This is an excerpt from our full AUD/USD 2024 Outlook report, one of nine detailed reports about what to expect in the coming year.

Why AUD/USD could benefit from a narrower Fed-RBA rate spread

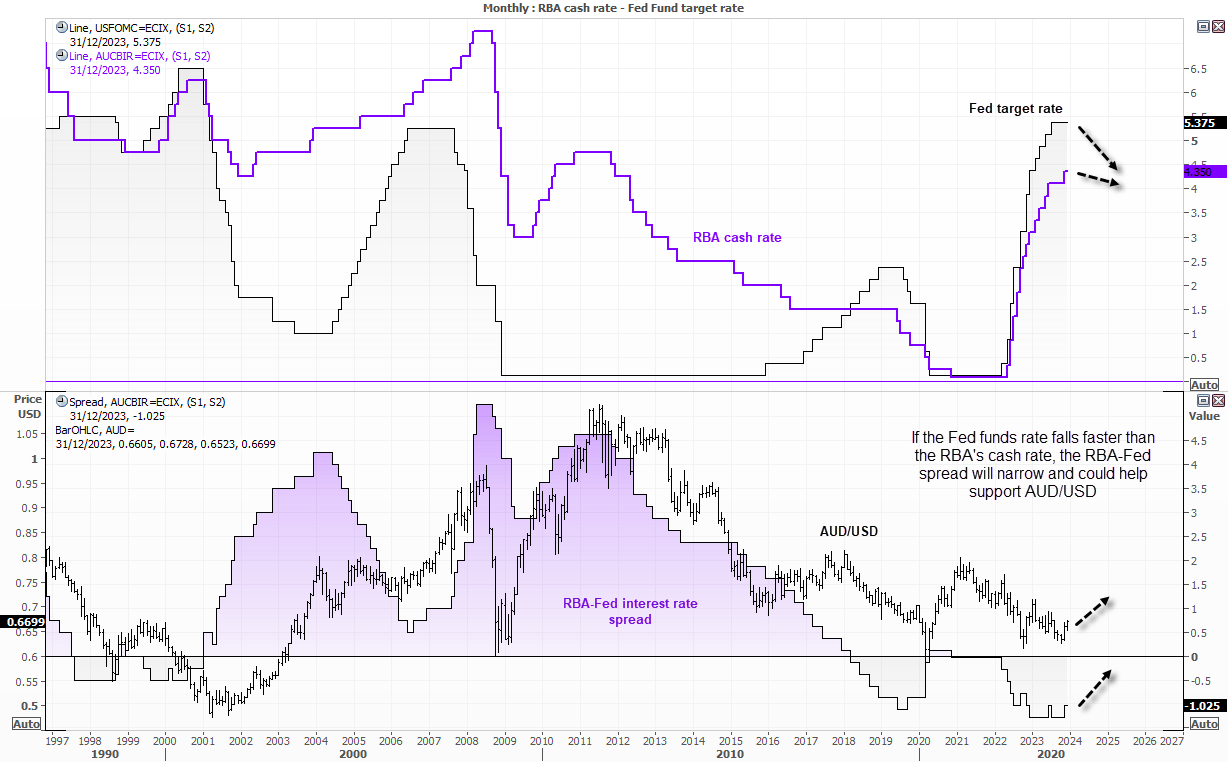

The Federal Reserve began their tightening cycle two months ahead of the RBA’s, maintained a higher yield throughout their tightening cycle and reached a higher peak of 5.5% compared to the RBA’s 4.35%. The relatively laidback approach from the RBA weighed on AUD/USD due to the negative yield differential, and large speculators reached a record level of net-short exposure to AUD/USD futures.

However, there is a possibility for the RBA-Fed cash rate spread to narrow and support AUD/USD in 2024. The Fed has just announced a significant policy reversal by hinting that their benchmark interest rate could be lowered to 4.6% by the end of 2024. Meanwhile, the RBA is expected to maintain a hawkish stance at its upcoming meetings and keep its rates at 4.35%. With the Fed at a higher rate, they have the potential to cut more quickly than the RBA, narrowing the RBA-Fed spread and lifting AUD/USD.

The RBA next meet on the 6th February, and it will also include their quarterly statement on monetary policy with updated forecasts, their usual statement and their newly added press conference. Given quarterly inflation data would have been released the week prior, this will be an important first meeting and could shape expectations for the following meetings.

Source: Eikon, StoneX

Will policy lags finally catch up with consumers?

We head into the new year with slightly mixed data, none if which is pointing towards an imminent hard landing for Australia. At least for now. Employment remains firm by historical standards which is a key reason as to why the RBA are likely to retain a hawkish bias at least through Q1. Spending has softened but not at a rate that screams a recession. And if my own experience in Australia is anything to go by, a classic economic recession doesn’t seem imminent with shops and restaurants full and tradies still very much in demand. House prices

continue to rise as mortgage demand absorbs higher rates.

But this is now, and policy lags might finally show up in the data as savings become depleted, spending slows and inflation slows further. And that could result in a cut or two by the RBA in the second half of 2024 for a cash rate back in the 3’s.

How could China impact AUD/USD? What signals can we garner from Copper's performance? What about the technical outlook for AUD/USD? See our full 2024 Outlook for more details!

Latest market news

Yesterday 01:32 PM

Yesterday 09:35 AM

Yesterday 07:23 AM

Yesterday 04:48 AM

Yesterday 12:17 AM

July 25, 2024 10:39 PM