The BOJ held interest rates at -0.1% and the YCC (yield curve control) band at 0.5%. But they also announced that they will aim to control the ‘flexibility’ of its 10-year target rate of +/- 0.5%, and allow the yields to rise above the ceiling by a “certain degree”. This is not a widening of the band as such, but a more relaxed approached to controlling the bond yield around it.

We saw some large moves across global markets on Thursday, following a report in the Nikkei newspaper that the BOJ were going to discuss tweaking its yield curve policy. This prompted some excitement that the BOJ were an important step closer to widening or scrapping the YCC band of +/- 0.5% on the 10-year JGB.

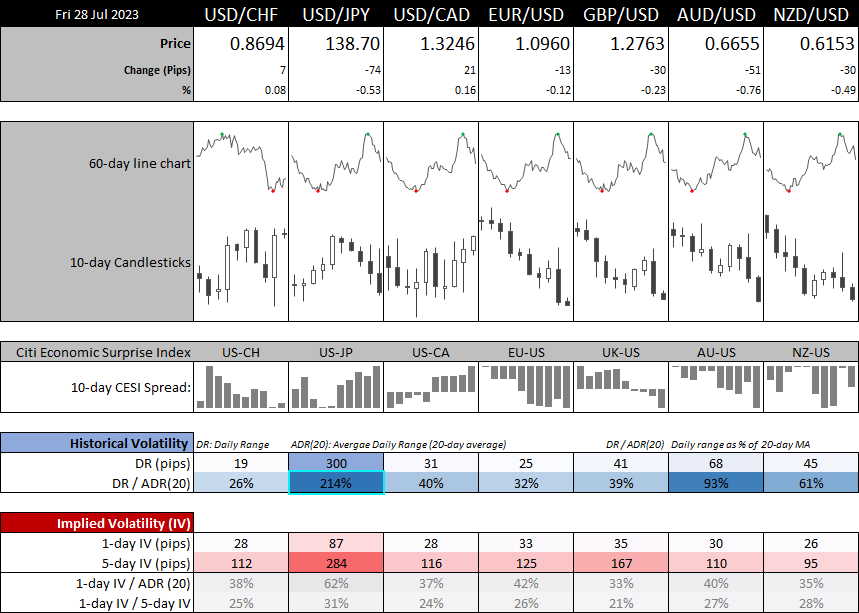

Wall Street indices printed prominent bearish outside day, with Dow Jones Industrial leading the losses with a -0.67% down day, the S&P 500 was -0.64% lower although the Nasdaq 100 got off lightly with -0.22%. The Japanese yen was higher across the board on Thursday, with GBP/JPY falling -1.69%, EUR/JPY down -1.48% and AUD/JPY off by -1.31%. And that saw AUD/JPY reach our bearish target around the 93.15 low faster than expected. The euro was already facing pressure after the ECB raised rates by the expected 25bp, but hinted at a potential pause in September.

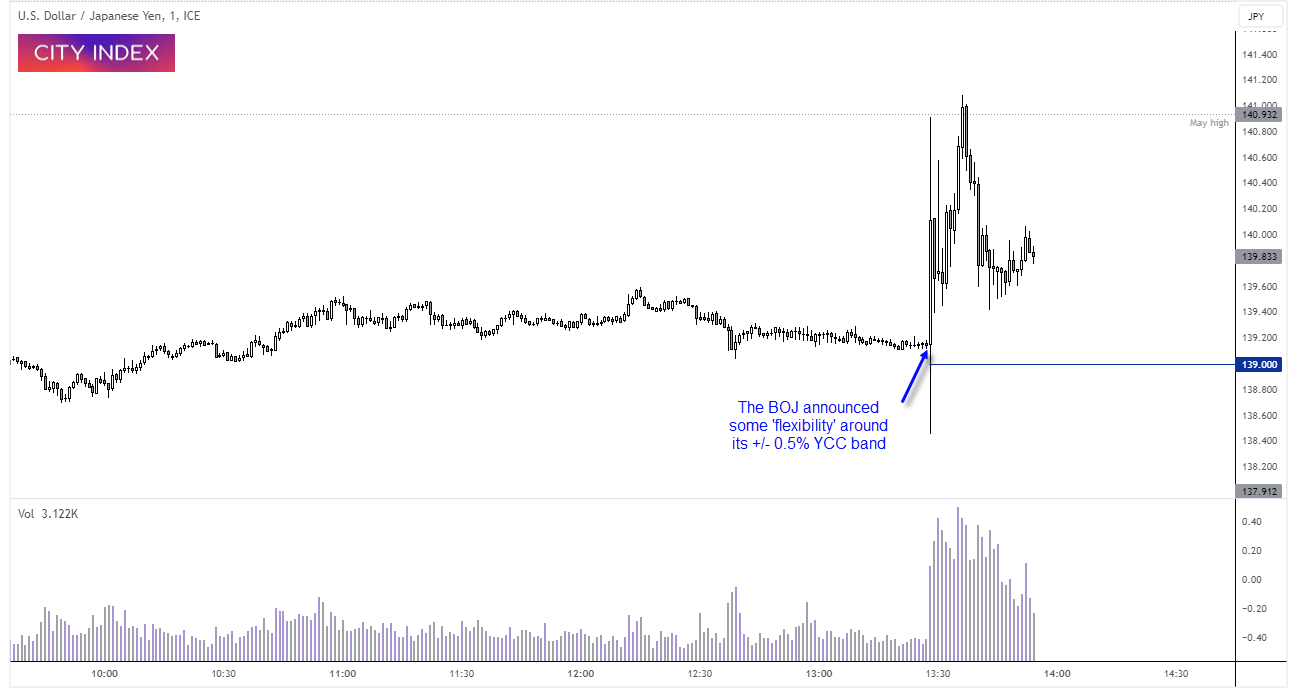

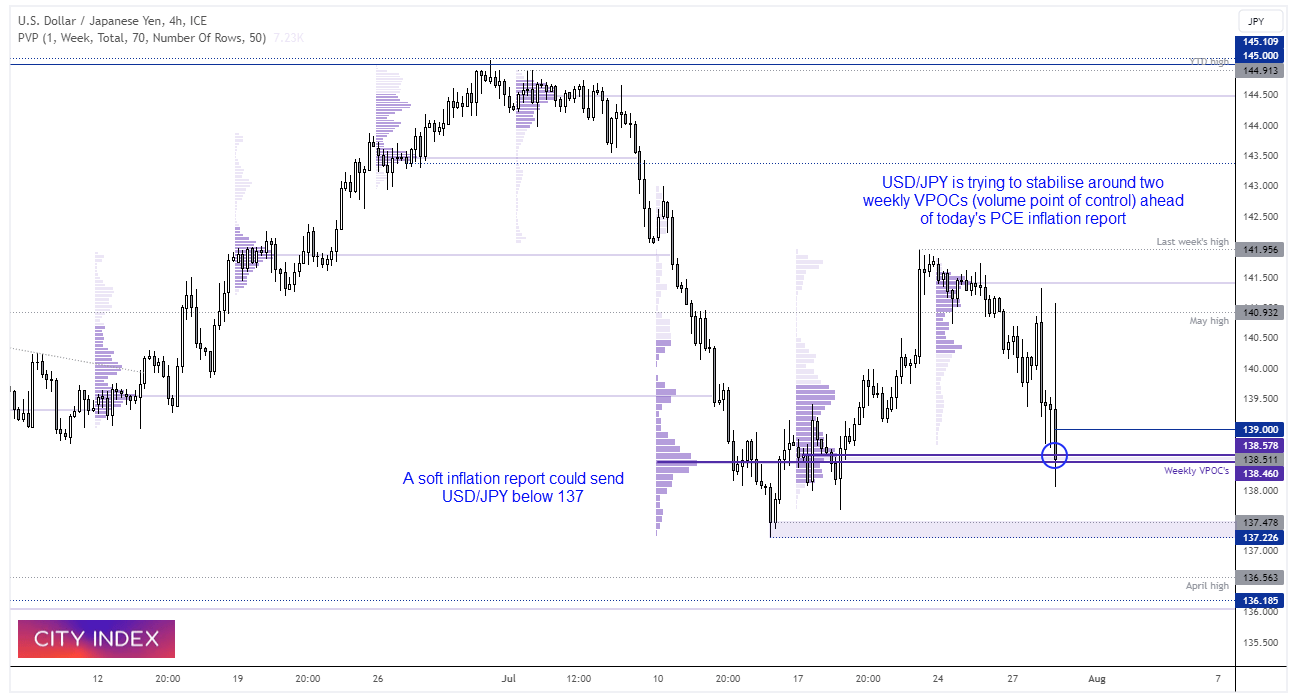

However, as markets had priced in an expectation of greater action, it led to some disappointment and saw then yen hand back much of Thursday’s gains. USD/JPY spiked either side of 139 before tapping 141, and has since returned to the centre of its daily range and exceeded its 1-day implied volatility range.

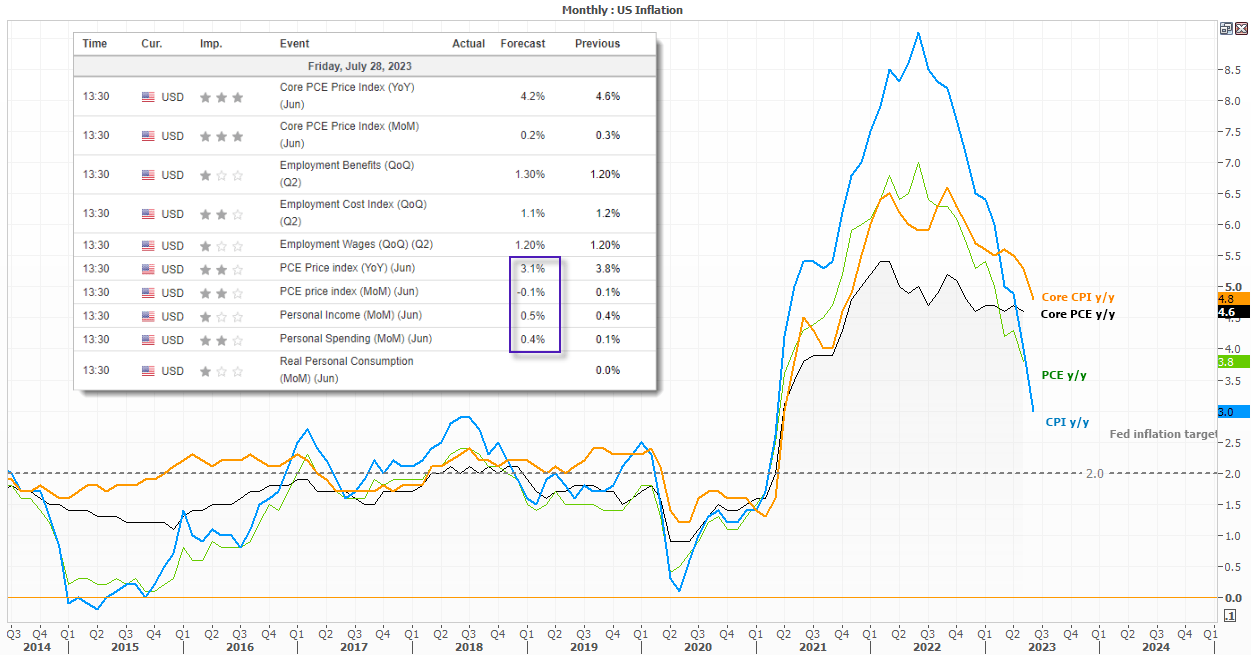

The focus now shifts to today’s PCE inflation report form the US, which could be the difference between another pause or a hike at the Fed’s September meeting. Jerome Powell emphasised the importance of incoming inflation data, and if core PCE softens as expected the we’ll likely be looking for USD/JPY to close below 137 for the week.

USD/JPY 4-hour chart

Price action remains volatile, but USD/JPY is showing the potential for stability around 138.50, near two weekly VPOCs (volume point of control). A hot US inflation report could see prices recover and shoot for 141 again, whilst a weak CPI set could send it to a fresh cycle low and close beneath 137 this week.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade