- A big earnings beat from Nvidia has seen US stock futures rise strongly after hours

- With a number of fundamental factors working in its favour, the setup suggests the Nikkei 225 may retest its prior record highs set in December 1989.

Nvidia shares flying in afterhours trade after another earnings beat, providing a tailwind to tech stocks globally. Slightly steeper yield curves in developed markets, providing banking stocks juice for margin expansion. USD/JPY offered against a basket of G10 currencies, keeping the outlook for Japanese exporter earnings buoyant.

If there was ever a day for Japan’s Nikkei 225 to overcome its demons and take out the record high set in December 1989, few screen better than today. The ducks look to have lined up for Nikkei bulls. If we can’t set a new peak, it may provide a subtle warning that the market has run too hard, too fast.

Japan’s bluechip index sits only 700 points from the intraday record of 38,957.44, a mere 1.8% from where it closed Wednesday. Gains of that magnitude have been seen frequently this year since the index broke resistance at 33750, triggering the latest run higher.

Nikkei 225 eyeing record high

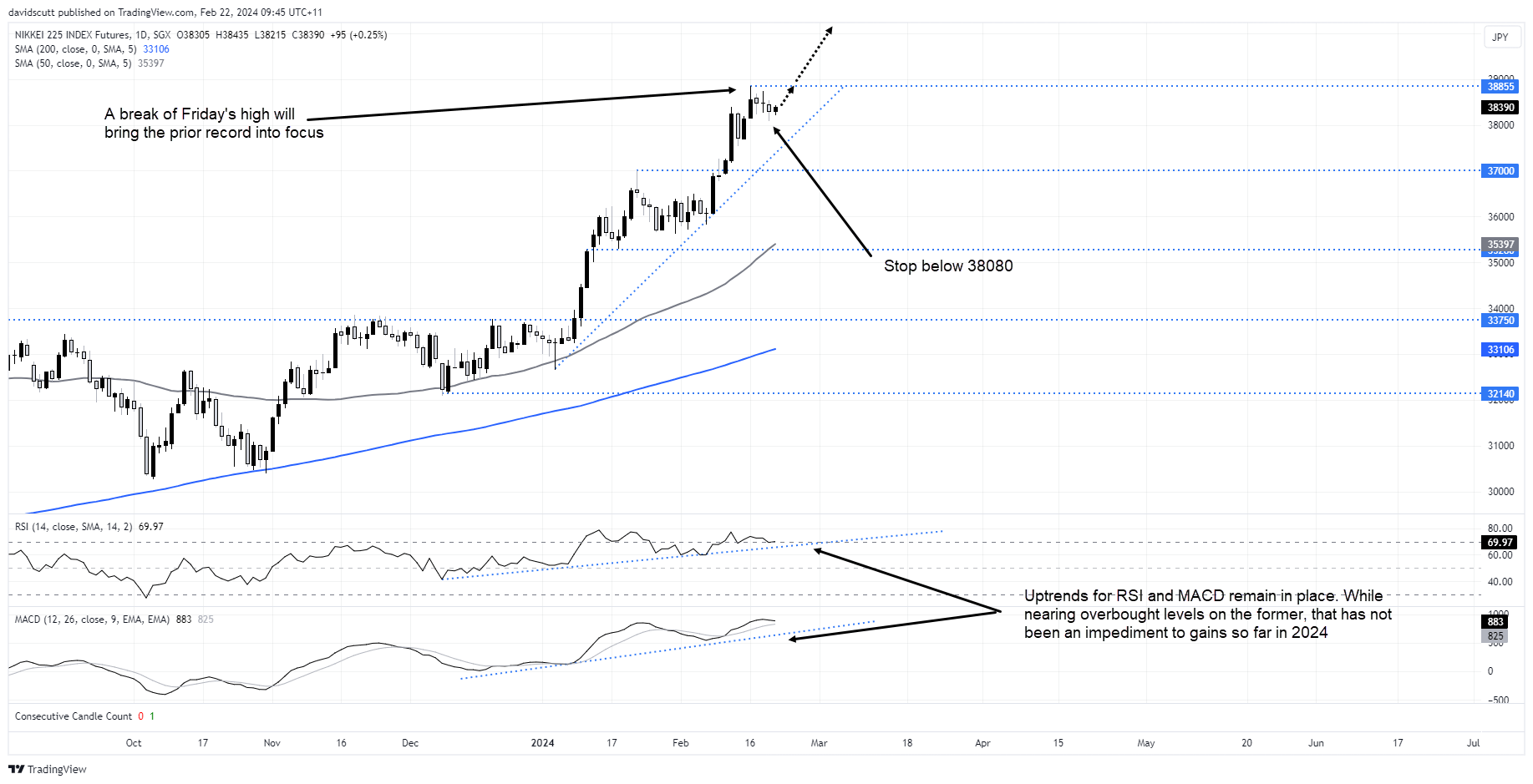

Looking at Nikkei 225 futures in Singapore, the first upside target for longs is 38855 where futures stalled late last week. Should that be taken out, the intraday record for the physical index will be squarely on the radar.

For those considering entering longs now, a stop below 38080 – where futures bounced on Wednesday – could be used for protection. Should the trade move in your favour, you could push it higher to your entry point, providing a free option looking for upside. As for potential targets above the 1989 peak, recent history suggests markets may gravitate towards round numbers such as 39000 and 40000 given the absence of technical levels.

Another trade idea could be to buy a clean break of 38855, allowing the level to be used for protection with a stop-loss order below.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade