Market Summary:

- The Fed are to begin cutting interest rates in June according to a Reuters poll, although there are risks that a sooner cut could also mean fewer cuts

- The BOJ are considering a rate hike in their March meeting according to ‘sources’ via Reuters

- BOJ member Keidanren said that a prolonged monetary easing “as a shot in the arm for economy is not healthy”

- Japan’s economy also narrowly avoided a technical recession after official growth figures were upgraded to a slight expansions in Q4. Yet with sluggish private consumption and GDP that remains below markets expectations, perhaps it is cause for concern for anyone expected the BOJ to actually hike this month.

- The Australian government announced that it will remove ‘nuisance’ tariffs on a wide range of every day goods in an attempt to help lower the cost of living

- The US dollar retraced slightly higher in line with my bias, although volatility for forex markets was sorely lacking during a light-news day, ahead of US inflation later today

- Bitcoin rose to a fresh record high new highs to notch up its fourth consecutive bullish day after printing a bearish engulfing candle (which is has since surpassed)

- Gold futures rose for a ninth consecutive day which itself is an outlier of a stat, so a I very much doubt it will rally over the next nine. But with large speculators having increased net-long exposure at their fastest weekly pace in 3.5 years last Tuesday, gold is clearly in demand and not a market to short for any length of time whilst traders expect Fed cuts

Events in focus (AEDT):

With US inflation data looming, volatility could again be on the quiet side leading up to the event. But with the US dollar already enduring its worst week of the year on bets of cuts, it could leave the US dollar vulnerable to a bounce if inflation doesn’t satisfy bets of anticipated cuts.

- 09:30 – RBA member Hint speaks

- 10:50 – Japan’s producer prices, large manufacturing survey

- 11:30 – Australian business confidence, building permits

- 18:00 – German inflation

- 18:00 – UK employment and wages

- 21:00 – US business optimism (NFIB)

- 23:30 – US inflation

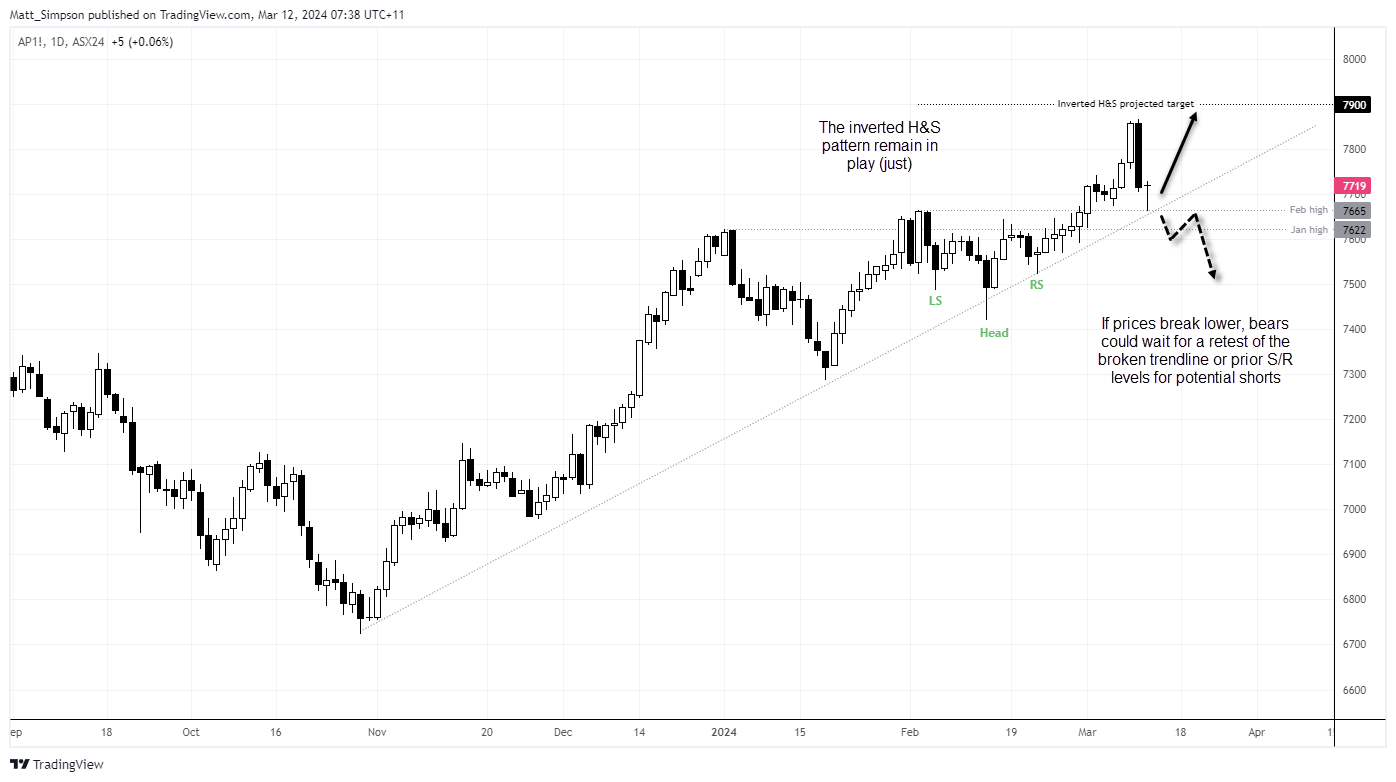

ASX 200 technical analysis:

- Clearly, my bullish bias for the ASX 200 did not work out well, with a large bearish engulfing day forming on the cash index on Monday

- It was the most bearish day in a year, although overnight the ASX 200 futures chart found support almost perfectly at the February high and bullish trendline.

- It will be interest to see how prices trade around these support levels as it provides a clear line in the sand for bullish or bearish setups.

- The inverted head and shoulders pattern remain in place with an upside target of 7,900, but only if prices remain above 7650.

- But if prices do break lower, bears could wait for a retest of the broken trendline as part of a swing-trade short

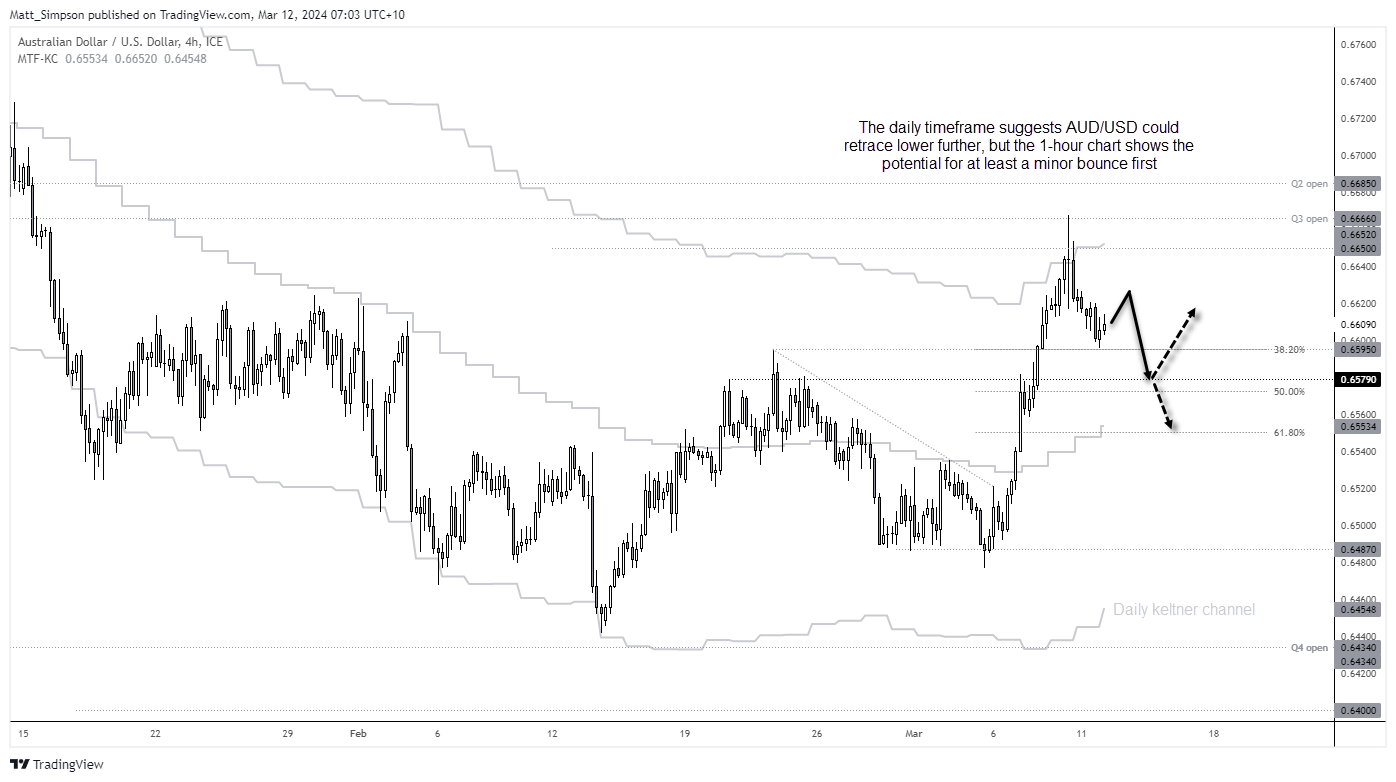

AUD/USD technical analysis:

As mentioned in the AUD/USD weekly outlook, the bias on AUD/USD is for a pullback on the daily chart given the 2.7% rally over 3 days, RSI (2) being overbought and a bearish pinbar at the upper daily Keltner band. Whilst prices have pulled back slightly, volatility was low across the board so the correction may not be over yet. Besides, we have US CPI data later today which could see markets on the quiet side until the data is released.

The 1-hour chart shows that the retracement found support overnight almost perfectly at a prior swing high and 38.2% Fibonacci level. I therefore suspect a bounce higher today in Asia, but still open to another leg lower. The 50% level sits at 0.6573 and the 61.8% is near the 20-day MA ~0.6550, which make potential support levels or targets for bears.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade