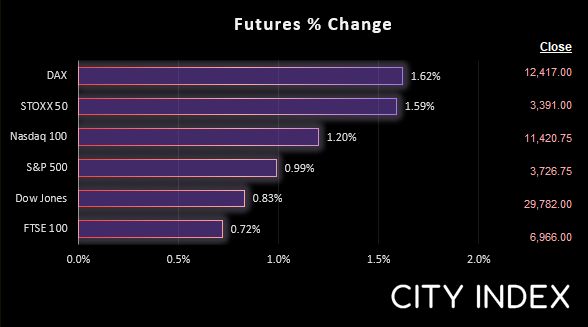

Asian Indices:

- Australia's ASX 200 index rose by 242.4 points (3.75%) and currently trades at 6,699.30

- Japan's Nikkei 225 index has risen by 730.5 points (2.79%) and currently trades at 26,946.29

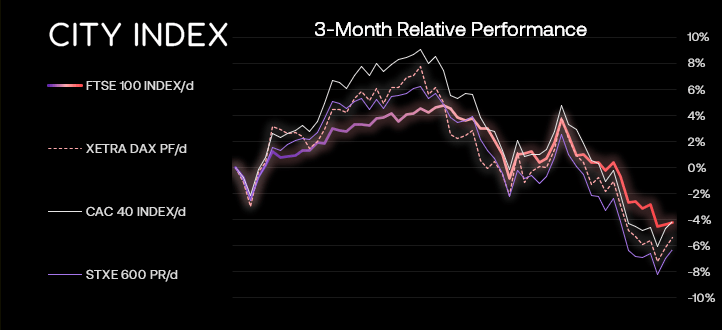

UK and Europe:

- UK's FTSE 100 futures are currently up 50 points (0.72%), the cash market is currently estimated to open at 6,958.76

- Euro STOXX 50 futures are currently up 52 points (1.56%), the cash market is currently estimated to open at 3,394.17

- Germany's DAX futures are currently up 196 points (1.6%), the cash market is currently estimated to open at 12,405.48

US Futures:

- DJI futures are currently up 244 points (0.83%)

- S&P 500 futures are currently up 135 points (1.2%)

- Nasdaq 100 futures are currently up 36.25 points (0.98%)

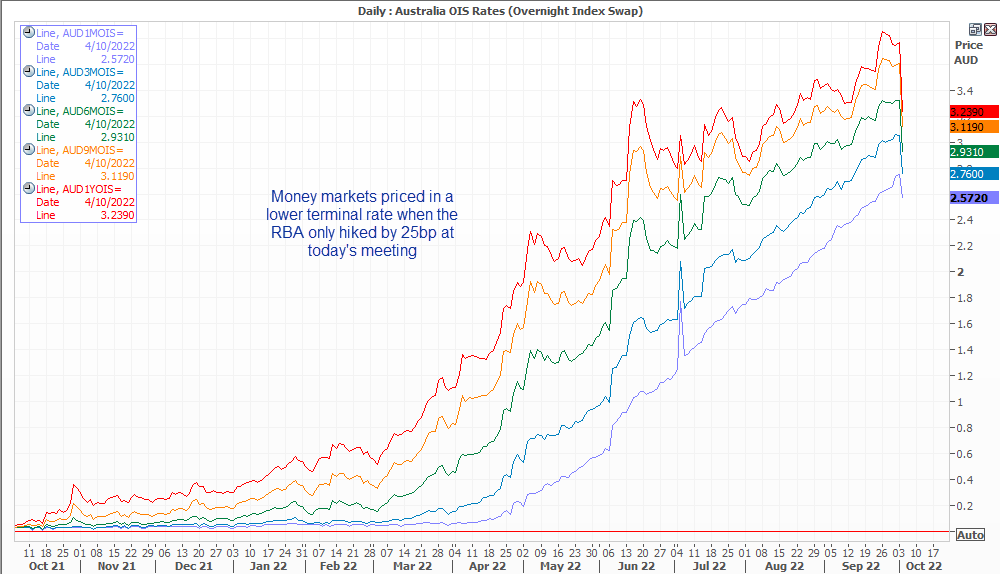

The Australian dollar is the weakest FX major after the RBA surprised markets by only raising interest rates by 25bp. The RBA raised the overnight cash rate by 25bp to 2.6% - making it their 6th consecutive hike and highest rate since September 2013. This saw a quick repricing of future rate expectations with the 1-year OIS falling -49bp. the 3-momth is down to 2.76% which is only marginally above the 2.6% cash rate.

It’s been an eventful day in Japan with North Korea firing a missile over the country – its first such act since 2017. It was also the longest-range missile test yet from, resulting in public transport being halted. Separately, inflation in Tokyo rose to 2.8% y/y, although once stripped of fresh food and energy it rose just 0.8%.

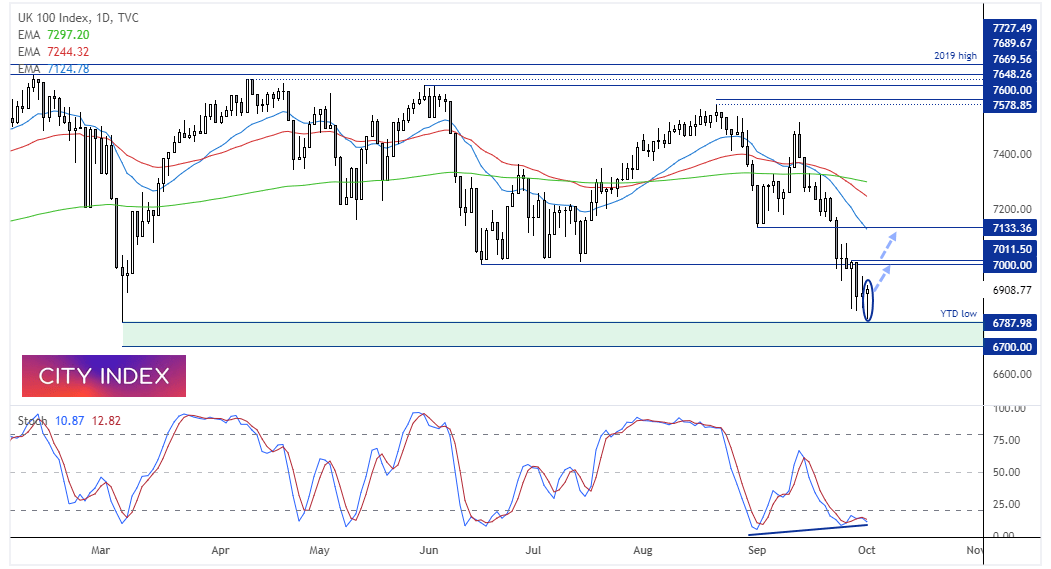

FTSE 100 daily chart:

The FTSE stopped just shy from testing the YTD low yesterday, before reversing earlier losses and closing the day with a bullish Pinbar. A bullish divergence has formed with the stochastic oscillator, which also remains within oversold territory. Given the bounce for risk appetite over the past 24hrs in the US and Asia, we favour a countertrend rally from support with 7,000 making a likely initial target. A break above which brings 7133 into focus.

FTSE 350 – Market Internals:

FTSE 350: 3807.86 (0.22%) 03 October 2022

- 221 (63.14%) stocks advanced and 126 (36.00%) declined

- 0 stocks rose to a new 52-week high, 29 fell to new lows

- 14.86% of stocks closed above their 200-day average

- 14% of stocks closed above their 50-day average

- 2.57% of stocks closed above their 20-day average

Outperformers:

- + 23.99% - Telecom Plus PLC (TEP.L)

- + 15.28% - Essentra PLC (ESNT.L)

- + 7.20% - Watches of Switzerland Group PLC (WOSG.L)

Underperformers:

- -8.08% - Aston Martin Lagonda Global Holdings PLC (AML.L)

- -7.43% - Carnival PLC (CCL.L)

- -4.86% - PureTech Health PLC (PRTC.L)

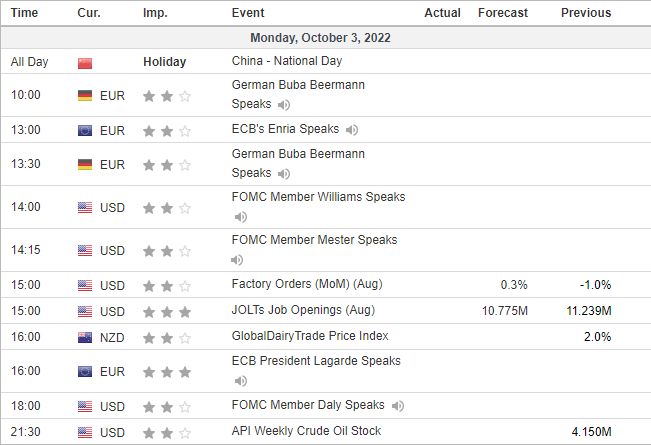

Economic events up next (Times in BST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade