With markets starting to question how many rate cuts we’ll see from major central banks this year, sentiment towards China’s economic outlook deteriorating rapidly and riskier asset classes coming under pressures, Thursday shapes up as an important session for Australia’s ASX 200 and the AUD/JPY which are threatening to break their respective uptrends from the rally that began late last year.

ASX 200 slices through upside support

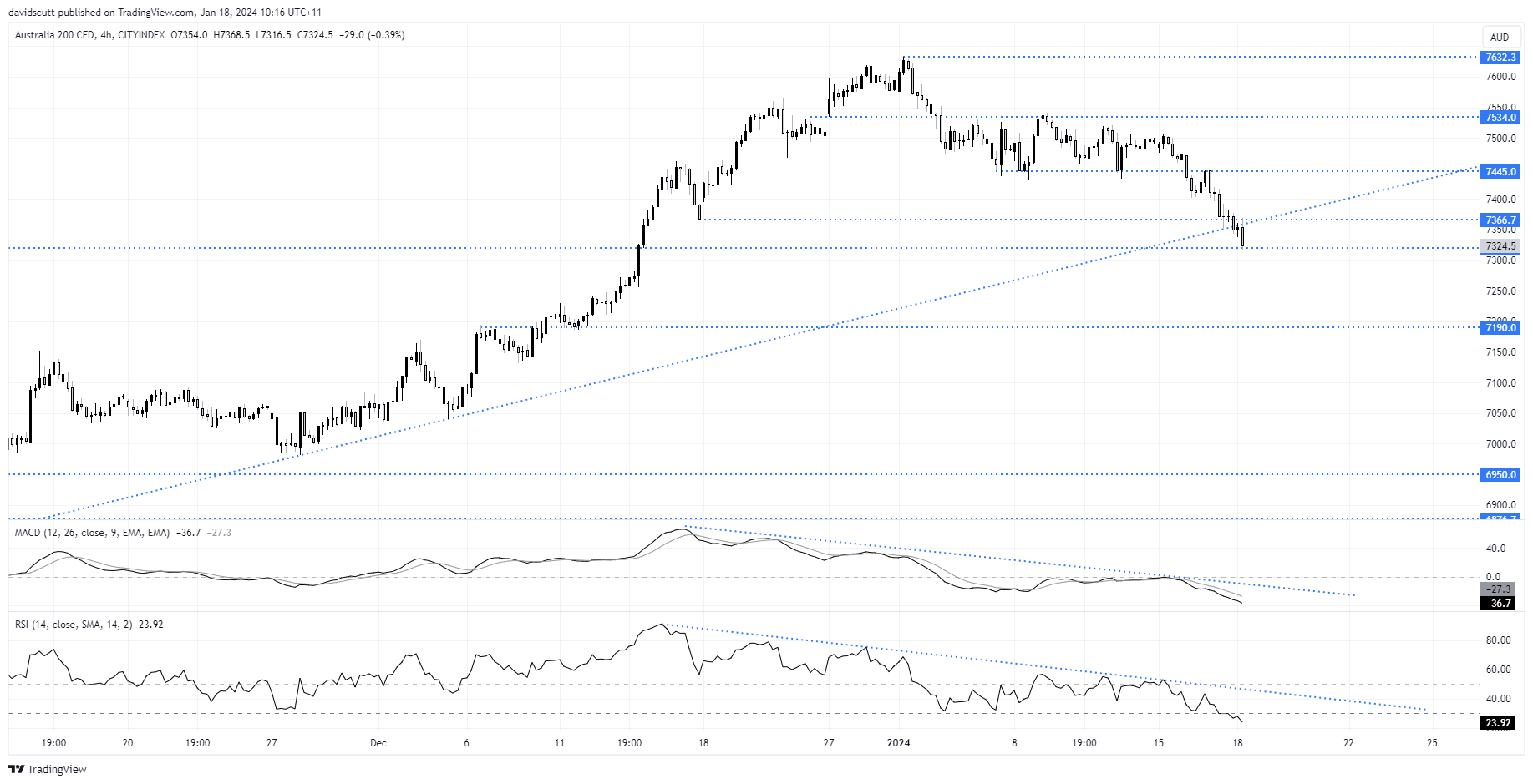

You can see the perilous position the ASX 200 finds itself in on the four-hourly chart, breaking through uptrend support to test 7320, a resistance level it struggled to overcome last year. With little in the way of major visible support of the latter, a clean break of the latter could see the index slide towards 7190, a level that acted as both resistance and support in the early stages of the risk rally.

Alternatively, a bounce would likely see the index push back towards the intersection of uptrend and horizontal support located around 7360. Beyond, 7445 would be the next upside target.

Australia’s December jobs report due at 11.30am AEDT – where employment is expected to lift by 15,000 leaving the unemployment at 3.9% -- is one event traders need to keep an eye on. Another is how the market responds to BHP’s fourth quarter production report released before the start of trade. The largest constituent in the index reported iron ore production in Western Australia rose 5% from the prior quarter. Copper production increased 7% over the first half of FY 2024.

Externally, the performance of mainland Chinese equities may also be influential with Australia’s equity market sinking into negative territory on Wednesday as Chinese stocks tanked.

AUD/JPY risks may be skewed higher near-term

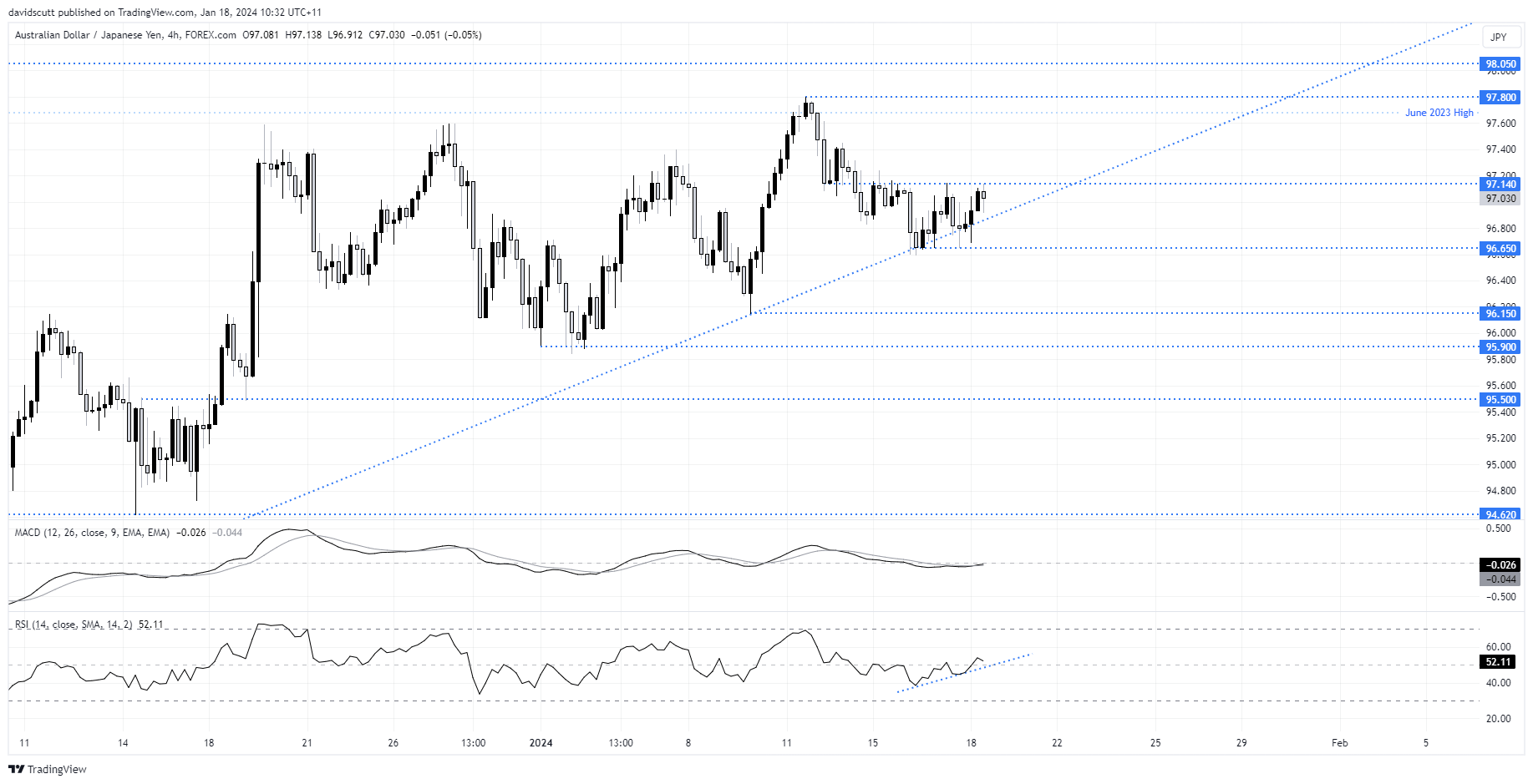

While not as dire as the ASX 200 picture, AUD/JPY is another market threatening to break the uptrend it’s been in since early December, hindered by significant weakness in the AUD/USD which has largely offset massive gains for the USD/JPY as yield differentials between the US and Japan widen yet again.

Sitting in an ascending triangle and having unsuccessfully broken lower despite several downside probes over the course of this week, the price action suggests the risks may be skewed higher in the near-term. A break of 97.14 may open the door to a test of the 2024 YTD high of 97.80. Below, AUD/JPY found buyers below 96.65 on several occasions this week. Should that demand dry up, the next downsides target would likely be 96.15 and 95.90.

While Australia’s employment report may cause short-term volatility, movements in US 2-year yields are likely to be highly influential given they not only driving movements in USD/JPY but also broader risk appetite. China’s equity market performance is another near-term factor to watch.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade