Ahead of key central bank decisions, we have seen some adjustments in risk assets today, with markets associated with China doing relatively well following news that top leaders in China indicated more support for the real estate sector. We have seen a big move in copper and other metal prices, with crude oil, yuan and Aussie all also pushing higher. So, in this edition of Technical Tuesday, we will provide analysis on the AUD/USD outlook, as well as the USD/CNH and copper.

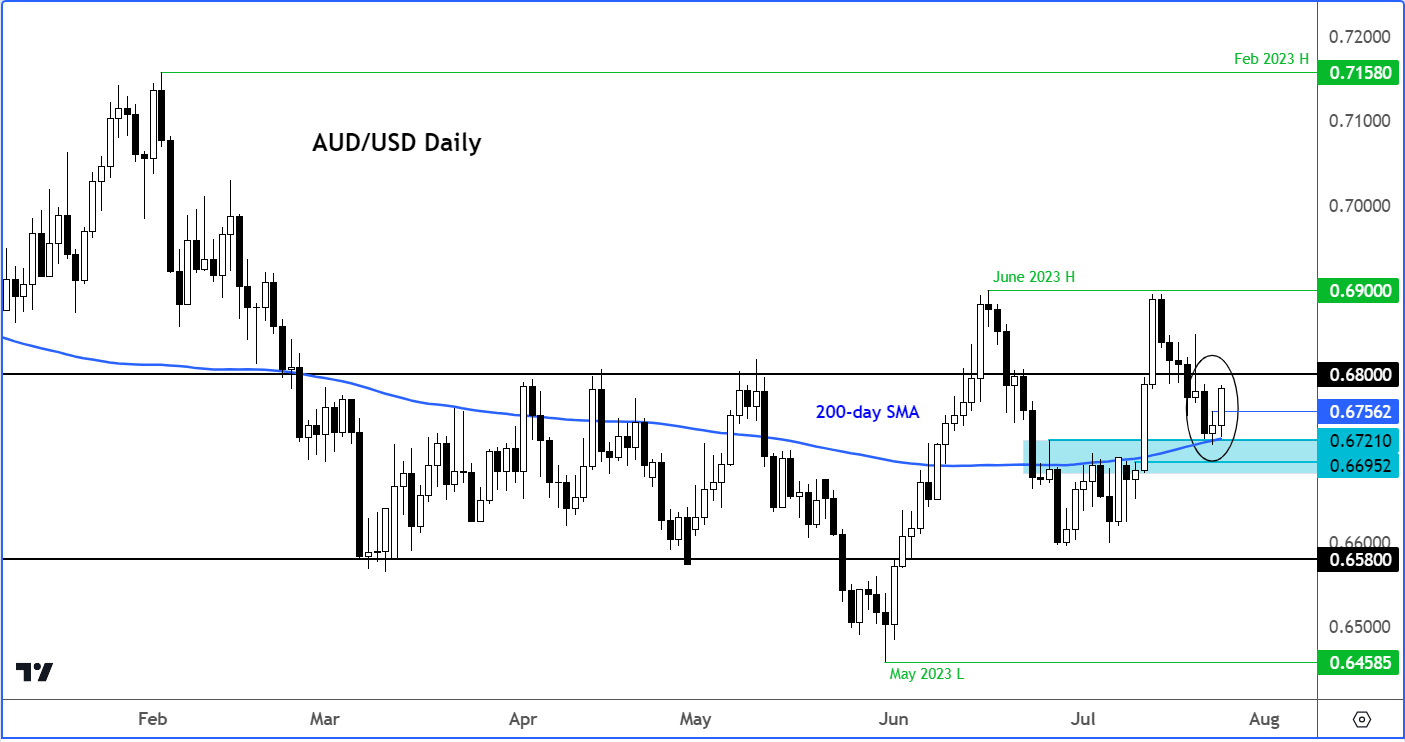

AUD/USD outlook: Aussie holds 200-day

The AUD/USD has held key support between 0.6700 to 0.6720ish so far this week, in a sign that investors are now happy to push rates higher again after the latest pullback.

The AUD/USD outlook turned mildly positive in May when the breakdown below prior key support at 0.6580 proved to be short-lived. As a result, the AUD/USD rallied sharply until peaking in mid-June at 0.6900. From there it has fallen twice.

Interestingly, the slope of the 200-day average has started to turn positive and price is beginning to respect this key moving average by holding mostly above it in recent times. This is potentially a strong bullish signal.

The bulls now need to see some upside momentum for confirmation that rates have indeed bottomed out. A move above 0.6800 on a daily closing basis would tip the balance in the bulls’ favour. If seen, watch out for a clean break above 0.6900.

In terms of support, Monday’s high at 0.6755 is now the first line of defence for the bulls. Break that and a move down to the key support area around 0.6670 could be next (shaded on the chart).

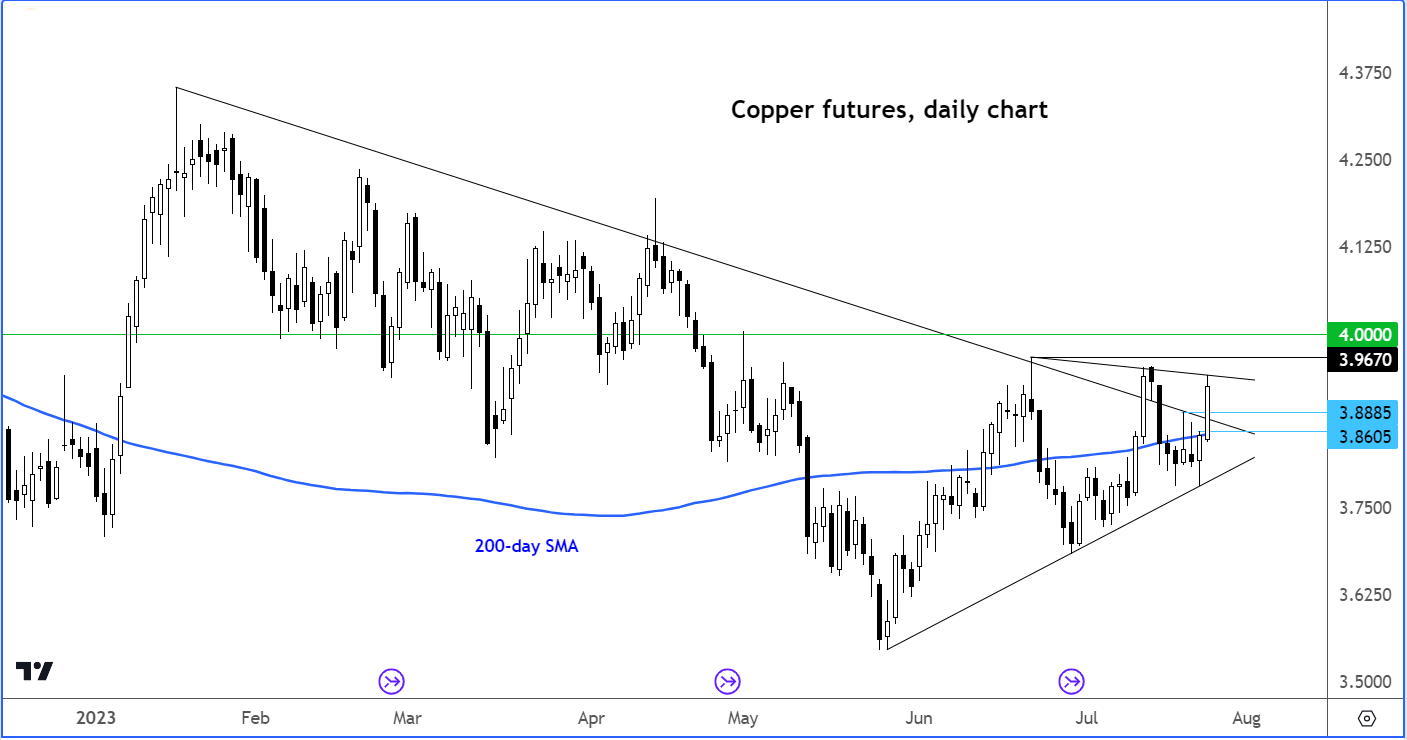

Copper outlook: Metal rises on China stimulus hopes

As can be seen from the futures chart of copper, the metal has been putting in interim higher lows since bottoming out around 3.5350 in May. Since then, it has struggled to stage a more decisive move higher, owing, in part, to concerns over China’s economy. But a bullish breakout could be on the cards soon. The metal has again broken above the 200-day average today and prior resistance around 3.8600 to 3.8885. These levels are now going to be the key defence lines for the bulls. There’s also a less-than-perfect bearish trend line in place, which looks like it is about to be take out in the next day or two.

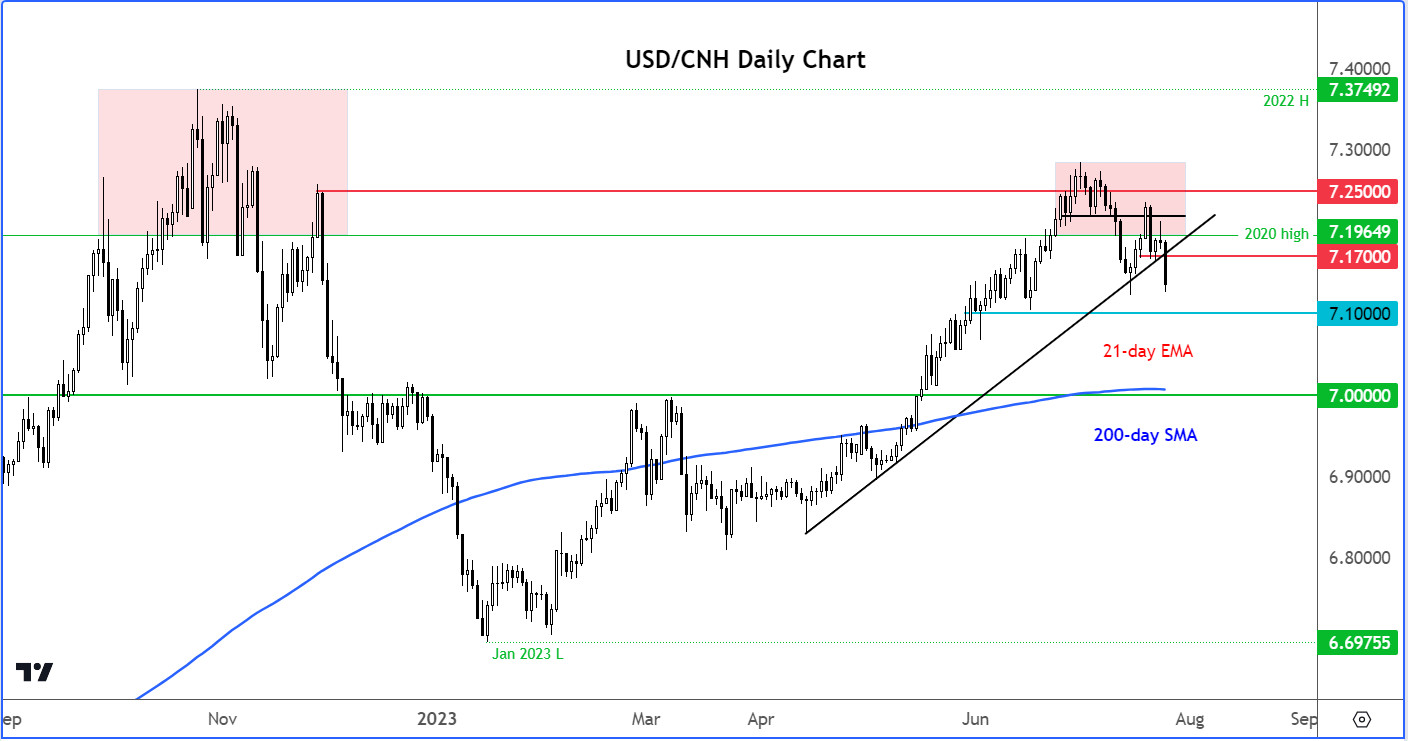

USD/CNH outlook: Yuan breaks key level

Boosted by hopes of more stimulus for the Chinese economy, the yuan staged a sharp rally overnight to turn the short-term USD/CNH outlook bearish. This pair has again filed hold the breakout above the 2020 high of 7.1965, similar to the price action at the back end of last year. For as long as it now remains below this level, I would maintain a bearish view on this pair – especially now that it has broken below the bullish trend line that had been in place since April.

As well as 7.1965, we have an additional resistance level to watch around 7.1700, the base of today’s breakdown. In terms of support, 7.1000 is now in sight. A potentially dovish Fed could lead to a move below this level, and towards long-term support circa 7.0000, where we also have the 200-day average coming into play.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

Source for charts used in this article: TradingView.com

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade