- Australia’s quarterly inflation report is the most important data release for the outlook for Australian interest rates

- Both AUD/USD and ASX 200 may react strongly to today’s report

- Odds of a November RBA rate hike sit around 30%

When you look back through the history books, no other economic data release is more important for the AUD and ASX than Australia’s quarterly consumer price inflation (CPI) report. I’ve lost track how many times the Reserve Bank of Australia (RBA) has adjusted the cash rate following its release, but it's a lot. Based on recent remarks from the RBA Governor, today’s report may be no exception. And, as avid RBA watchers know, the RBA doesn’t mind a Melbourne Cup Day hike just before the horses jump.

The definition of material will be important for ASX 200 and AUD

After what was a family non-eventful start, new RBA Governor Michele Bullock is beginning to stamp her authority on the outlook for interest rates, providing markets with a far more hawkish tone than her predecessor Philip Lowe.

Check out her comments from the Commonwealth Bank Global Markets forum on Tuesday evening:

“It is possible that this can be done with the cash rate at its current level but there are risks that could see inflation return to target more slowly than currently forecast,” she said. “The Board will not hesitate to raise the cash rate further if there is a material upward revision to the outlook for inflation.”

The remarks were conveyed right at the top of her speech, providing a not-so-subtle reminder that today’s inflation report could easily force the RBA hand ahead of the release of it's updated economic forecasts in the November Statement on Monetary Policy.

Just how material is material?

That’s the question market pundits will be asking themselves ahead of the inflation report. You’ll be bombarded with all kinds of numbers and obscure economic terms today, but only one really matters when it comes to the outlook for rates: the trimmed mean quarterly inflation rate. It’s the RBA’s preferred underlying inflation measure, so you can push aside commentary about headline, tradeable and non-tradeable inflation. They will create noise, not signal.

But what exactly is material? Based on the RBA’s prior forecasts, it expects trimmed mean inflation will rise 0.9% for the quarter. For a material upside surprise to alter the expected path towards inflation moving back to the top of the RBA 2-3% target range, it’s unlikely to be 0.1 percentage points higher. Nor is likely to be 0.2 percentage above. With the RBA attempting to retain employment gains while at the same time bring inflation back to target, it suggests a “material” surprise would be a quarterly growth rate of at least 1.2%, seeing the annual rate ease lower to 5.1%.

Looking at where the median consensus trimmed mean inflation forecast has landed, you can see why markets are attaching around a one-in-three chance of the RBA hiking the cash rate by 25 basis points to 4.35%. It’s an uncomfortable 1.1%. Oof. Today’s going to be a big one!

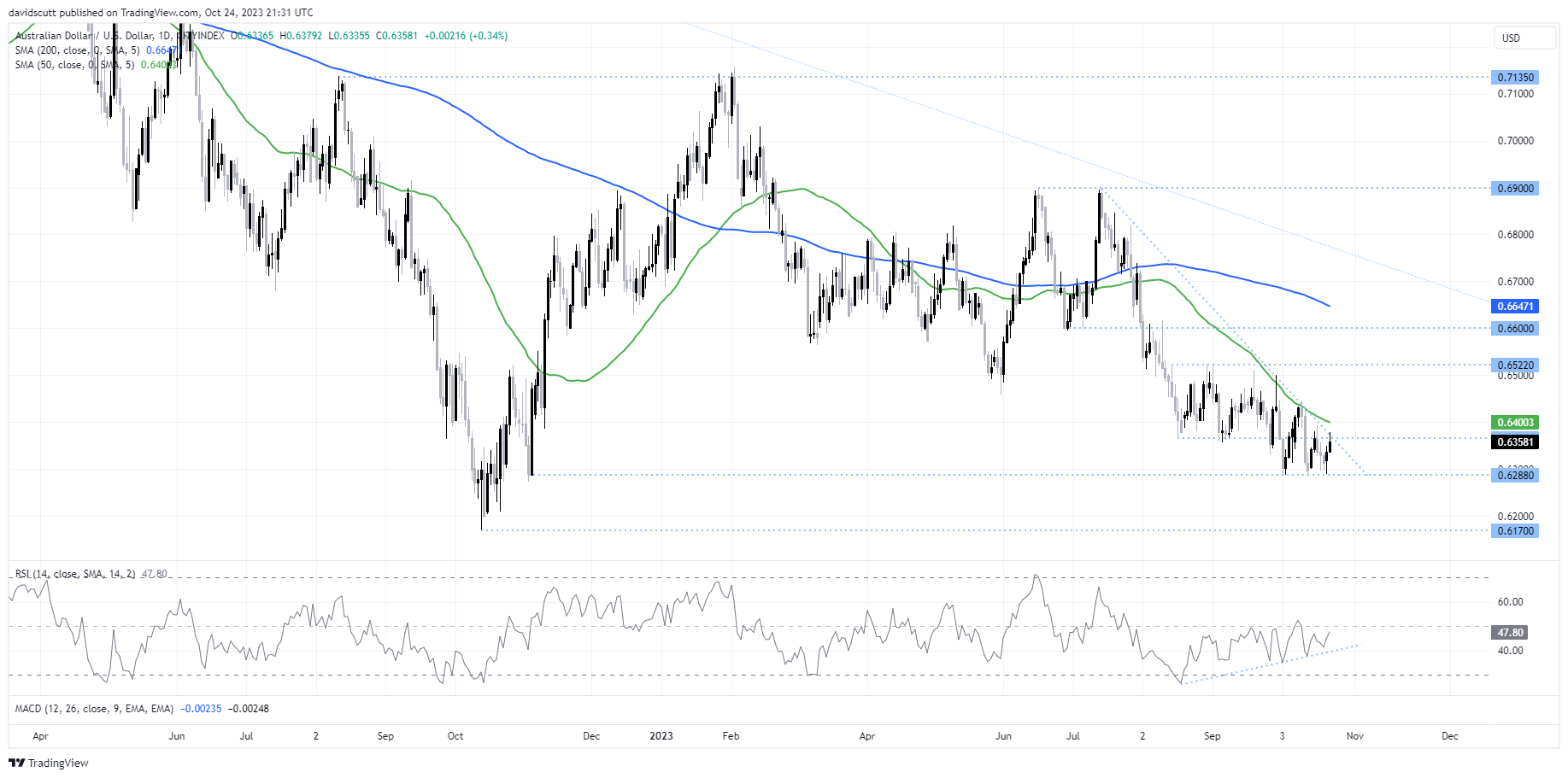

AUD/USD breakout likely on hot inflation report

Looking at AUD/USD, it’s found upward momentum on the daily over the past 24 hours, helped by an improvement in risk appetite, China issuing ¥1 trillion in sovereign debt to support economic activity and reports of an unprecedented visit from Chinese President Xi Jinping to the PBOC, China’s central bank, spurring hopes for a coordinated policy response to kickstart China’s spluttering emergence from covid restrictions.

While the conflict between Israel and Hamas remains a constant threat, you get the sense events of the past day may have provided a release valve for AUD/USD, making today’s inflation report either a catalyst for renewed upside or a continuation of the prevailing narrow trend.

AUD/USD remains sandwiched between support at .6288 and downtrend resistance around .6375. Should the inflation report come in hot, the latter may give way given the implications for the RBA cash rate outlook, potentially opening the door for AUD/USDS to push towards horizontal resistance located above .6500. On the flipside, an undershoot in inflation may see a retest of support at .6288, a move that may attract decent buying support given it has held strong through conditions far worse than these.

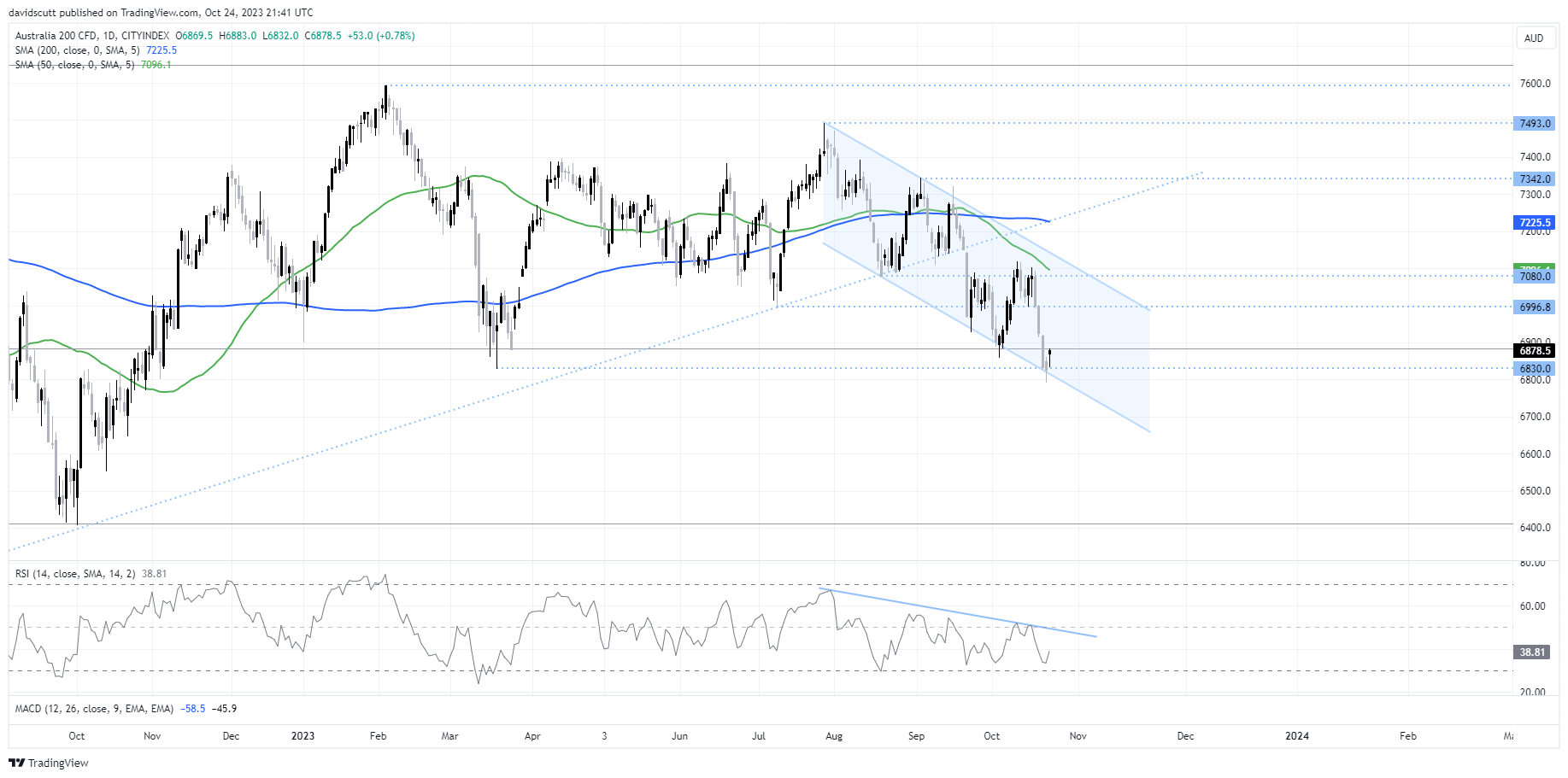

ASX 200 finds its mojo

Given the flow-through to earnings and relative income sources, the inflation report is also important to the ASX 200. After an ugly week, Australia’s benchmark index has found its mojo in recent days, bouncing strongly following an attempted push through channel support and horizontal support located at 6830. A couple of bullish hammers on the daily have taken the index back to the 23.6% Fibonacci retracement of the pandemic low highs at 6884.

If the inflation report is hot, we may see a retest of 6830 before attention switches to the performance of mainland Chinese markets to the latest stimulus news. Should the inflation report print in line or softer than market forecast, the positive momentum may see a push towards resistance located just below 7000. Above that, a sterner test awaits at 7080, should the index get there.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade