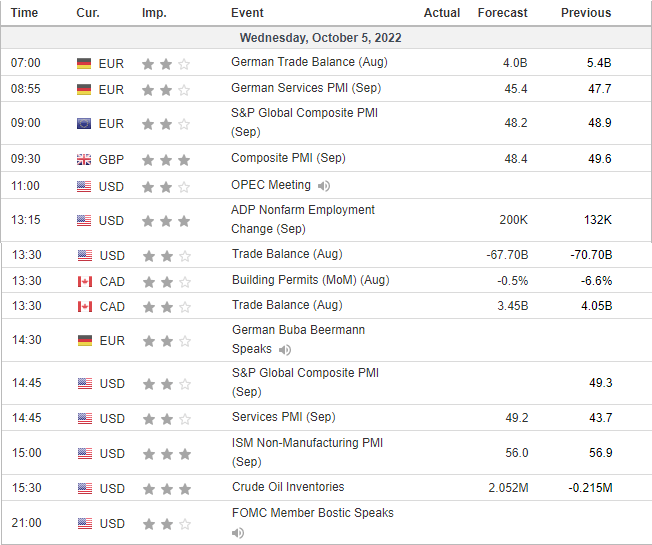

Economic events up next (Times in BST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade