- The UK and US are considering launching military strikes on Houthi rebels operating in Yemen

- Increased conflict across the Middle East may increase the geopolitical risk premium already attached to gold and crude oil prices

Upside risks for gold and crude oil look appear be building as the war between Israel and Hamas fighters in Gaza threatens to spillover to a far larger and more disruptive regional conflict.

The latest escalation stems from continued attacks by Houthi rebels in Yemen on vessels operating in and around the Red Sea, including a reported missile attack in the Gulf of Aden which deviates from methods used previously. In response, several leading news outlets are reporting UK Prime Minister Rishi Sunak has ordered joint military strikes with the US against the rebels, potentially within hours.

It’s a fluid situation carrying two-way risks. It could easily fizzle as other flare-ups have. But the broader question is whether the tensions are likely to dissipate meaningfully in the near-term, removing the risk premium that’s been built into crude oil and gold since the onset of the conflict? Looking at the latest headlines, the answer appears to be no, meaning the skew for this premium remains to the upside.

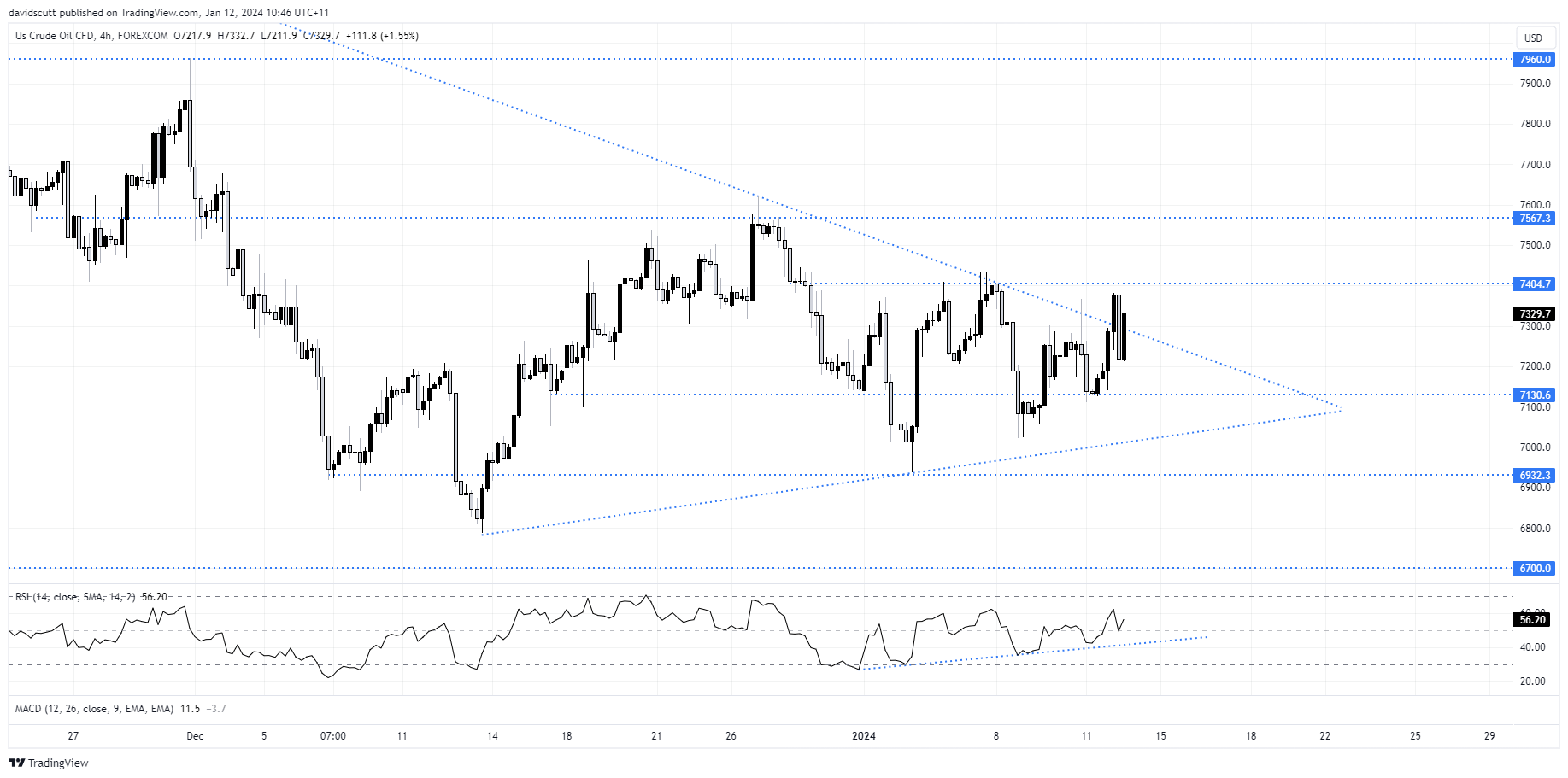

Crude oil cushioned by proximity of key technical support

As discussed in an earlier post this week, further downside for crude oil beyond that already seen was already looking challenged from a technical perspective given the proximity of the 200-week moving average to the current price. It’s been a level that’s acted as a trigger to buy dips successfully throughout 2023. With downbeat sentiment regarding the outlook for the supply-demand balance now arguably in the price, any negative supply shocks, coupled with strong technical support below, creates the kind of environment that could promote renewed upside given favourable risk-reward.

Looking at crude on the four hourly, the price has been grinding higher since bottoming in mid-December, with ranges gradually compressing having been unsuccessful in breaking downtrend resistance dating back to September. But the latest headlines are now seeing crude attempt to break this downtrend.

For those considering initiating long positions, the 200-week moving average is located around $70.91. Support levels on shorter timeframes include $71.30, $69.30 and again at $67.00. Depending on your upside target, those could be used to place stop-loss orders to protect against the possibility of another lurch lower for prices. As for potential upside targets, $74, $75.70 and $79.60 are levels to consider.

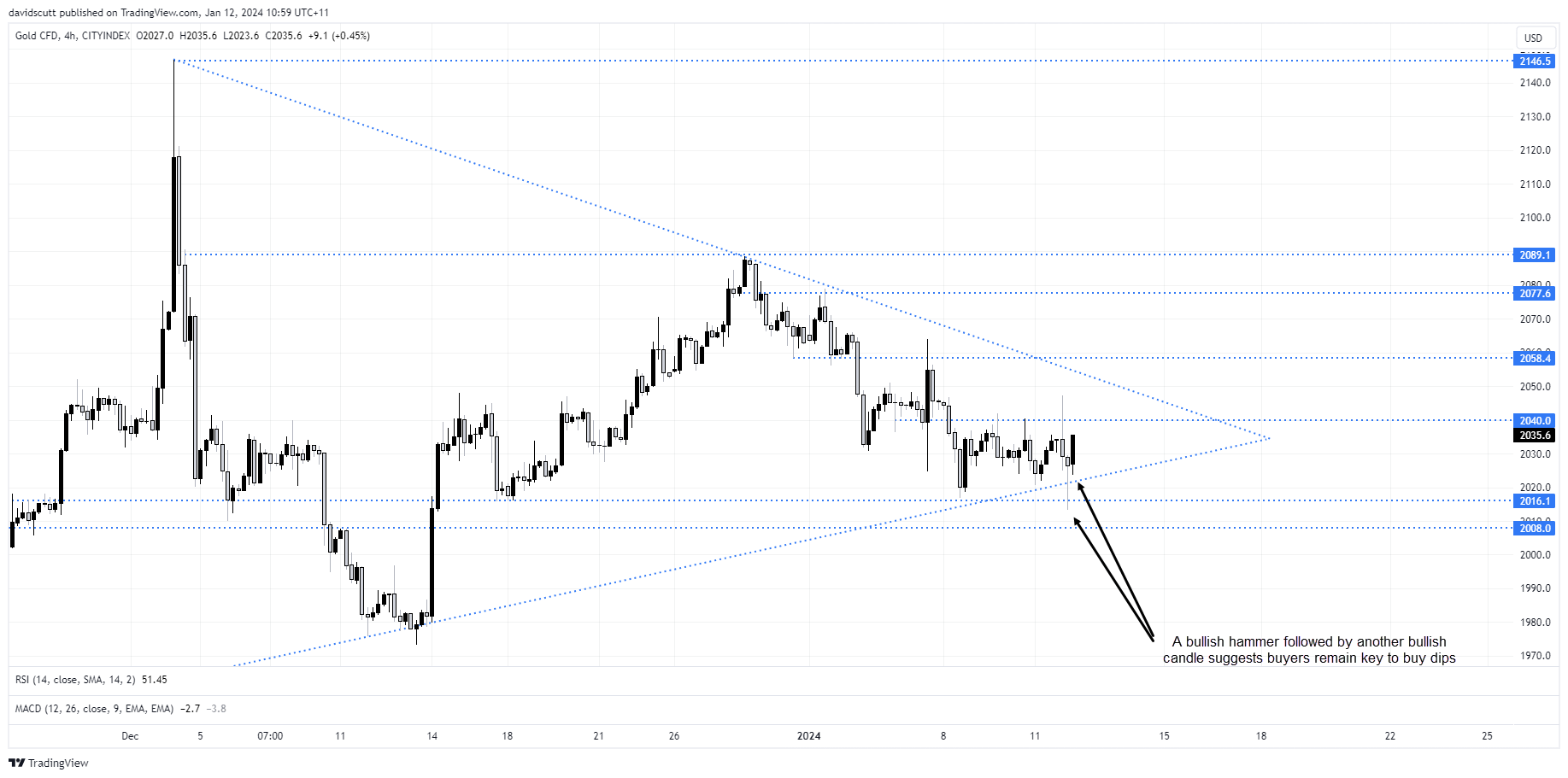

Gold showing signs that buyers are gaining the ascendency

Gold is another asset class than has responded to the latest Middle Eastern headlines, popping back above uptrend support after an unsuccessful attempt to break lower earlier in the session. The bullish hammer candle sparked on the four-hourly by that reversal, followed by the subsequent bullish candle, suggests buyers have the ascendency in the near-term.

For those looking at longs, $2008 to $2016 has acted a decent support zone dating back several months, allowing stops to be placed below for protection. On the upside, potential long targets include $2040. $2058, $2078 and $2089.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade