Sterling is barely slipping because things aren’t looking good for Johnson ahead of Parliament’s suspension

Brexit-politics tends to move swiftly, if not efficiently. Case in point: no sooner had we noted sterling’s resilience to Westminster drama (including confirmation that Parliament will be suspended for five weeks from tonight) than another set of near unprecedented events rapidly hit the wires. As such, a quick update makes sense.

- The latest and biggest news is that The Speaker, John Bercow announced his resignation by the end of October at the latest. This isn’t entirely surprising. Bercow floated his retirement from the post of Speaker of the House months ago. But like many things in Brexit there’s a twist. The former Conservative MP has been a sympathetic supporter of politicians on both sides of the aisle who’ve been trying to thwart a no-deal Brexit. By predicating the potential date of his departure as soon as tonight, if The House votes in favour of Prime Minister Boris Johnson’s proposal for an election by mid-October, he’s applying pressure to lawmakers to ensure that doesn’t happen. To be sure, Johnson’s chances are slim anyway. The PM faces a house opposed to no-deal, and his Tory Party is now even more hamstrung having jettisoned 21 rebel MPs last week. Still, the outcome of Bercow’s conditionality ought to help bring about a sixth parliamentary defeat of Johnson in just a few days (a record for any new Prime Minister). Bercow said he will remain in post till 31st October if the government loses the early-election motion. He would thereby remain at the House’s disposal right up to Brexit current deadline. In all probability, he would also be willing to go against precedent—again—if necessary, to ensure most MPs’ determination to avoid no-deal wins out. After that, Brexit prospects may be quite different, depending on the nature of the next Speaker

- As well as the election-date vote, The Speaker today also approved an application for an emergency debate on whether to force the government to release details on its 1. No-deal planning and 2. Any discussions it had ahead of the decision to suspend Parliament

- The House agreed to force the government to release both sets of details.

- These points could become slow burners for the government. Underlying the questions, tabled by former Conservative Attorney General Dominic Grieve, a pro-European, is the suspicion that 1. Planning may be flawed, at best 2. Discussions may have been perfunctory at best. Not only could the debate and any consequences be embarrassing, but it could possibly pave the way to further legal challenges against the government regarding its authority for such a long suspension.

Chart thoughts

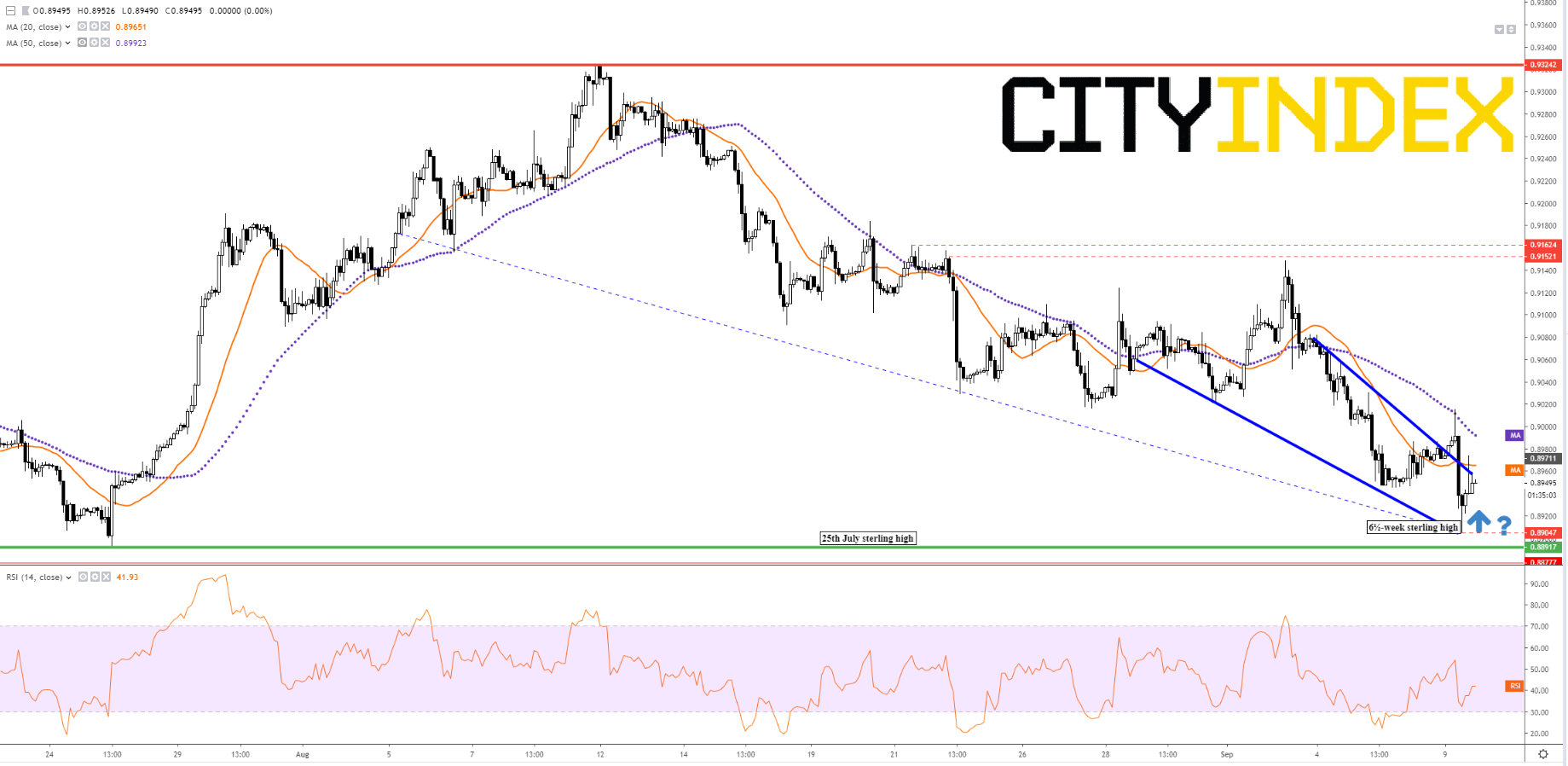

Sterling reacted negatively to earlier events, but a wholesale reversal of its upswing to multi-week highs in recovery from its deepest rout in years looks off the cards right now. Trade against the euro may be particularly pithy this week given the strong likelihood of single currency turbulence when the ECB announces policy on Thursday, with a rate cut, at least, priced into rates markets at a probability of slightly more than 50%. The pound remains favoured in the short-term view charted below, affirmed by declining 20- and 50-interval moving averages and beyond. The EUR/GBP rate trades below the 50-interval average and was earlier clipped back under the 20-interval one too after a half-hearted look above it. Sure, sterling is beginning to lack wiggle rooms at highs (EUR/GBP lows). Its bounce back to near—but just short—of 25th July’s top was followed by a reversal. That move snapped the falling wedge that began forming last week. The breakout spoils some of the cadence of sterling’s advance. But the pound continues to draw a promising declining trend for EUR/GBP. In this case it’s ‘heads I win, tails you lose’ for the euro because a breach would quicken volatility in favour of sterling. At some point the pound is set to be confronted by its 6½-week high versus the euro at 89.047p which protects 25th September’s nearby 88.917p high. Their proximity corroborates solid sterling resistance in the region. At that point, the pound will either need to charge purposefully through to demonstrate its recent advance can significantly extend, or, the risk of an equally significant setback will grow.

EUR/GBP – Hourly

Source: Tradingview/City Index