DJIA, S&P 500, and Nasdaq 100 Key Points

- Fears of war in the Middle East drove major US indices lower last week, and traders will have to keep a close eye on headlines in the coming week.

- Earnings season picks up this week, highlighted by results from tech giants Netflix and Taiwan Semiconductor on Thursday.

- US indices are seeing diverging performance, with the DJIA looking relatively weak and the Nasdaq 100 uptrend remaining healthy.

Key Theme: Middle East Tensions

As of writing on Friday afternoon, the major US indices are all poised to close lower on the week, hurt by fears of “higher for longer” interest rates after a hotter-than-expected US CPI report and concerns about an imminent Iranian attack in Israel.

The most recent news as we go to press is that US Senator Rubio stated that, "[b]arring some last-minute development, Iran is going to attack Israel" and markets appear to be taking the threat seriously. The conventional “war trade” is afoot, with global stocks falling while “safe haven” assets like US treasury bonds, the US dollar, the Japanese yen, and gold all rise.

It’s difficult to handicap how the weekend and coming week will play out at this point, but it’s worth noting that previous concerns of escalating geopolitical tensions have generally dissipated before growing into a broader conflict, so traders may be keen to buy any war-fearing dips if there are any signs of de-escalation

Key Theme: Big Bank Earnings

Friday’s earnings reports from major U.S. banks like JPMorgan Chase (JPM), Wells Fargo (WFC), and Citigroup (C) showed mixed outcomes that highlight ongoing challenges in the sector, mainly due to income from interest payments and concerns about future interest rate changes by the Federal Reserve.

JPMorgan Chase's stock fell around 5% after it reported lower-than-expected interest income. Similarly, Wells Fargo's stock also dipped slightly despite better-than-expected overall revenue, as it too faced weaker interest income. Additionally, the earnings reports showed differing results across the gamut of banking activities. While some areas like digital payments are showing strength, others, including auto loans and mortgages, are weakening.

As noted above, broad market sentiment remains wary, and that helped drive the S&P 500 banks index to a near-month low. This caution reflects concerns that, despite some positive trends like increased credit card use, underlying issues such as loan performance and economic uncertainty remain significant risks. Banks are the lifeblood of a modern capitalist economy, so traders will be watching next week’s releases for more clarity on how the sector is doing.

Earnings to Watch this Week

Speaking of earnings, the rest of the month, and maybe the first week of May, mark the “peak” of Q1 earnings season, giving traders plenty of relevant updates to chew on in the coming weeks. This coming week’s most important earnings reports are below:

Monday

- Goldman Sachs

- Schwab

Tuesday

- Bank of America

- Morgan Stanley

- Johnson and Johnson

- UnitedHealth

Wednesday

- ASML

Thursday

- Netflix

- Taiwan Semiconductor

Friday

- American Express

- Procter and Gamble

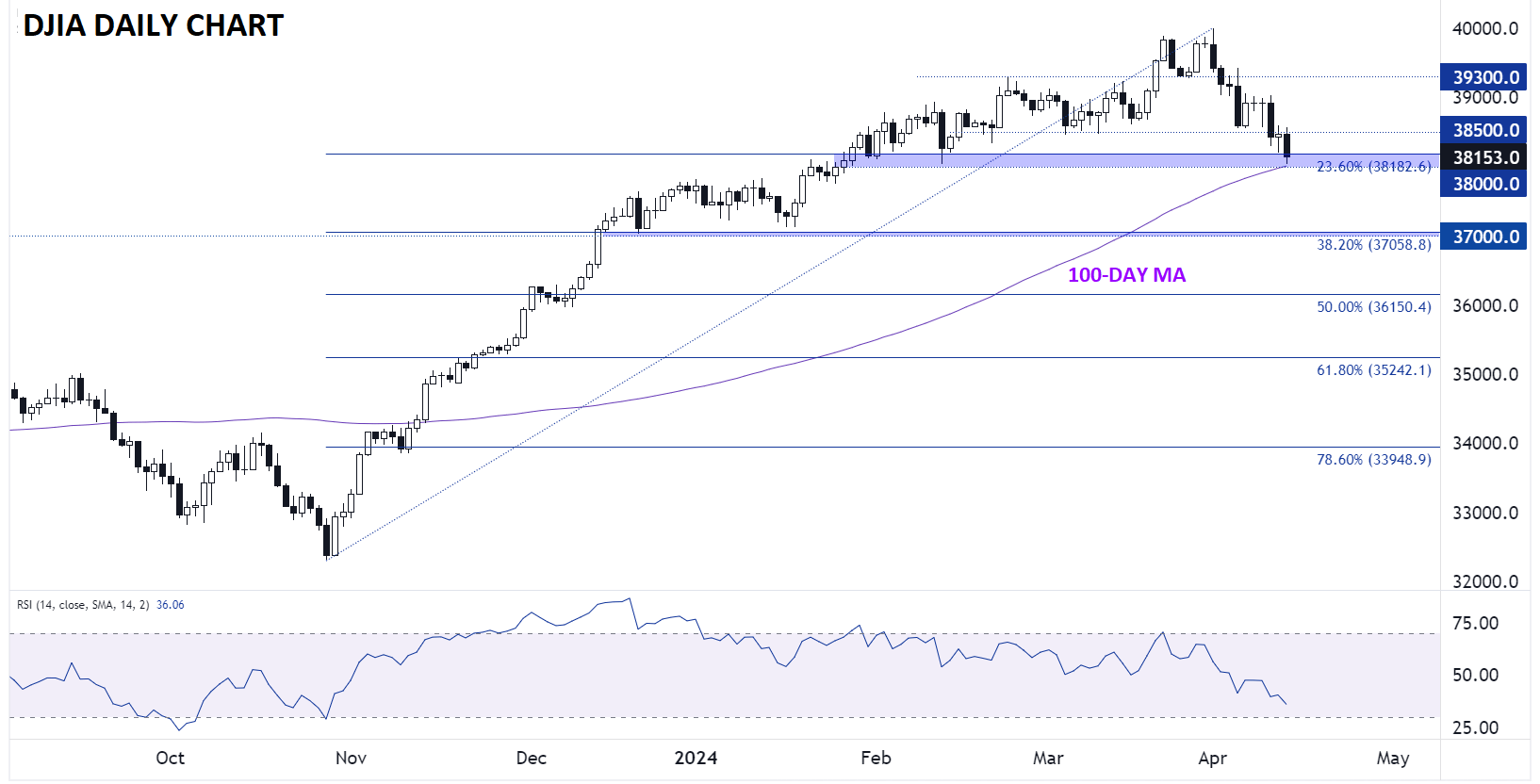

Dow Jones Industrial Average Technical Analysis – DJIA Daily Chart

Source: TradingView, StoneX

As the chart above shows, the oldest US index is on the verge of breaking down below its 100-day SMA at 38,000 to the lowest level since January. Taking a step back, the index has now retraced about a quarter of its November-March rally, marking the biggest retracement among all the major US indices. Looking ahead, a break below 338,000 would open the door for additional downside toward the confluence of the year-to-date lows and 38.2% Fibonacci retracement near 37,000.

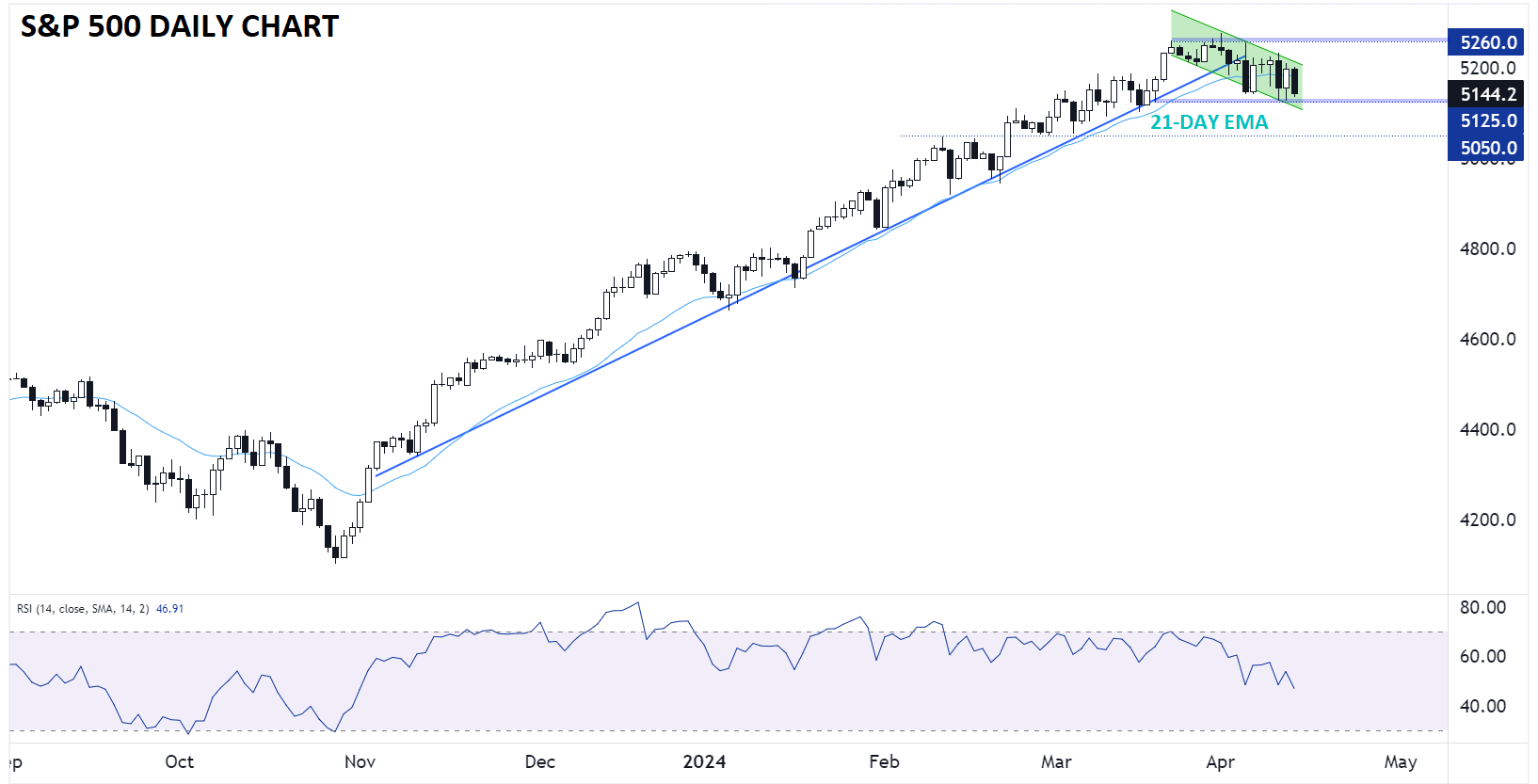

S&P 500 Technical Analysis – SPX Daily Chart

Source: TradingView, StoneX

Relative to the Dow, the S&P 500 looks more constructive, though the “up only” rally off the November lows remains under more threat than it has been to date. For this week, the key level to watch will be last week’s low near 5125, with a break below that level potentially setting the stage for another leg down toward the March lows at 5050 next. Meanwhile, a bullish recovery, especially if earnings are strong and fears of conflict in the Middle East dissipate, could reach the record closing highs at 5260 in short order.

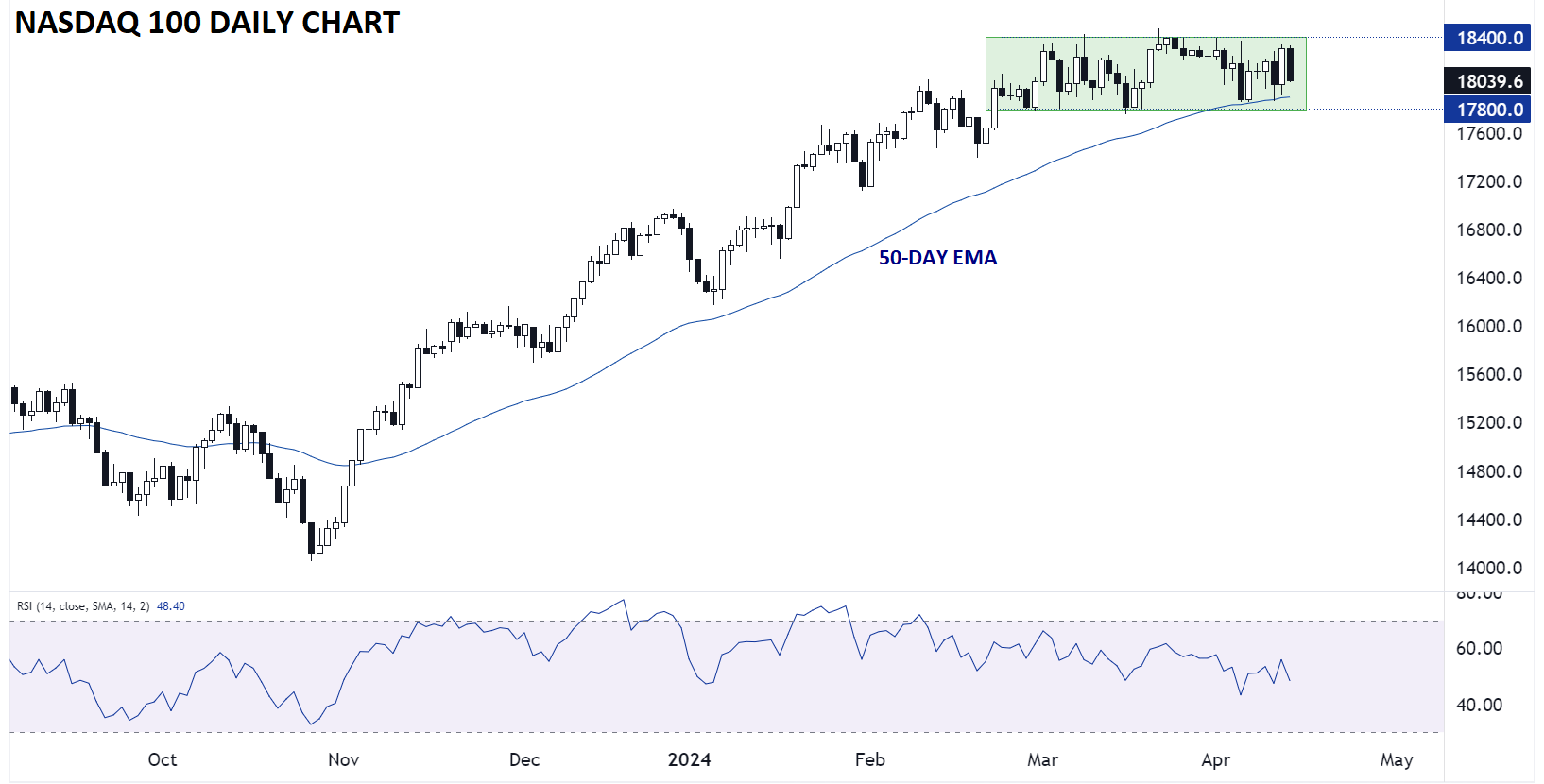

Nasdaq 100 Technical Analysis – NDX Daily Chart

Source: TradingView, StoneX

Saving the best for last (at least for bulls), the Nasdaq 100 has hardly seen a pullback at all, merely consolidating in a sideways range between 17,800 and 18,400. Unless/until that range breaks to the downside, the strong uptrend will remain intact and the path of least resistance will remain to the upside.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX