Woolworths is a defensive stock that benefitted from the arrival of COVID-19 in Australia last year as households stocked up on toilet paper, pasta, and other pantry items. The latest COVID-19 outbreak impacting Sydney, Melbourne and Canberra has seen another round of panic buying that recently pushed the share price of Woolworths above $42.00.

The rally above $42.00, coming despite the spin-off of the Endeavour Group, which includes Dan Murphy’s, BWS, and the largest hotel network in Australia. As explained by the Woolworths Chairman, the spin-off enhances “shareholder value through a greater focus on each business’ core customers offering and growth opportunities.”

Woolworths shareholders received one Endeavour share for every Woolworths share they owned ahead of the spin-off. The Endeavour Group share price is currently trading near $7.00 per share.

According to reports, Goldman Sachs analysts expect Woolworths to report full-year revenue of $55,414.5 million, a 12.5% decline compared against FY20. Earnings before interest and tax (EBITDA) are forecasted to come in at $2,795.9 million, down 13% from FY20 ($3,218.7 million). Goldman Sachs expect the company to pay a full-year dividend of 86 cents per share.

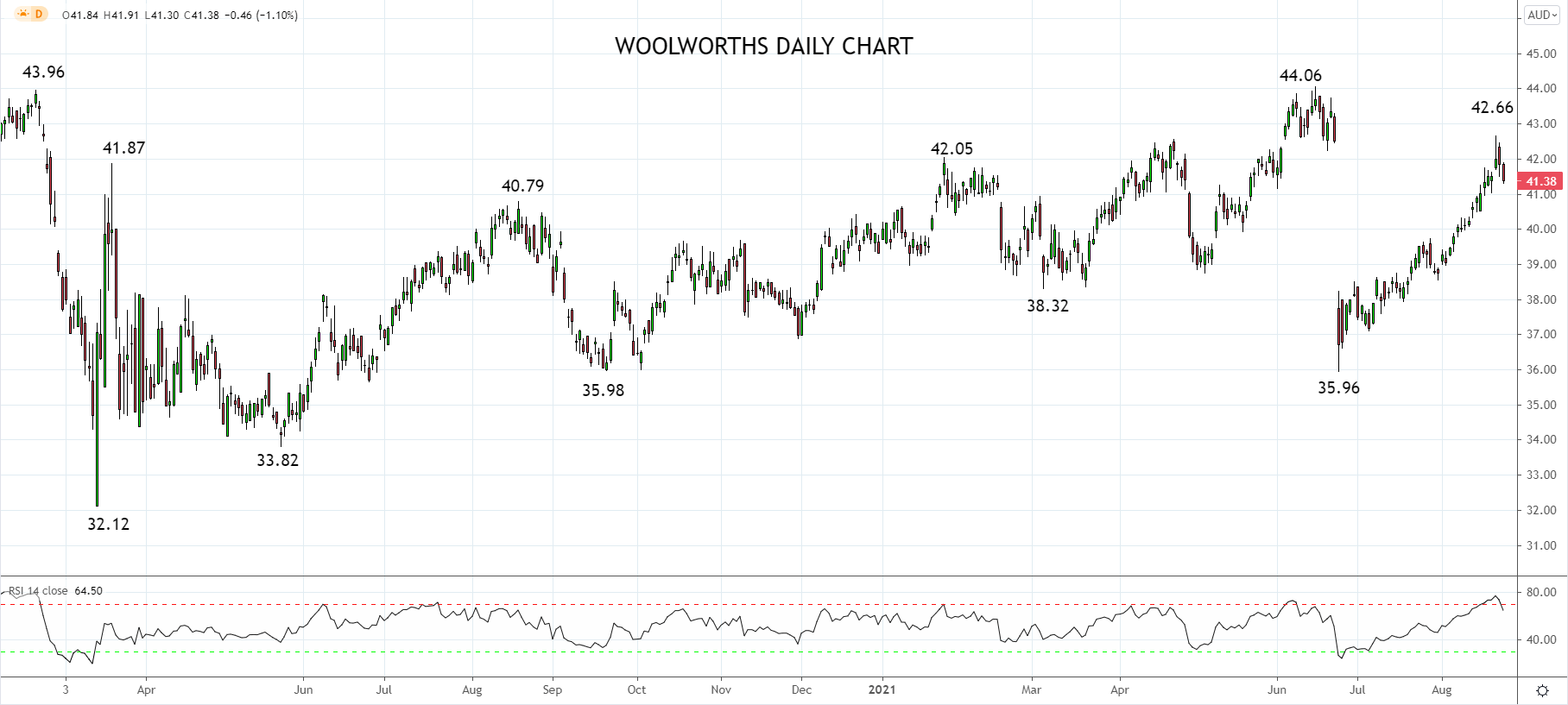

Last week’s rally to the $42.66 high, filled the gap following the Endeavour spin off in late June. The subsequent rejection reinforces the strong level of resistance between $43.00 and $44.00 and warns that a deeper pullback towards interim support at $38.00 is likely, possibly as a result of an easing in lockdown restrictions in October.

Source Tradingview. The figures stated areas of the 25th of August 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Latest market news

Yesterday 01:32 PM

Yesterday 09:35 AM

Yesterday 07:23 AM

Yesterday 04:48 AM

Yesterday 12:17 AM

July 25, 2024 10:39 PM