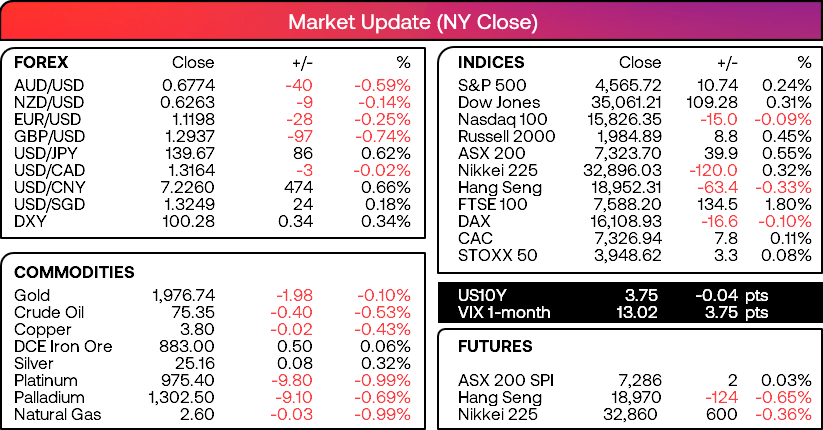

Market Summary:

- Wall Street handed back earlier gains after some big-name earnings misses

- Tesla’s gross margin was lower in Q2 following its attempt to boost profits via price cuts, although it did beat revenue estimates

- Netflix was lower with revenue falling short of expectations

- Goldman Sachs (GS) profits fell 60% in Q2 to a 3-year low due to write down on real estate investments and its consumer business, but shared rose 2% after citing a pickup for investment banking

- Another say, another 15-month high for the S&P 500 although the day closed with a bearish pinbar (the Nasdaq 100 rose to less than 70 points from 16k before pulling back to Tuesday’s close)

- UK inflation data was broadly weaker than expected, sending GBP immediately lower as traders scaled back bets of another 50bp hike. Whilst they may go for a 25bp hike, I do not believe the risk of a 50bp has been fully removed considering inflation was not much lower than expected (although a case can be made that the rate of inflation has topped).

- There was less to celebrate with European core CPI rising to 5.5% y/y and 0.4% 0.4% m/m – both above estimate – which keeps pressure on the ECB for a September hike

Events in focus (AEDT):

- 09:50 – Japan’s trade data

- 11:15 – PBOC loan prime rate: There’s a reasonable chance that the PBOC could cut their loan prine rates to boost stimulus. And that could help the Hang Seng regain its footing and eventually head for the break above 20k we’ve been waiting for

- 11:30 – Australian employment report: The RBA’s minutes do not seem to have swayed the general consensus that the RBA will pause again next month, despite the statement and minutes both reminding us that the central bank remains data dependent. Today’s employment report could change minds if we were to see unemployment fall to 3.5% or lower and be accompanied with strong job growth and higher participation rate. And that could benefit the Aussie dollar and take some wind out of bullish ASX sails.

- 16:00 - German producer prices: With some ECB officials suggesting a September hike is not a done deal, any signs of weaker inflation could eventually weigh on the strong euro – which looks stretched to the upside to my eyes.

- 22:30 – US jobless claims report

Technically Speaking:

- EUR/USD fell to a 4-day low as the US dollar embarked upon its upside technical correction we warned about yesterday

- USD/JPY rose to a 4-day high as its countertrend move get underway, with 140 and the 50-day EMA making a likely resistance levels for today (a break above which brings 140940 into focus)

- AUD/USD traded lower for a fourth day and closed beneath 68c, which makes the 50-day EMA at 0.6740 and last week’s 0.6705 breakout level the next line of defence for bulls (or targets for bears)

- NZD/USD has also pulled back for a fourth day in line with AUD/USD and close with a Doji. As the daily low found support at the 50-day EMA and last week’s breakout level, perhaps it will hold support today (which could see AUD/NZD pull back a little more if AUD/USD continues to decline)

- AUD/NZD nicely to a 12-day high after its false break of 1.08 (post CPI) but has since pulled back to 1.08. We still think it might be able to move towards 1.090 but a move beneath Monday’s view invalidates the near-term bullish bias.

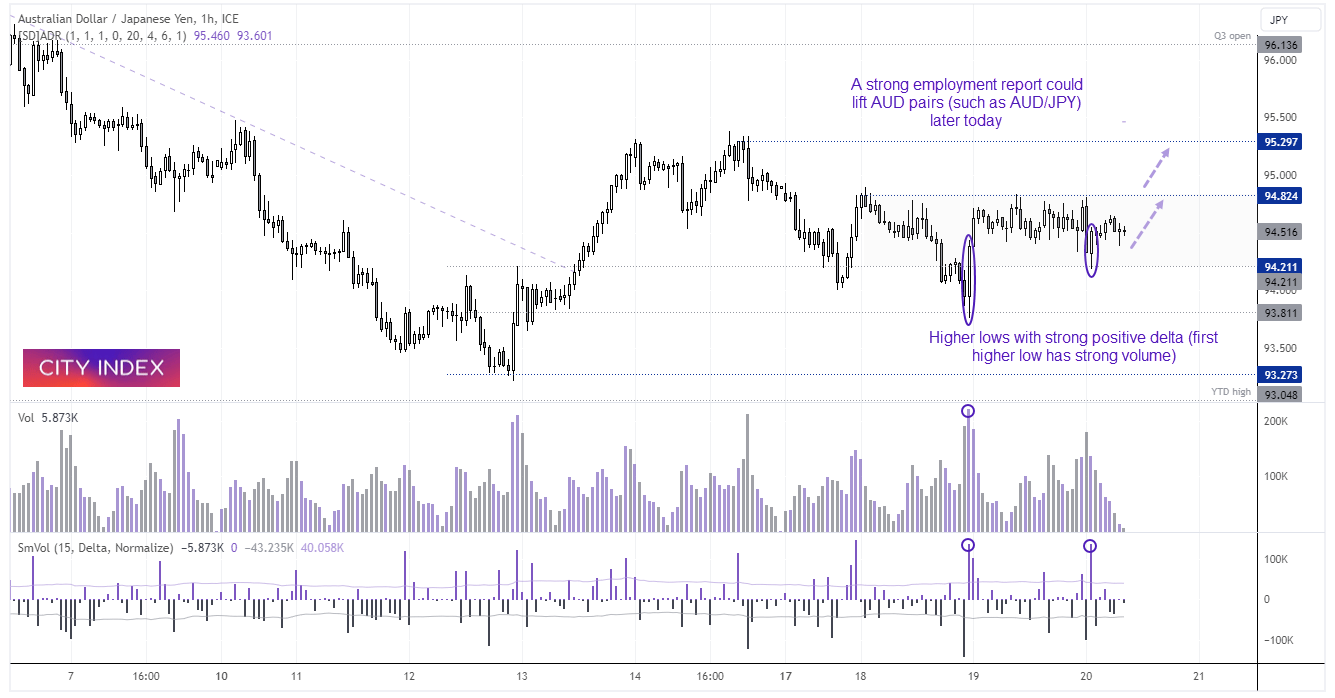

- AUD/JPY printed a daily bullish pinbar at the 50-day EMA on Tuesday following its 2-day retracement, and a small inside day Doji formed with a higher daily low to show demand might be slowly picking up. Bulls seeking to trade the range could seek dips down to 94.20 and seek a move to the 95.20 highs, with a break beneath 93.80 invalidating the near-term bullish bias

- USD/CNH rose for a fourth day and broke convincingly above the 2019 and 2020 highs. Having now recouped all of last week’s losses a move to the June high may be on the cards

- The Nikkei 225 rose to an 8-day high after finding support at the 50-day EMA and 61.8% Fibonacci level, with bulls now likely targeting the 1990 high just above 33,200

- Gold formed a small inside day in the top quarter of Monday’s bullish range, with a potential bullish continuation pattern hinting at a test and break above 1980

- WTI crude oil formed a bearish hammer day which also forms a higher low, suggests all is not well at these highs over the near-term whilst the US dollar corrects higher

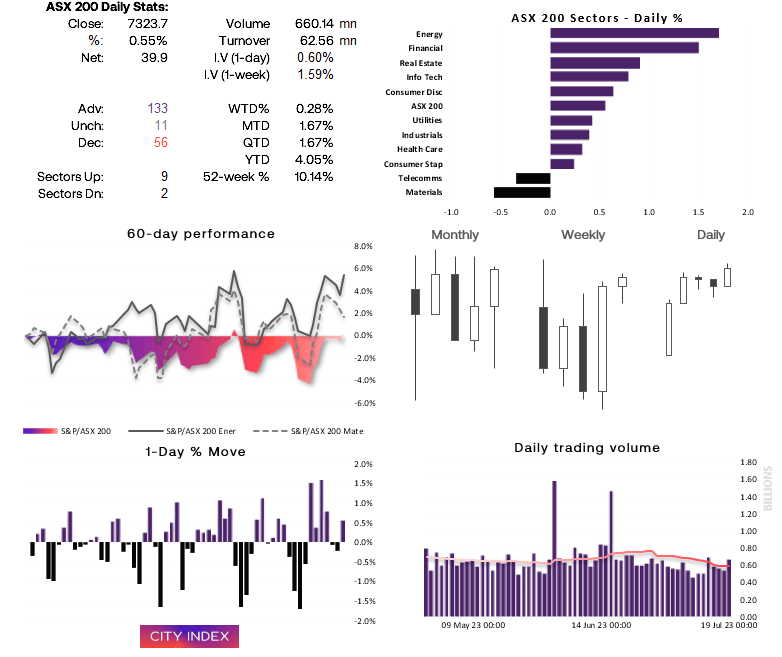

ASX 200 at a glance:

- The ASX 200 broke above 7300 and closed at a 4-week high following a two-day retracement

- 9 of its 11 sectors also posting gains (five of which outperformed the broader market, led by energy and financial stocks)

- However, this week’s candle is a mere 25.4 points, which hardly screams ‘bullish breakout’ above last week’s high

- We could be in for another low-ranging day

- But bulls should also keep in mind key highs nearby which could caps gains or trigger a reversal lower if sentiment sours

- Support levels: 7261, 7283, 7300 7318

- Resistance levels: 7368/70, 7400

AUD/JPY 1-hour chart:

The 1-hour chart of AUD/JPY shows two bullish candles that formed higher lows with high positive delta (more uptick volume than downtick volume). The initial candle with a low of 93.05 was very high volume to show support around that level, and the second candle had above-average volume although it was less than the prior bearish bar. However, we would consider buying dips with retracements towards 94.21 for a move to the 94.82 high – a break above which brings 95 and 95.30 into focus.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Latest market news

Yesterday 01:32 PM

Yesterday 09:35 AM

Yesterday 07:23 AM

Yesterday 04:48 AM

Yesterday 12:17 AM

July 25, 2024 10:39 PM