This is an excerpt from our full 2024 Central Bank 2024 Outlook report, one of nine detailed reports about what to expect in the coming year.

Federal Reserve Outlook 2024

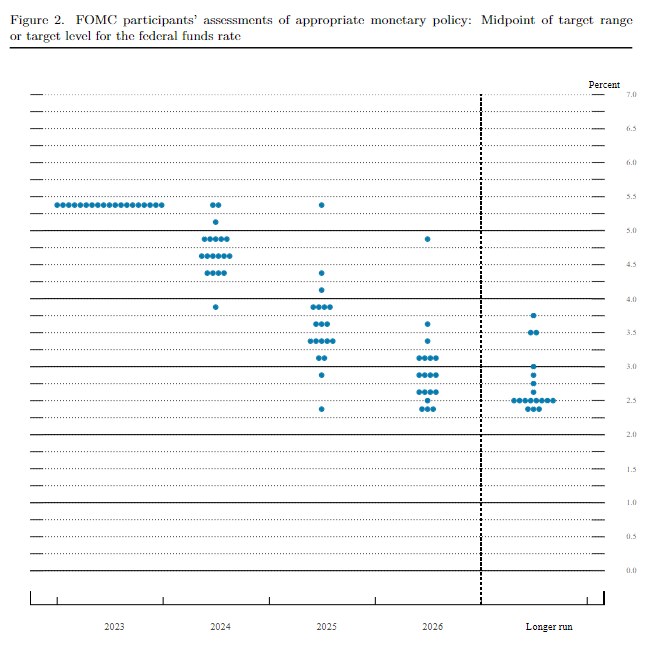

The Federal Reserve appears to be on track to alter the course of monetary policy in 2024 as the central bank says that the ‘policy rate is likely at or near its peak for this tightening cycle.’ As a result, the Federal Open Market Committee (FOMC) may continue to adjust the forward guidance over the coming months as officials ‘do not view it as likely to be appropriate to raise interest rates further.’

What will a long-awaited shift in monetary policy at the Fed mean for the US dollar? What about the outlooks for the European Central Bank, Bank of England, and Bank of Japan?

Check out our full 2024 Central Bank preview, along with all of our 2024 Outlook guides!