COVID-19 continues to present challenges for CSL’s supply chains and the collection of plasma, an essential raw material used in the production of many of CSL’s therapies, which account for almost half of CSL’s sales.

CSL products are critical to sustaining patients’ lives, and because of this, its plasma collection centers and manufacturing facilities are classified as ‘essential services’ remaining operational during the pandemic.

The Covid-19 vaccine that CSL was working on with the University of Queensland was scrapped in December after it delivered misleading results. Following the cessation of the trials, CSL focused its attention on producing and accelerating the manufacture of the Oxford University/AstraZeneca COVID-19 vaccine. The first doses were dispatched at the end of March 2021.

CSL is renowned as a quality company. However, it is trading only about 3% higher than it started in 2021, while the broader market is up over 15% year to date, partly explained by the increased costs associated with the collection of plasma.

Some headwinds have begun to ease. A significant portion of CSL’s revenues is earned offshore in US dollars. A lower AUDUSD exchange rate is helpful to CSL’s earnings.

Additionally, CSL is believed to be a front runner to produce vaccines based on the mRNA science underpinning vaccines produced by Moderna and Pfizer instead of the AstraZeneca adenovirus-based vaccine.

At its half-year earnings report, CSL said it expects FY NPAT to grow at between US$2.17 billion to $2.265 billion, implying growth of between 3% and 8%. Not overly exciting for a company trading on a price/earnings ratio of more than 44X FY 21s earnings.

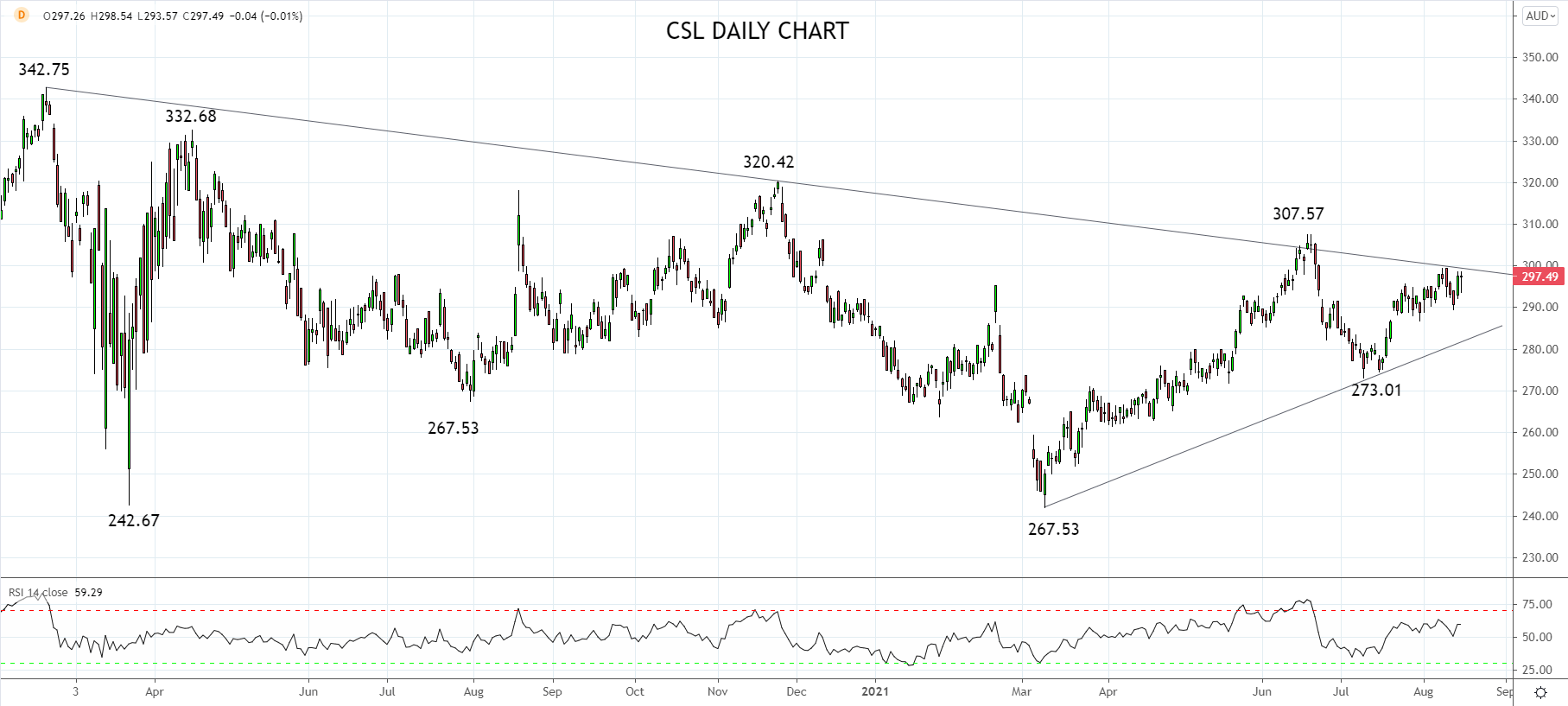

Technically, the decline from the $342.75 high of February 2020 appears to be a countertrend after a stunning multi-year rally. Once the correction is complete, the uptrend is expected to resume.

As such, we would consider buying CSL shares on a dip into support near $280, coming from the trendline from the March $267.53 low . Or on a sustained break above trend channel resistance $300/310ish, an indication the uptrend has resumed.

Source Tradingview. The figures stated areas of the 17th of August 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as having any financial product advice or financial product recommendation

Latest market news

Yesterday 01:32 PM

Yesterday 09:35 AM

Yesterday 07:23 AM

Yesterday 04:48 AM

Yesterday 12:17 AM

July 25, 2024 10:39 PM