- The Australian dollar has hit the highest level since July

- Its latest leg higher coincided with no sign the BOJ intends to tighten monetary policy imminently

- With little on the domestic calendar, positioning, sentiment, declining market liquidity and US PCE inflation loom as the most likely market drivers heading into Christmas.

The AUD/USD is coming home with a wet sail after what’s been another rough year, breaking to multi-month highs on Tuesday as the risk rally shows few signs of slowing down ahead of Christmas.

AUD/USD enjoying party mode

With traders ignoring pushbacks from Fed members against aggressive policy easing priced next year, and with it too soon for data or corporate earnings to definitively question the Fed’s soft landing outlook that drove last week’s dovish pivot, risk assets are in party mode, including AUD/USD.

After looking vulnerable to a pullback having been rejected above .6720 for three consecutive sessions, AUD/USD found another wave of buying on Tuesday as the Bank of Japan made no changes to policy rates or yield curve control, nor hinted at an imminent change at its January meeting, providing more fuel to the soft landing narrative.

AUD/USD hits highest level since July

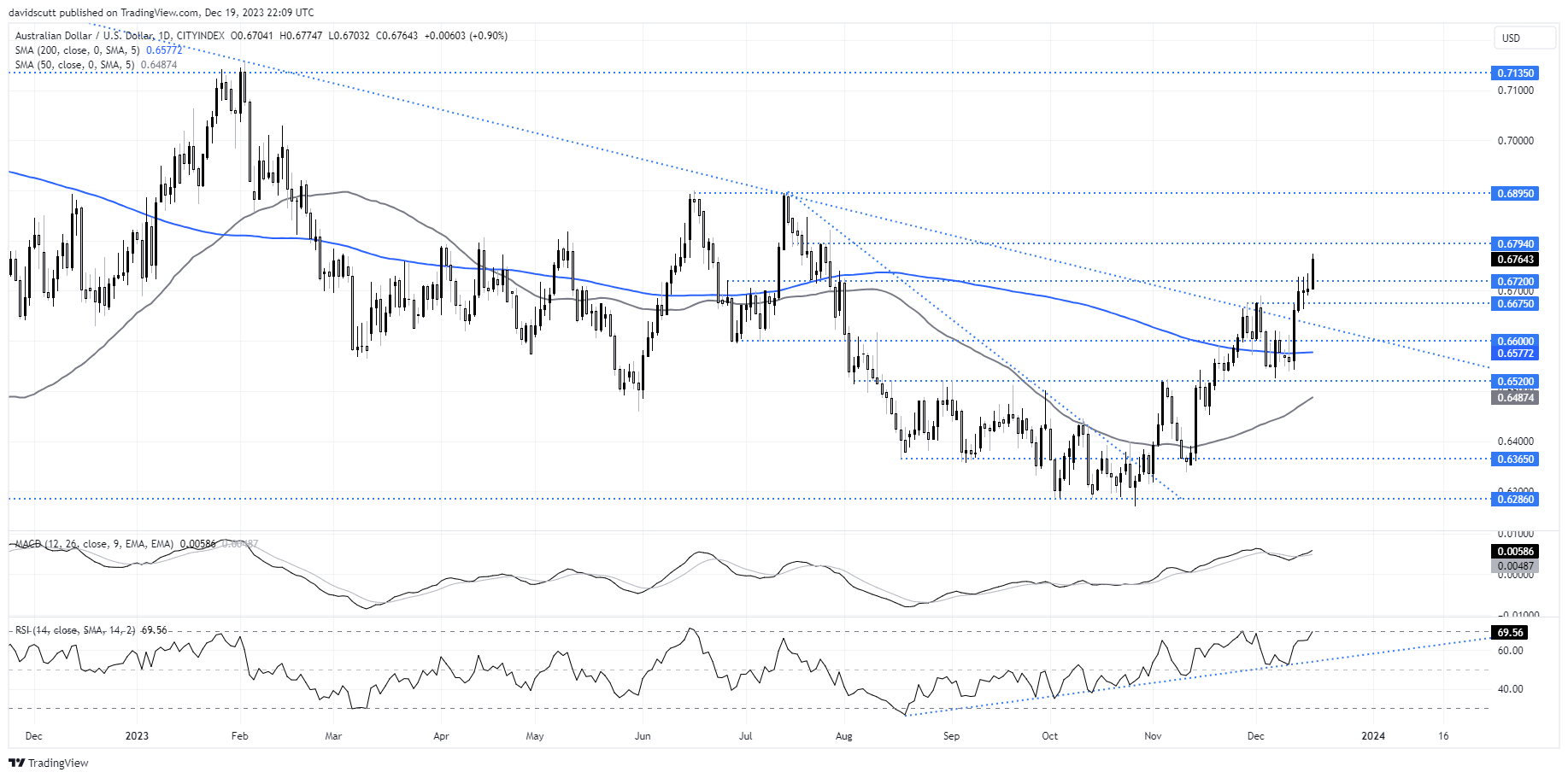

At around .6764, AUD/USD sits at the highest level since July, extending its surge from the lows hit in October to over 8%. With MACD and RSI continuing to trend higher, momentum remains to the topside, making it a buy-on-dips prospect for the foreseeable future. Traders will be eyeing off a potential test of the double-top at .6895 given the strength of the trend with only resistance around .6794 standing in the way.

On the downside, any dips towards .6720 may attract buyers in the absence of a sudden shift in sentiment. Those considering initiating longs could place stops below this level for protection.

Looking ahead, stretched long positioning in numerous riskier asset classes, a 20-year US Treasury auction later Wednesday, and the November US PCE inflation report, which is expected to come in soft at both the headline and underlying level on Friday, are the known events that could upend the positive momentum heading into Christmas.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade