Market summary

- The RBA delivered another 25bp hike (their 12th this cycle) to take their cash rate to 4.1%

- Whilst the RBA suspect that ‘inflation has passed its peak’ it remains ‘too high’ and some further tightening may be required

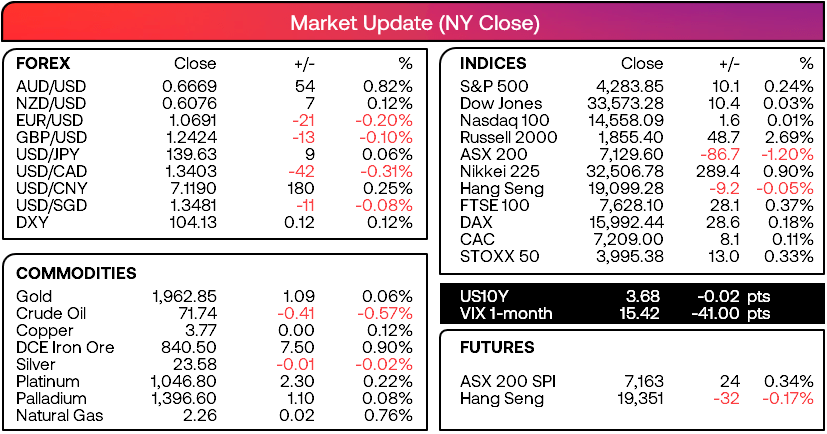

- AUD pairs were broadly higher, the Aussie was the strongest FX major, AUD/JPY closed to a fresh YTD high and the ASX 200 erased all of Mondays gains

- The Canadian dollar was given a lift following the RBA’s hike, as it slightly increases the odds of a BOC hike tonight or hawkish tone (they have paused the last two meetings and we suspect they will hold again today)

- Oil prices have done full circle, having filled Monday’s gap higher, pulled back towards $70 yesterday’s before rising back to Friday’s close (making it a directionless, tricky market to trade for now)

- Wall Street was slightly higher but volatility was low for the S&P 500, Nasdaq and Dow Jones

- Apple shares were a touch lower following Monday’s key reversal

- The world bank increased global growth forecasts for 2023 but downgraded them fore 2024

Events in focus (AEDT):

- 09:20 – Speech by Philip Lowe, Governor – A Narrow Path

- 09:50 - Panel Participation by Michele Bullock, Deputy Governor

- 11:30 – Australian GDP report

- 13:00 – China trade data

- 00:00 - BOC cash rate decision (hold expected)

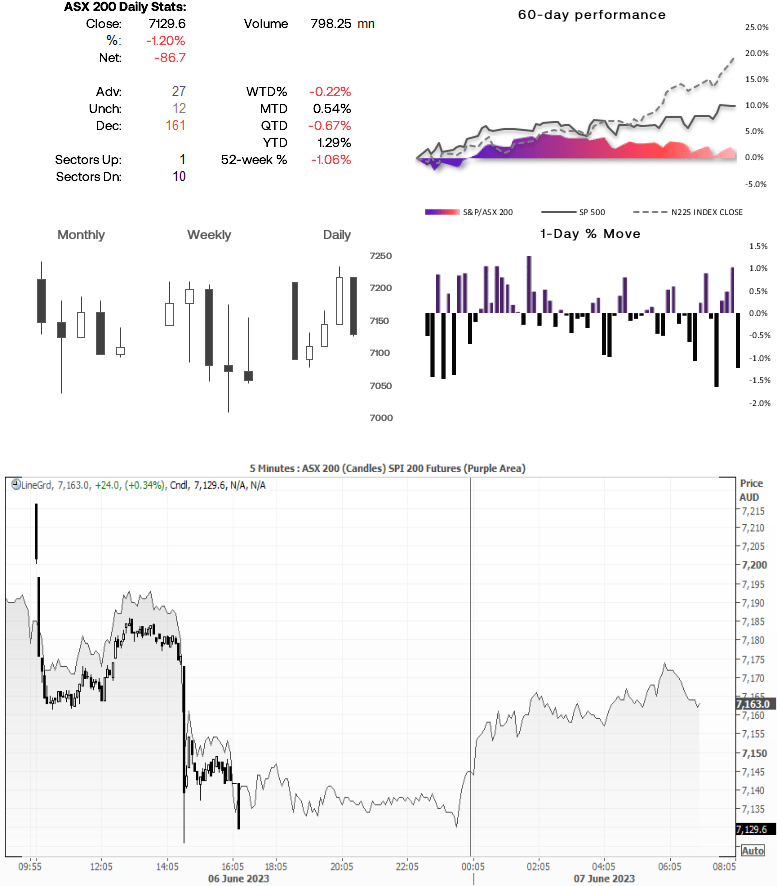

ASX 200 at a glance:

- A bearish engulfing day formed due to the RBA hike

- 10 of its 11 sectors closed lower, led by consumer discretionary and industrial

- Intraday support: 7127, 7110.8, 7100 and 7077

- Intraday resistance: 7161.5, 7185.8

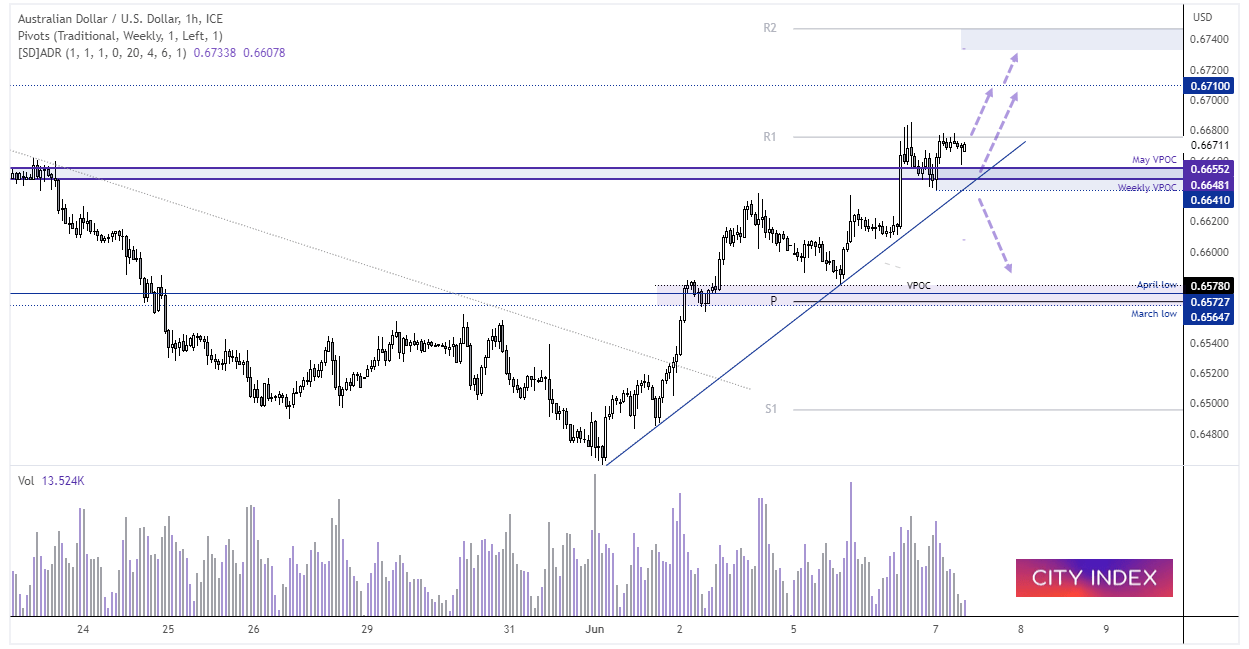

AUD/USD 1-hour chart:

AUD/USD posted a strong rally immediately following the RBA’s hike, prices have since pulled back into the VPOC support zone and are now trying to break to a new cycle high. A bullish pinbar formed at the end of the NY close so perhaps it can break above the weekly R1 pivot and continue higher towards 0.6700 / 1.67100, and the upper ADR band near the weekly R2 pivot. A break beneath the bullish trendline assumes a retracement against the June rally is underway.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Latest market news

Yesterday 01:32 PM

Yesterday 09:35 AM

Yesterday 07:23 AM

Yesterday 04:48 AM

Yesterday 12:17 AM

July 25, 2024 10:39 PM