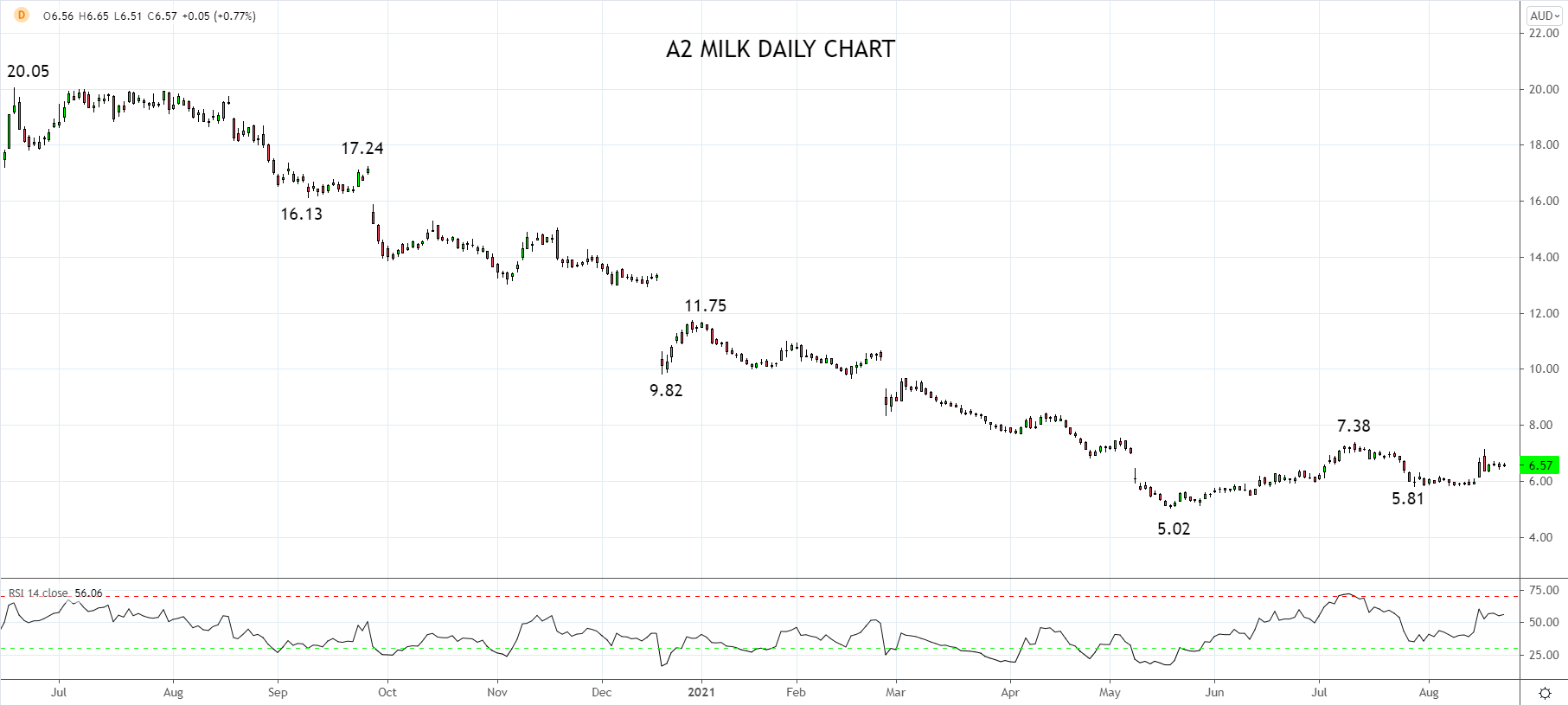

At the start of the pandemic, A2 Milk was a beneficiary as sales surged on a wave of panic buying. In response, A2 Milk upgraded its full-year earnings guidance in April 2020 by 32%. Shortly afterwards, in June 2020, the share price traded to its all-time high of $20.05c.

Since that point, a drastic reversal of fortune has occurred.

In its half year update in February, A2 Milk downgraded its full-year guidance in response to the fallout from a decline in daigou sales. A2 Milks products were purchased in NZ and Australia and then shipped into China to sell to customers there. The closure of international borders bought this channel to a halt that accounted for 60-70% of the region's revenue.

After an escalation in the political tensions between China and Australia, A2 Milk in May slashed its sales and earnings forecasts again and wrote down $90 million in nearly out-of-date stock, sending the share price to a low of $5.02c, almost 75% below its 2020 high.

Last week, the beaten-down share price rallied briefly above $7.00 on reports that A2 Milk has become a takeover target for Nestle. A takeover by the Swiss giant would reinvigorate A2 Milk's infant formula in China and leverage Nestles in-country distribution network. A2 Milk has declined to comment on the takeover speculation leaving the market to ponder the possibilities of a takeover.

In its last update in May, A2 Milk said that it expects full-year sales to be in the range of $NZ1.2 billion to $NZ1.25 billion and an EBITDA margin of 11 percent to 12 percent. The latter implies an EBITDA of just NZ$132 million to NZ$150 million. This compares to FY 2020's revenue of NZ$1.73 billion and EBITDA of NZ$549.7 million, a reduction of 73% to 76% year on year.

After falling from $20.05 to a low of $5.02 in just 12 months, some stability has returned to the A2 Milk price recently. Nonetheless, there aren't any obvious technical or fundamental reasons to buy A2 Milk other than for the reason a corrective bounce is possible after such a sharp sell-off. For those that think that last week's takeover rumour might, in time, prove correct, then consider buying A2 Milk at $6.57 with a stop loss placed below $5.75.

Source Tradingview. The figures stated areas of the 23rd of August 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation