Market Summary:

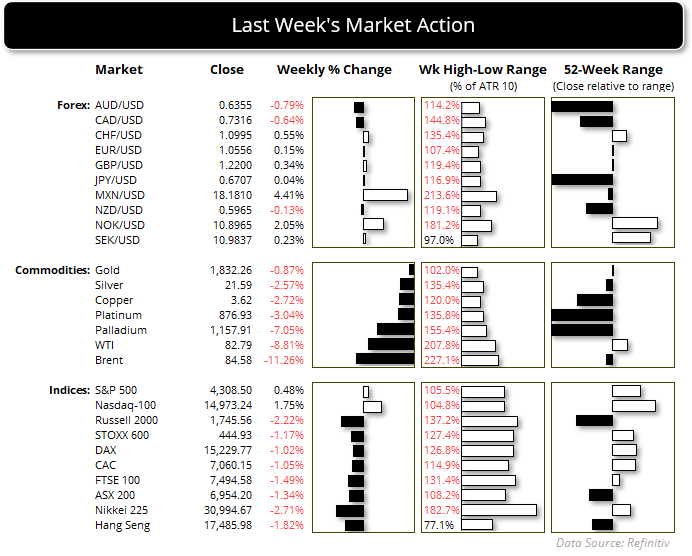

- Nonfarm payroll job growth blew past expectations on Friday, rising 336k versus 170 forecast and 227k previously. August’s figure was also upwardly revised from 180k.

- Unemployment rose to 3.8% from 3.7%, and average hourly earnings (and inflation input) rose just 0.2% compared with 0.3% expected. This took the edge off of the strong job growth figure, and Fed Fund futures continue to imply that the Fed will hold rates at their next meeting in November

- Canada’s strong employment report upped the odds of another Bank of Canada interest rate hike, with 63.8k jobs added and average hourly earnings rising to 5.3%

- The US dollar snapped an 11-week winning streak and formed a bearish pinbar week to warn that its 7.8% rally is in need of a pause or retracement

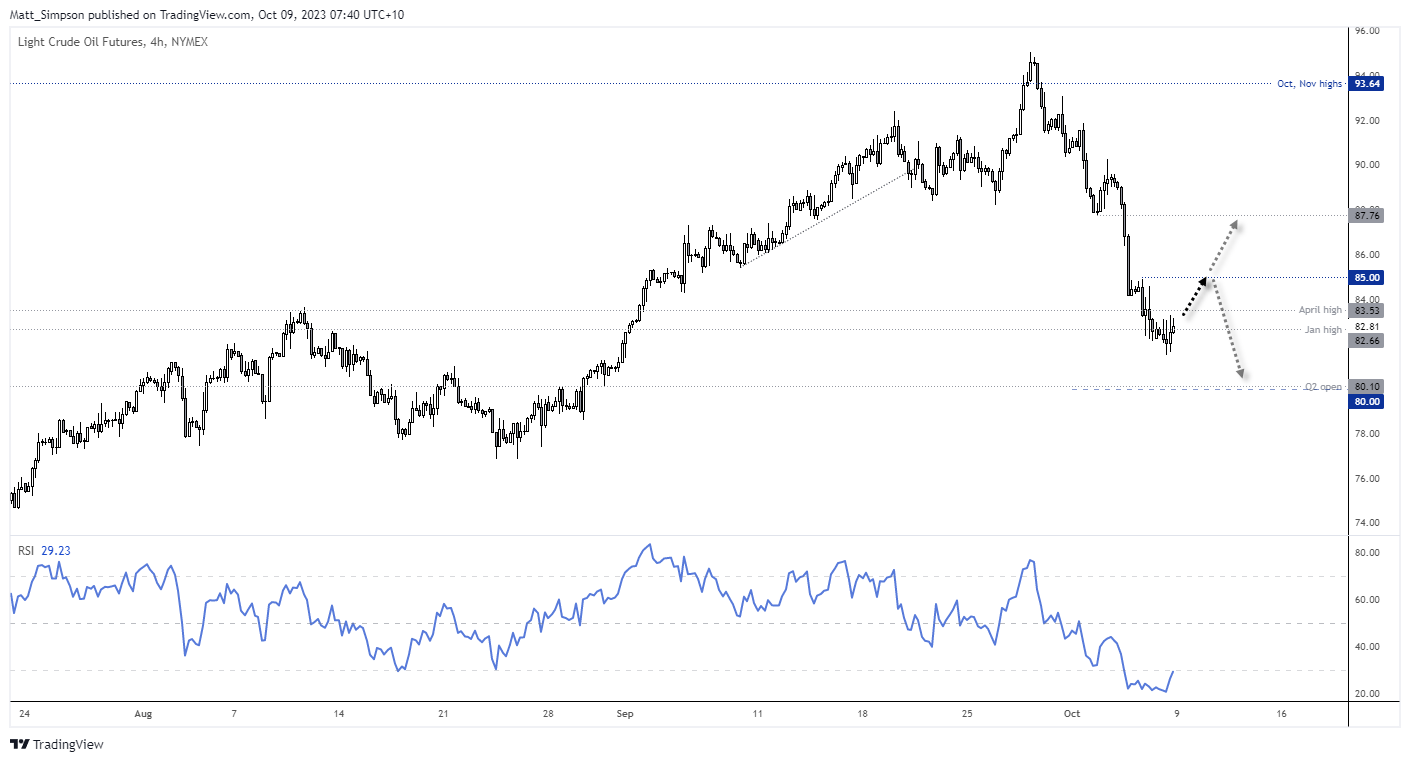

- Oil suffered its worst week in six months, with WTI crude oil falling over -8% due to demand concerns. However, oil prices found stability on Friday and traders are now watching developments in the Middle East to see if Iran’s declaration of war with Palestine will escalate and effect supply.

- Gold fell for a third week, although bearish volatility was around a third of the prior week’s and prices are showing signs of stability above the YTD low and $1800

- AUD/USD fell for a third week, although it found support above 63c and closed back within its 110-pip range that the open to close has finished in over the past seven weeks

- Volumes should pick up in Asia this week with China returning from a 1-week public holiday

Events in focus (AEDT):

- Public holiday in Japan and Canada

- No major economic new is schedule in today’s Asian session

- 17:00 – German industrial production

- 19:30 – EU Sentix investor confidence

- 00:00 – Fed Logan speaks

- 00:15 – Fed Vice Chair for Supervision Barr speaks

- 01:00 – US employment trends index

- 03:50 – Fed Governor Jefferson speaks

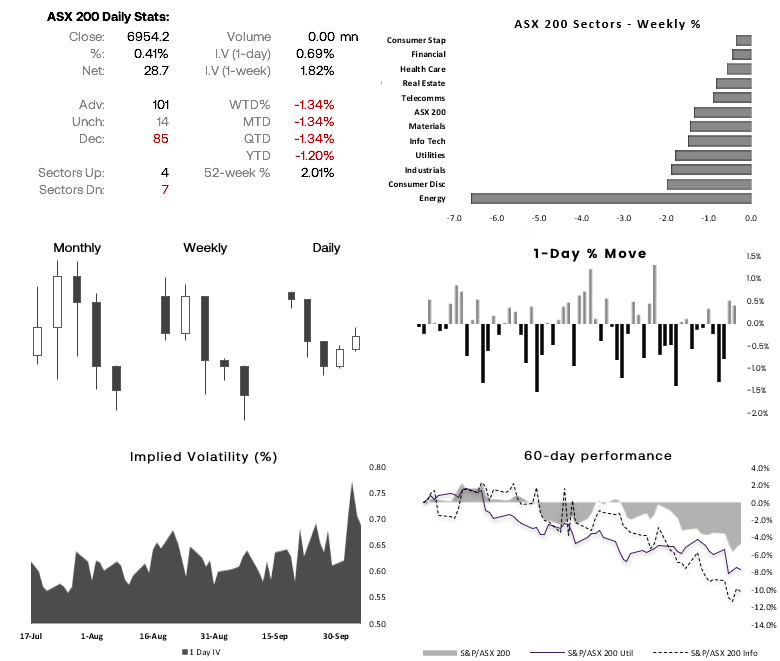

ASX 200 at a glance:

- The ASX 200 rallied for a second day on Friday as it recovered from its false break of key support around 6,900

- 7,000 remains a likely level for bears to fade into, but it would also be an important level for bulls to conquer and open up a run for 7,100

- Global sentiment remains a key driver for the ASX, and the best bet of the ASX staging a recovery rally is if yields were to retrace meaningfully. But as of yet there are no obvious signs of a top.

WTI crude oil technical analysis (1-hour chart):

Oil prices stabilized on Friday, with WTI crude oil posting a small bullish candle and helping RSI (2) move higher from oversold to hint at a swing low on the daily chart. The 4-hour chart shows that the decline is trying to form a base above $80, and that several upper and lower wicks coincide with a loss of bearish momentum. This suggests that prices are trying to form a base and may try to bounce higher. $85 is an initial target for bulls to target, a break above which opens up a run for $88 as there is little in the way of resistance above this level. If bears maintain control, $80 is the next major level to focus upon.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade