- EUR/USD analysis: Euro holding 200-day average amid improved risk appetite

- US dollar rally pauses ahead of UoM Consumer Sentiment survey

- Next week’s highlights include ECB, global PMIs and US GDP & PCE

Welcome to another edition of Forex Friday, a weekly report in which we highlight selected currency themes. In this week's edition, we will discuss the US dollar and EUR/USD, and look forward to the week ahead.

The first half of Friday’s session has been dominated by a “risk-on” theme, with US futures rising following Thursday’s big rally that lifted the Nasdaq 100 to a fresh record and China’s markets extended their gains for the second day amid reports of government support for the local markets. European indices consolidated gains made the day before. Risk-sensitive commodity dollars outperformed, led by the AUD, while a slump in UK retail sales hurt the GBP. The EUR was a touch firmer as USD was held back by improved appetite for risk, which allowed gold and silver to rise for the second session. All eyes will be on consumer sentiment data, due for release at 15:00, ahead of key macro events in the week ahead.

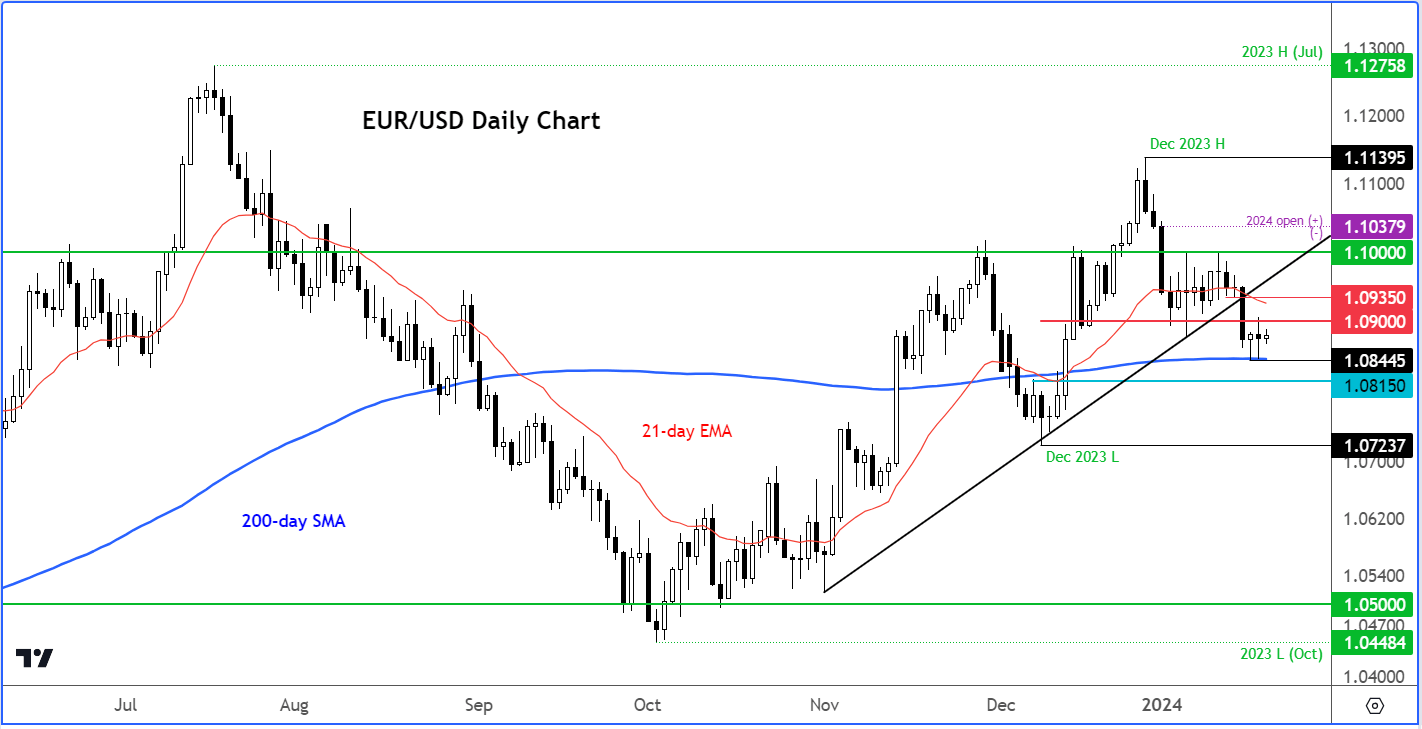

EUR/USD analysis: Euro holding 200-day average amid improved risk appetite

The EUR/USD was able to hold it own relatively well on Thursday considering the fact we had further improvement in US data, which further weighed on expectations of a March Fed rate cut. The popular currency pair has been supported in part because of the ECB also pushing back against early rate cuts, with Christine Lagarde suggesting a cut in the summer is likely than before. The sharp improvement in risk appetite also supported risk sensitive currency pairs like the EUR/USD. The Nasdaq hit a fresh record after breaking December's peak of 16970 as technology stocks, led by Apple, fuelled the latest rally, despite concerns over a delay in interest rate cuts by the Fed.

In the Eurozone concerns about inflation remaining sticky, with wage pressures continuing to remain elevated, is the main reason why the ECB is refusing to cut rate sooner. This is something that several ECB officials expressed concerns about.

With the ECB pushing back rate cut expectations, we have seen the single currency perform better against the likes of the Swiss franc, where the central bank seems to have turned quite dovish. But against the dollar, the euro will require US data to start turning lower and fast, before it can start pushing sharply higher again and break the 1.10 barrier. For now, the bulls must try to defend the 200-day MA as they have done in the past couple of sessions.

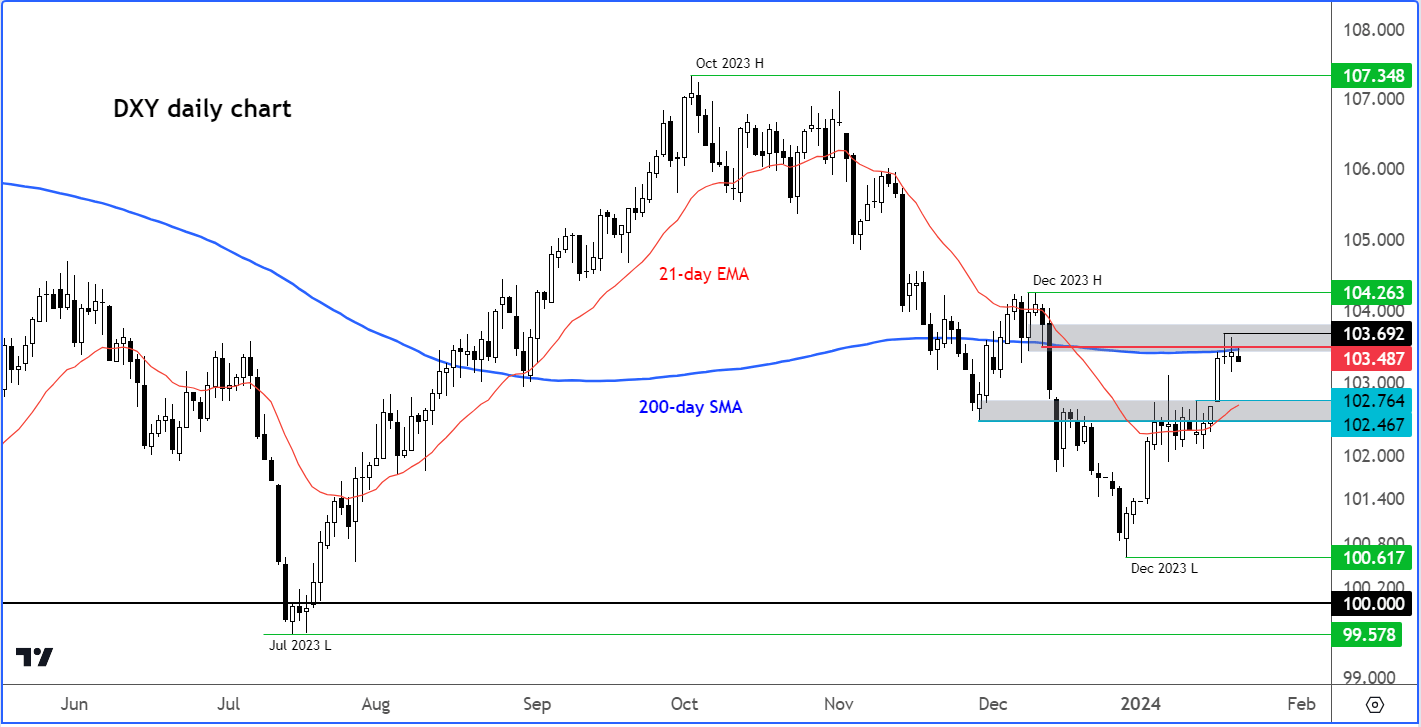

US dollar analysis: DXY rally pauses ahead of UoM Consumer Sentiment survey

Since peaking at 103.69 on Wednesday, the Dollar Index has been unable to further extend its gains, with the 200-day average offering strong resistance around the 103.50 area. This is despite the fact we have had better-than-expected US retail sales and housing market data while further evidence pointing to the resilience of the labour market was released with jobless claims falling to their lowest level in more than a year. Admittedly, we have had more disappointing data in the manufacturing sector, where the Philly Fed index printed -10.6 which was worse than the expected, with activity in the Philadelphia region now declining for 18 out of the past 20 months.

The greenback also unable rise further despite centrist Raphael Bostic sound more hawkish, along with several other of his FOMC colleagues who have spoken lately. Let’s how it will react to today’s release of UoM consumer sentiment and inflation expectations surveys as well as existing home sales, before the focus turns to next week’s key data and central bank meetings.

EUR/USD analysis: Looking ahead to next week

The week ahead features three central bank policy decisions, namely the BOJ, BOC and ECB, as well as top-tier data, including global PMIs, US GDP and core PCE Price Index.

Let’s discuss the top 3 events that will be important for the EUR/USD currency pair below.

Global PMIs

Wednesday, January 24

Concerns about the health of the Chinese and European economies have held back commodities and commodity-heavy indices such as the UK 100, China A50 and Hong Kong 50 among others. However, tech-heavy indices such as US Tech 100 and Germany 40 have outperformed on bets the global slowdown will trigger a sharp reduction in interest rates. Let’s see what surveyed purchasing managers in the manufacturing and services industries have reported at the start of the year. The PMIs are leading economic indicators and in the eyes of investors will carry more weight. If we see a positive response in risk assets, then the EUR should benefit.

ECB rate decision

Thursday, January 25

Last week saw several ECB officials tried to push back against early rate cuts, mirroring the Fed. While in the case of the US, the pushback is mainly because of a relatively stronger economy, elsewhere – especially in the UK and Eurozone – it is all about concerns about inflation remaining sticky, with wage pressures continuing to remain elevated. ECB President Christine Lagarde suggested that borrowing costs could come down in the summer rather than in spring, while several other ECB officials have also expressed concerns about wage inflation. Let’s see if the ECB will provide any further hints at this meeting. The more hawkish the ECB, the more the EUR is likely to find support.

US Advance GDP

Thursday, January 25

Following stronger-than-expected CPI, jobs and retail sales reports in the last couple of weeks, the dollar has been pushing higher, keeping the EUR/USD under pressure. There has been renewed concerns over the Fed’s inclination to maintain higher interest rates longer, after Fed governor Christopher Waller suggested a measured approach, cautioning against any haste in considering near-term rate cuts. If GDP reveals further strength in the US economy, expectations of an imminent reduction in interest rates will be pushed further out. The EUR/USD bulls will be looking for weakness in US data, including GDP on Thursday and Core PCE the following day.

For a full week-ahead report, check out my colleague Matt Simpson’s preview here.

Source for all charts: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade