- EUR/USD analysis: Why is US dollar gaining ground?

- German retail sales down for the fourth month in a row

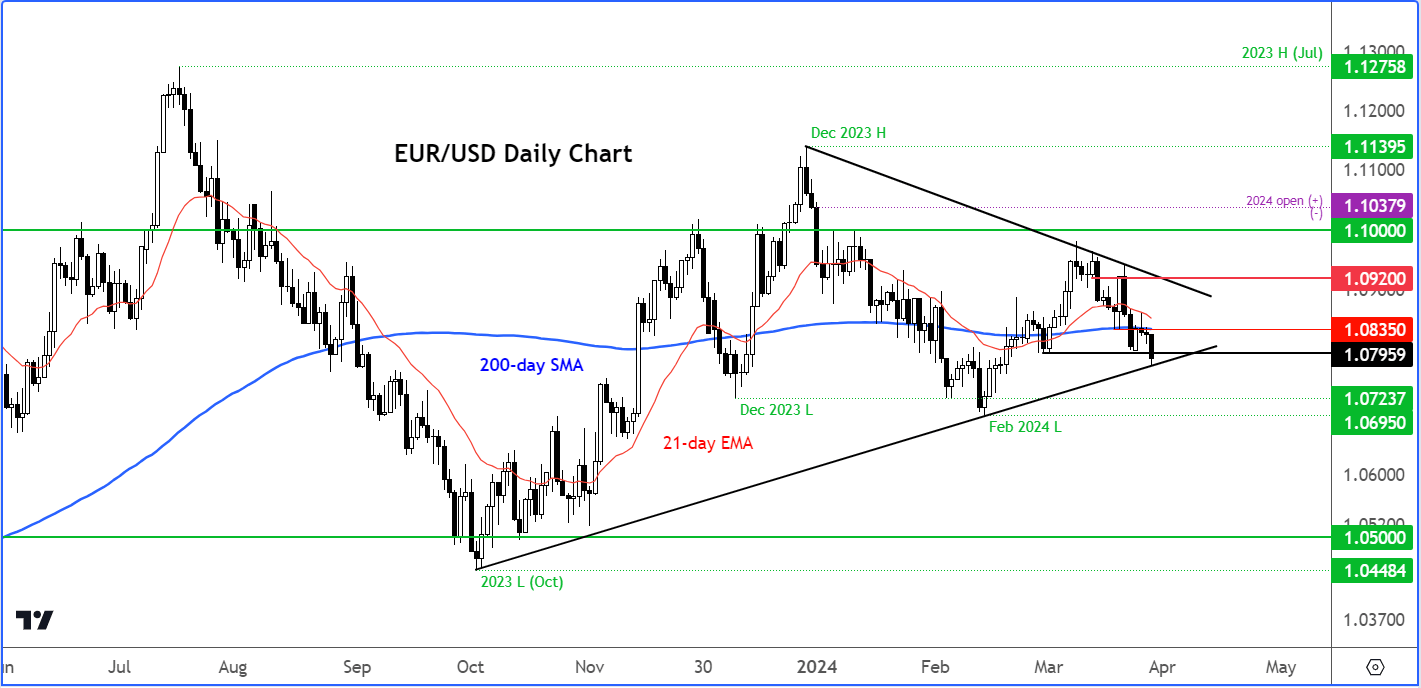

- EUR/USD technical analysis shows rates testing a key trend line

The EUR/USD dropped to a 5-week low in early European trade, before bouncing off a trend support. Some of the major euro crosses like the EUR/GBP and EUR/JPY also fell, suggesting that the earlier move was driven at least partly by disappointing German retail sales data that was released this morning. But the US dollar was up against most major currencies too, which provided additional pressure on the world’s most heavily traded currency pair. However, as we look forward to upcoming PCE inflation data on Friday, and more market-moving data in the next couple of weeks, the US dollar may start to ease back as most of the positive influences are already priced in. What’s more, the ongoing risk rally suggests the dollar may gave way to more risk-sensitive currencies moving forward.

EUR/USD analysis: Why is US dollar gaining ground?

The US dollar index extended its gains on in the first half of Thursday’s session. Support for the dollar came ever since Christopher Waller, one of the Federal Reserve's prominent figures, gave a speech with a slightly hawkish tone last night. Unlike the Fed Chair, Waller was slightly more concerned over the early-year sticky inflation data, while also pointing to strong jobs growth. We also saw an unexpected upward revision to US Q4 GDP estimate to 3.4% vs. 3.2% reported initially, although this was ignored by traders as the focus is firmly fixated on inflation data now.

As we approach the end of the quarter, the US dollar thus remains strong. In the next quarter, we will get closer to the time of policy normalisation in the US, Eurozone and UK, among other places. This is at least partly why we have seen gold and major indices reach repeated new highs.Indications from Fed’s hawkish camp such as Waller, and dovish central banks elsewhere, suggest that the Fed may lag behind in the policy normalisation process, which is why the dollar hasn’t exactly sold off despite the Fed acknowledging it has reached peak rates and that a cut in June is likely. Indeed, the likes of the Swiss franc have been falling sharply of late after the Swiss National Bank became the first major bank in G10 to cut rates last week, while the Riksbank yesterday hinted at a possible rate reduction in May or June. Elsewhere, remarks from the RBNZ Governor overnight suggests the New Zealand central bank is ready to normalise its policy, sending the kiwi further lower. The euro has been constantly pressured by weakness in German data. Consequently, short-term interest rate differentials have been shifting in favour of the US dollar.

However, these influences are now priced in, I feel. For the dollar to continue finding buyers, it will need the support of strong data from the world’s largest economy.

German retail sales down for the fourth month in a row

This morning's release of German retail sales figures showed sales continued their decline for the fourth consecutive month. Real retail sales fell by 1.9% month-on-month and 2.7% year-on-year in February, pointing to a weak German consumer. But we have seen a bit of improvement in sentiment surveys, such as the GfK consumer confidence indicator earlier this week. Perhaps things will start to improve in hard data in the months ahead. If so, this could provide the euro support.

EUR/USD technical analysis

Source: TradingView.com

As mentioned, the EUR/USD fell to a five-week low earlier, breaking below 1.0795 which was the low from end of February. At the time of writing the EUR/USD was testing a bullish trendline that had been in place since October of last year around 1.0780 area. Should the EUR/USD close below this trend line, we could see further technical selling in the days ahead. If so, the next downside target could be at around 1.0700 area where the EUR/USD had previously found support in December and again in February.

The bulls meanwhile will be looking for a false break below this 1.0795 level. If rates were to climb back above this level by the close of play today and ideally go on to rise above the 200-day moving average at 1.0835 level, then that would be a strong bullish signal.

Given that we have key US data coming up on Friday (core PCE inflation) and Powell is also speaking, I wouldn’t be surprised if the EUR/USD were to climb back higher from these levels.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade