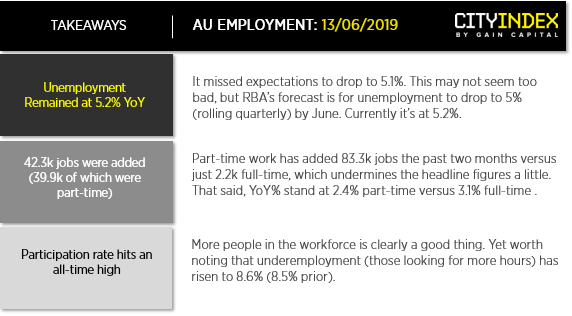

Unemployment may have remained steady but, it’s not on track for RBA’s target which is seeing a rise in calls for RBA to cut in July.

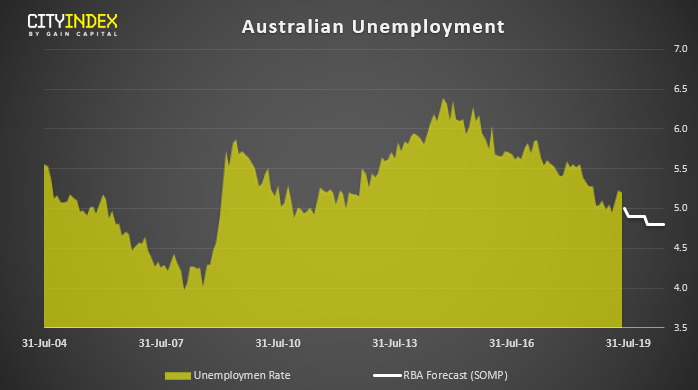

Today was really all about the unemployment rate, which remained steady at 5.2% but missed expectations to fall to 5.1%. Were it not for the fact that RBA have target 5% by end of Q2, this may have been OK. But as markets were already pricing at 50% chance of a July cut yesterday, we suspect today’s employment data could tip the scales towards a July cut by the close of today. We can see unemployment rising against RBA’s SOMP forecast and, with it pencilled in to drop to 4.8% by June 2021, further rises with unemployment will only hear calls for further cuts and sooner.

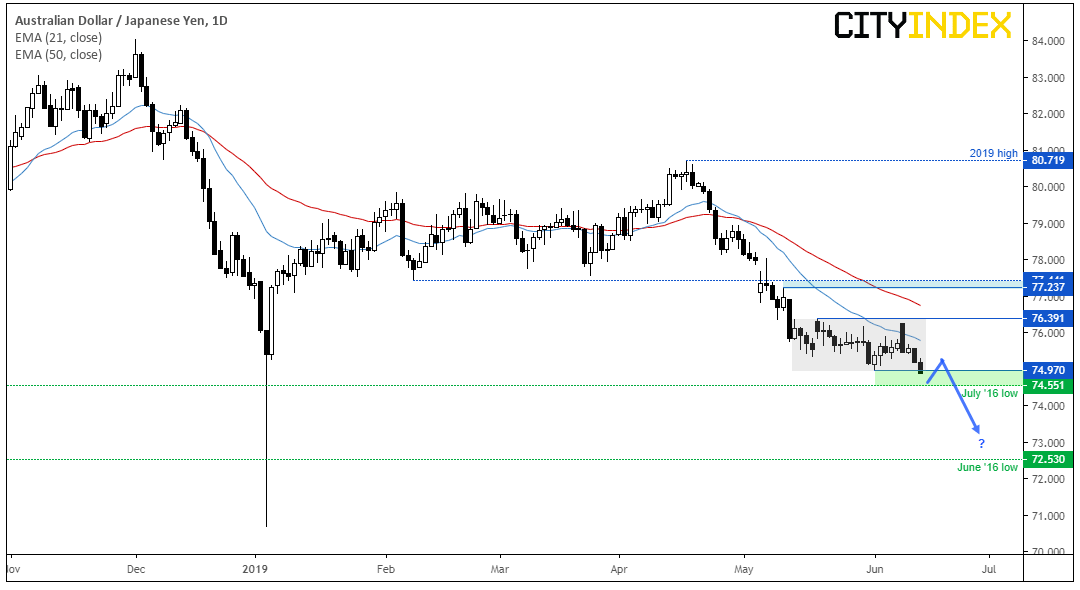

AUD is currently today’s weakest major with AUD/JPY being today’s biggest mover (and loser). We can see on the daily chart that AUD/JPY has just broken to its lowest level since January’s flash crash, in a bid to breakout of a sideways correction pattern. Moreover, a prominent swing high has formed with Monday’s bearish engulfing bar. The 74.55 low makes an obvious, near-term target, although we expect AUD/JPY to break beneath the July 2016 low after an initial bounce, given the strength of bearish momentum leading into the correction.

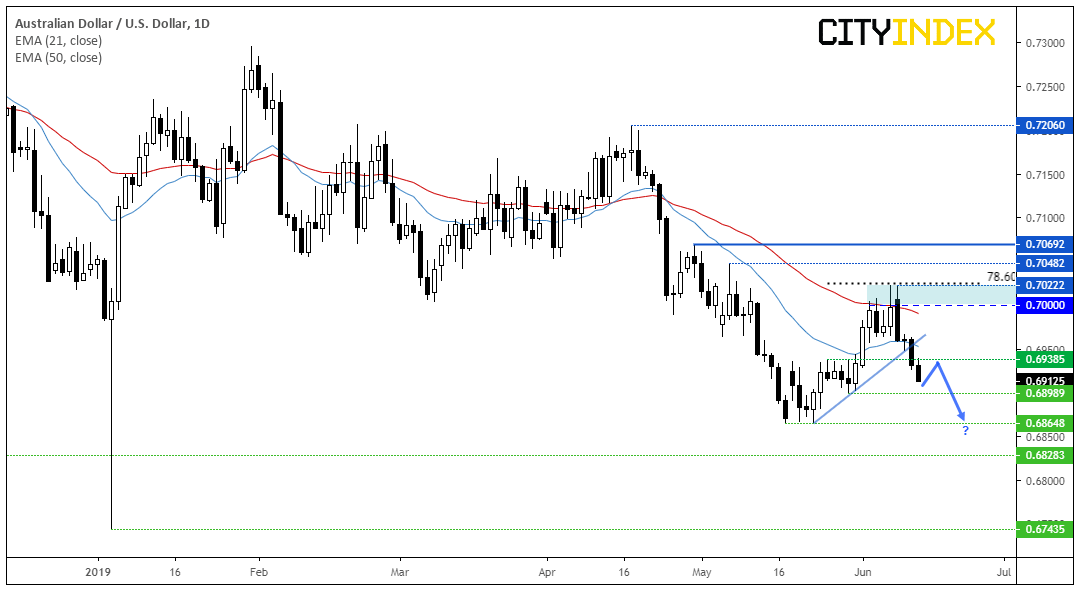

As for AUD/USD, the retracement line and 0.6938 pivotal support level gave way ahead of the meeting (with the latter acting as today’s high). Currently at a 9-day low, momentum favours the bear-camp so we’d prefer to sell into intraday rallies and target key support levels.