- Crude oil analysis: China set to import record Russian oil

- Crude oil analysis: What will traders be watching this week?

- WTI technical analysis point higher

After last week’s noticeable gains, crude oil looks to extend its winning run as we kick off a bustling week. Overnight, China delivered a mixed bag of data, unveiling somewhat lacklustre consumer and real estate figures but surprisingly robust investment and industrial data, hinting at a potential shift in growth drivers for 2024 with the looming prospect of a stimulus rollout. The sturdy industrial data bolstered hopes for a robust demand recovery in commodities, nudging crude prices slightly higher during Asian trading hours, before trading further higher during European and US hours.

Crude oil analysis: China set to import record Russian oil

China’s industrial production came in stronger than expected, rising 7% year on year in February and marking the fastest pace of growth in two years. Economists were expecting a slower growth of 5%. The rationale behind the latest oil gains on the back of the Chinese data is a simple one: accelerating output in Chinese factories means more demand for oil. Speaking of Chinese demand, the world’s biggest oil importer has ramped up purchases of crude from Russia and is set to hit record levels this month. As per Kpler and Bloomberg, large volumes of Sokol oil, which have been shunned by India due to concerns over US sanctions, have been imported by China. Beijing is set to import about 1.7 million barrels a day of Russian crude this month.

Crude oil analysis: What will traders be watching this week?

Over the next few days, the economic agenda is filled with significant central bank meetings and key economic indicators from various countries, including Australia, China, the UK, Eurozone, US, and Canada. Expect heightened market volatility across asset classes. Major central banks slated for announcements include the Bank of Japan and Reserve Bank of Australia on Tuesday, followed by the US Federal Reserve on Wednesday, and rounding off with the Swiss National Bank and Bank of England on Thursday.

Of particular interest to oil traders will be the global manufacturing PMI data, set to take centre stage on Thursday among the upcoming economic reports. Optimism over demand could get another boost should we see stronger-than-expected numbers this time.

A strong set of PMI figures will also be needed to justify the recent bullish demand forecasts from the International Energy Agency (IEA). The IEA raised its projections for global oil demand growth in 2024 by 110,000 barrels per day to 1.3 million barrels, citing a stronger US economic outlook and increased demand for marine fuel. This uptick in demand is attributed to ships choosing longer routes to avoid Houthi attacks in the Red Sea. The IEA revised also revised its previous forecasts of oversupply and now think there is a possibly of a shortfall due to expectations that OPEC+ will extend production cuts later in the year.

The weekly crude oil inventories report should move prices at least momentarily. In the last couple of weeks, we have seen bullish data. Last week, inventories came in at -1.5 million barrels, marking the first decline in seven weeks, with a reduction in stocks at the Cushing hub also providing bullish support for oil prices.

Oil traders will also want to keep a close eye on the direction of US dollar, which has been gaining bullish momentum of late, increasing import costs for foreign buyers. Following this week’s central bank meetings, they will want to see a resumption lower in the US dollar. However, if the Fed turns out to be more hawkish in its assessment of inflation and thereby interest rates at its upcoming FOMC policy decision in mid-week, then this may send the dollar further higher and potential weigh on buck-denominated commodities, including crude oil.

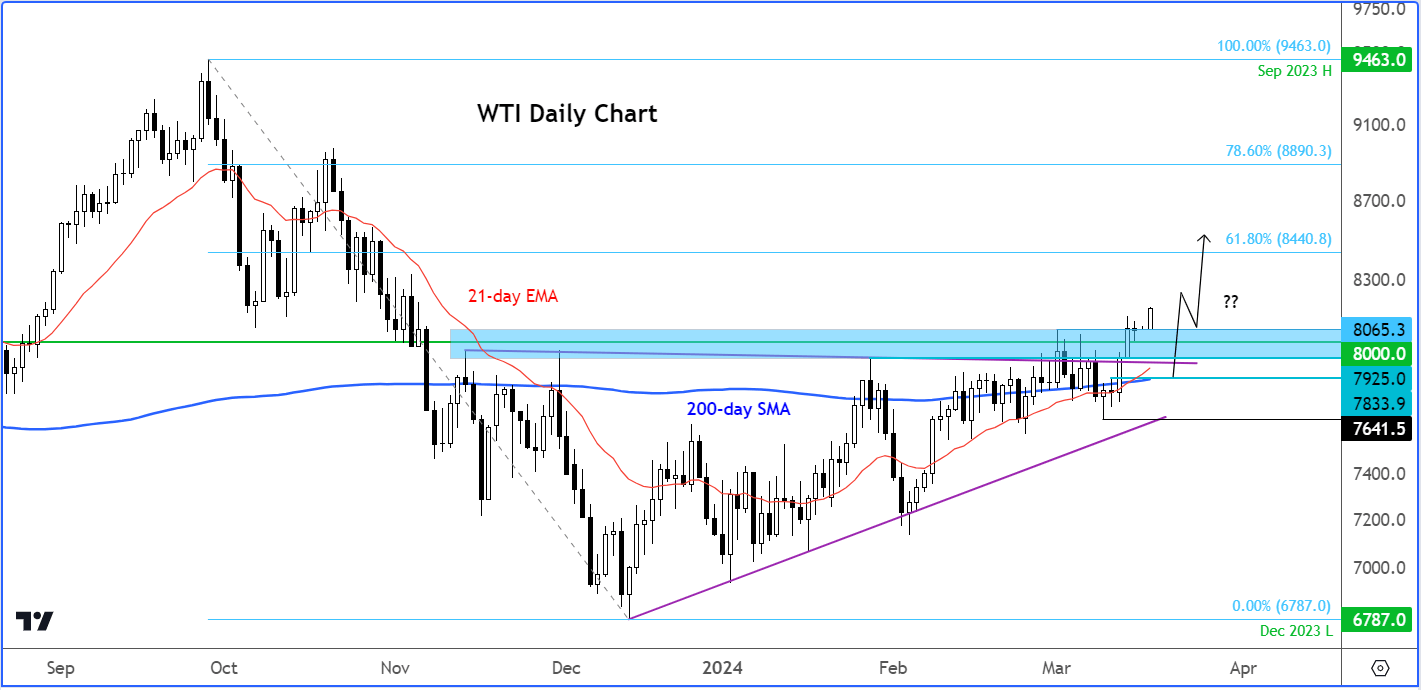

WTI technical analysis

Source: TradingView.com

From a technical perspective, WTI presents a promising picture after ascending over the past two and a half months, albeit within a somewhat imperfect bullish trend that was marked by intermittent downward swings. Since November, WTI has faced repeated sell-offs near the $79.00 mark, struggling to maintain levels above the 200-day moving average. However, in recent weeks, WTI has managed to hold above this moving average more frequently, with sell-offs gradually becoming less severe. With a decisive breakthrough above the $79.00 threshold last week, followed by surpassing the psychologically significant $80.00 level, the technical outlook indicates a clearer path of least resistance towards higher price levels.

Looking ahead, the technical bullish sentiment hinges on oil's ability to sustain levels above the now-penetrated $79.00-$80.00 range during any short-term dips. Maintaining these levels would uphold bullish momentum, potentially propelling prices towards the mid-$80s in the coming days. The next measured move target is at $84.40, which converges with the 61.8% Fibonacci retracement of the significant downward swing that began from the peak of $94.63 in September.

For those adopting a bearish stance on oil, it may be prudent to await the emergence of a clear reversal pattern or the formation of a lower low. In this context, many bulls would consider last week's low at $76.41 as a critical threshold. A potential breach of this level could trigger a sharp downturn, although such a scenario is not my primary expectation.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade