In a matinee to today’s FOMC meeting, Canada released CPI data for February. The headline February print was 5.7% YoY vs 5.5% YoY expected and 5.1% YoY in January. This was the highest level since August 1991! In addition, the Core CPI, which excludes food and energy, rose to 4.8% YoY vs 4.5% YoY expected and 4.3% YoY in January. Recall that on March 2nd, the Bank of Canada increased its key interest rate by 25bps, its first hike since 2018. However, the central bank also kept its bond holdings in the “reinvestment phase”, not yet ready to allow its balance sheet to begin unwinding. In addition, the February Employment Change released last week showed that 336,000 new jobs were added to the economy vs an expectation of +160,000. Average Hourly Wages were 3.3% YoY vs 2.3% YoY expected and a 2.4% YoY increase in January. Both the higher inflation readings and the strong Employment Data may suggest that the Bank of Canada needs to do more when deciding Monetary Policy.

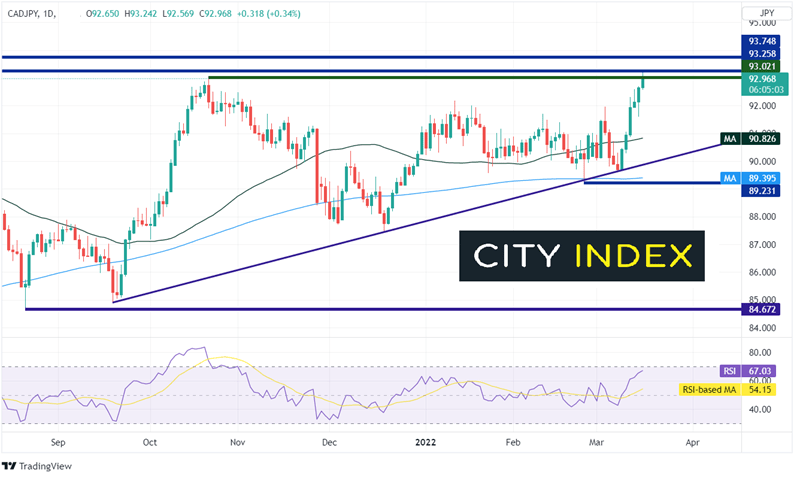

CAD/JPY made a hammer low on August 20th, 2021, near 84.67 and moved aggressively higher to 93.02 on October 21, 2021. Since then, the pair has been moving within a rising triangle formation, while oscillating around the 50- and 200-Day Moving Averages. Like most yen pairs over the last week, CAD/JPY has been moving higher along with higher interest rates. Combine that with stronger inflation and high employment and it continues to grind higher today. The pair moved to its highest level since November 2015 as it broke above the previous highs from October 21st at 93.02. Resistance from November 2015 sits at today’s highs of 93.25.

Source: Tradingview, Stone X

Trade CAD/JPY now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

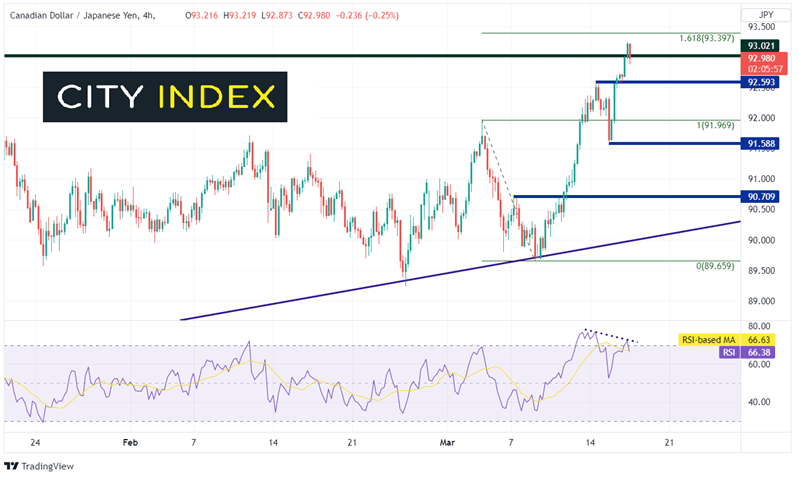

In addition to the horizontal resistance on the daily timeframe, the 161.8% Fibonacci extension from the highs of March 3rd to the lows of March 8th crosses at 93.40. If price manages to break above there, horizontal resistance from March 2015 crosses at 93.75.

Source: Tradingview, Stone X

However, notice that the RSI is diverging with price, an indication that CAD/JPY may be ready for a pullback. First horizontal support is at 92.59 then the highs from March 3rd at 91.97. Below there, price can fall to the March 8th lows at 91.59 then horizontal support at 90.71.

The stronger than expected Canadian CPI, combined with stronger employment data, will continue to pressure the Bank of Canada to do more with regards to tightening monetary policy. These factors have helped strengthen the Canadian Dollar vs the Yen. However, watch for a potential pullback as the RSI is diverging with price.