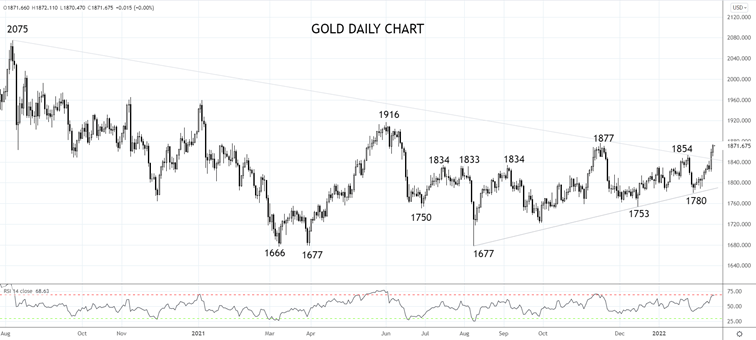

Despite a hawkish Fed shift that prompted the start of a sharp move higher in real yields and the U.S dollar, gold stubbornly refused to remain below $1800 for any meaningful length of time.

In 2022 the breakdown between gold and real yields intensified. In an article here in early February, we noted the market was likely accumulating gold for a trifecta of excellent reasons.

“to protect against the debasement of fiat currency/inflation, equity market volatility, and European geopolitical tensions.”

An argument strengthened by Friday's 1.76% rally in the gold price above $1860 on reports that Russia may invade Ukraine as early as this week.

The ability of gold to sustain and build on the break above downtrend resistance at $1845, coming from the 2020, $2075 high early this week, is a bullish development.

Providing gold does not retreat below support $1845/33 (daily closing basis), the expectation is for gold to extend gains towards $1950. Aware that news headlines around Russian/Ukraine tensions will play a role in what path it takes to travel there.

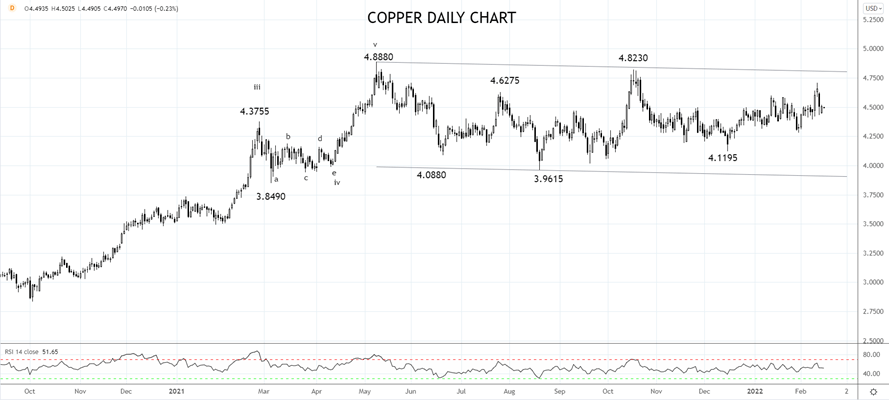

Copper

The price of copper rose sharply in the first half of 2021, with LME copper prices hitting a record $10,747.5/mt and Comex copper futures hitting $4.88 lb. However, since then, the copper price has traded sideways.

China's regulatory reset last year, which caused deleveraging in the real estate sector in Q3, along with a higher U.S. dollar and prospects of a more aggressive Federal Reserve hiking cycle, currently overshadows record low copper inventories.

Following an easing of China monetary policy in December and as demand for copper is expected to grow as the world moves further along the clean energy cycle, the preference is to buy dips in copper towards the bottom of its range at $9,200/000 or $4.20/00 area. The profit target is a retest of 2021 range highs.

Source Tradingview. The figures stated areas of February 15th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade