Asia Morning: US Stock Markets Sharply Lower amid Tech Shares Sell-off

On Thursday, U.S. stocks closed sharply lower amid tech shares sell-off. Nasdaq 100 plunged 649 points (-5.2%) to 11771, the largest decline since March. S&P 500 slumped 125 points (-3.5%) to 3455 and the Dow Jones Industrial Average lost 807 points (-2.8%) to 28257. The VIX Index, a measure of expected volatility, jumped 26.5% to a 3-month high of 33.60.

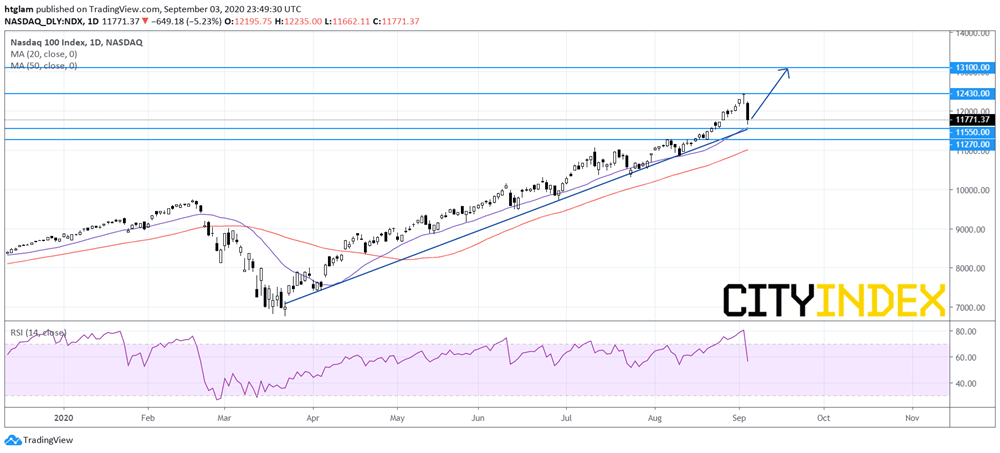

Nasdaq 100 daily chart:

Source: Gain Capital, TradingView

Technology Hardware & Equipment (-7.24%), Semiconductors & Semiconductor Equipment (-6.22%) and Software & Services (-4.87%) sectors led the decline. Approximately 67.4% of stocks in the S&P 500 Index were trading above their 200-day moving average and 79.8% were trading above their 20-day moving average.

Regarding U.S. economic data, the ISM Services PMI dropped to 56.9 in August (57.0 expected) from 58.1 in July, while initial jobless claims fell to 0.88 million in the week ending August 29 (0.95 million expected) from 1.01 million in the prior week.

Later today, the closely watched non-farm payrolls report for August will be released (+1.35 million jobs, jobless rate at 9.8% expected).

European stocks were broadly lower. The Stoxx Europe 600 Index retreated 1.0%, Germany's DAX 30 slid 1.4%, France's CAC 40 fell 0.4% and the U.K.'s FTSE 100 was down 1.5%.

The benchmark U.S. 10-year Treasury yield declined to 0.6347% from 0.6477% Wednesday, down for a fifth straight session.

WTI crude oil futures (October) slipped 0.3% to $41.37 a barrel.

Spot gold lost 0.6% to $1,931 an ounce, as the U.S. dollar extended its rebound.

On the forex front, the ICE U.S. Dollar Index gained 0.1% on day to 92.78, posting a three-day rebound ahead of the non-farm payrolls report due later today.

EUR/USD was little changed at 1.1849. Official data showed that the eurozone's retail sales declined 1.3% on month in July (+1.0% expected).

GBP/USD slid 0.6% to 1.3276. Research firm Markit will publish U.K. Construction PMI for August later in the day (58.3 expected).

USD/JPY slipped 0.1% to 106.10, after a three-day rally.

USD/CAD rose 0.7% to 1.3131. Official data showed that Canada recorded a trade deficit of 2.45 billion Canadian dollars in July (2.50 billion Canadian dollars deficit expected). Later today, Canada's official jobs report will be released (+250,000 jobs, jobless rate at 10.1% expected).

Meanwhile, AUD/USD plunged 1.0% to 0.7266. Australia's July trade surplus totaled 4.61 billion Australian dollars (5.35 billion Australian dollars surplus expected), according to the government. On the other hand, China's Caixin Services PMI slipped to 54.0 in August (53.9 expected) from 54.1 in July.

Latest market news

Yesterday 10:44 PM

Yesterday 05:00 PM

Yesterday 03:13 PM