- USD/CNH has fallen to multi-month lows

- A sustained reversal in the yuan may flow through to other Asian FX majors such as JPY and AUD

- Near-term, Monday’s US 20-year Treasury auction may play a major role in dictating the direction of the USD

The latest episode of US economic exceptionalism may be coming to an end, resulting in US bond yields and US dollar coming off their highs. Major Asian FX names like the Japanese yen and Chinese yuan have been taking note, strengthening further against the buck on Friday. Given its ties to the performance of emerging market assets, these moves normally bode well for the Australian dollar which is threatening to break out of the sideways trading range it’s been in for several months.

Upside pressure eases on USD/JPY and USD/CNH

Last week we asked the question whether the plunge in the US dollar index following the US October report – the largest this year – was a turning point for broader asset classes, suggesting it may lead to further upside in gold and the S&P 500 if that was the case. Adding to the sense it may have been the start of a more prolonged move, even FX pairs that were among the biggest underperformers from the prior bout of US dollar strength – like USD/JPY and USD/CNH – are showing signs of rolling over.

That shouldn’t come as a surprise given US economic data has been a little spotty following a stellar Q3, resulting in the yield advantage the US enjoys over other major FX names narrowing noticeably across all tenors.

For two-year yields, which often reflect market views on the monetary policy outlook from central banks, the US advantage over equivalent Japanese debt has narrowed by over 30 basis points from the highs. Against Chinese 2-year yields, the differential has compressed by an even larger 45 basis points.

While the Japanese and Chinese economies are hardly rollicking along, it’s been the softening in the US data that has been the major driving force behind these moves. That’s probably limiting the ability for the yuan and yen to really get moving when it comes to a meaningful reversal.

USD/CNH hits multi-month lows

When it comes to lead indicators for what broader Asia FX may do against the dollar, there are worse places to look than USD/CNH. After threatening to break to new cyclical highs for much of the past few months, it has started to rollover recently, hitting the lowest level since August last Friday. 7.2100 looms as important for the near and longer-term performance, coinciding with the intersection of horizontal support and uptrend support dating back to the start of the year. A downside break may usher in a more prolonged reversal, setting the course for push towards 7.0000 or lower. Alternatively, a bounce from short-term oversold conditions is also a possibility, bringing former support located at 7.23750 and 7.2700 into play.

At some point the yuan will likely find some decent traction against the USD, but whether this is “that” moment remains unclear given the Chinese economy continues to struggle thanks to weakness in the property sector. Whichever way the yuan moves, it may be influential on other major Asian FX names like the Japanese yen.

USD/JPY slices below 150, but will is stay there?

Coinciding with the USD/CNH unwind last week, USD/JPY broke uptrend support dating back to the start of November, falling from 150.40 to 149.20 before bouncing into the New York close. Unless we see a big risk-off event or large spike in US yields, USD/JPY seems to be evolving to a sell-on-rallies rather than a buy-on-dips play. But much like the CNH, the risk of significant downside appears limited given the sluggish Japanese economy is reducing the the risk of the Bank of Japan normalising monetary policy settings.

On the topside, resistance is found at 150.15 and again at 150.76. Support kicks in at 149.85, 149.37 and 149.20. Near-term, a US 20-year Treasury auction will likely determine how US yields and dollar fare in the latter parts of Monday’s session.

AUD/USD bulls battling bears above .6500

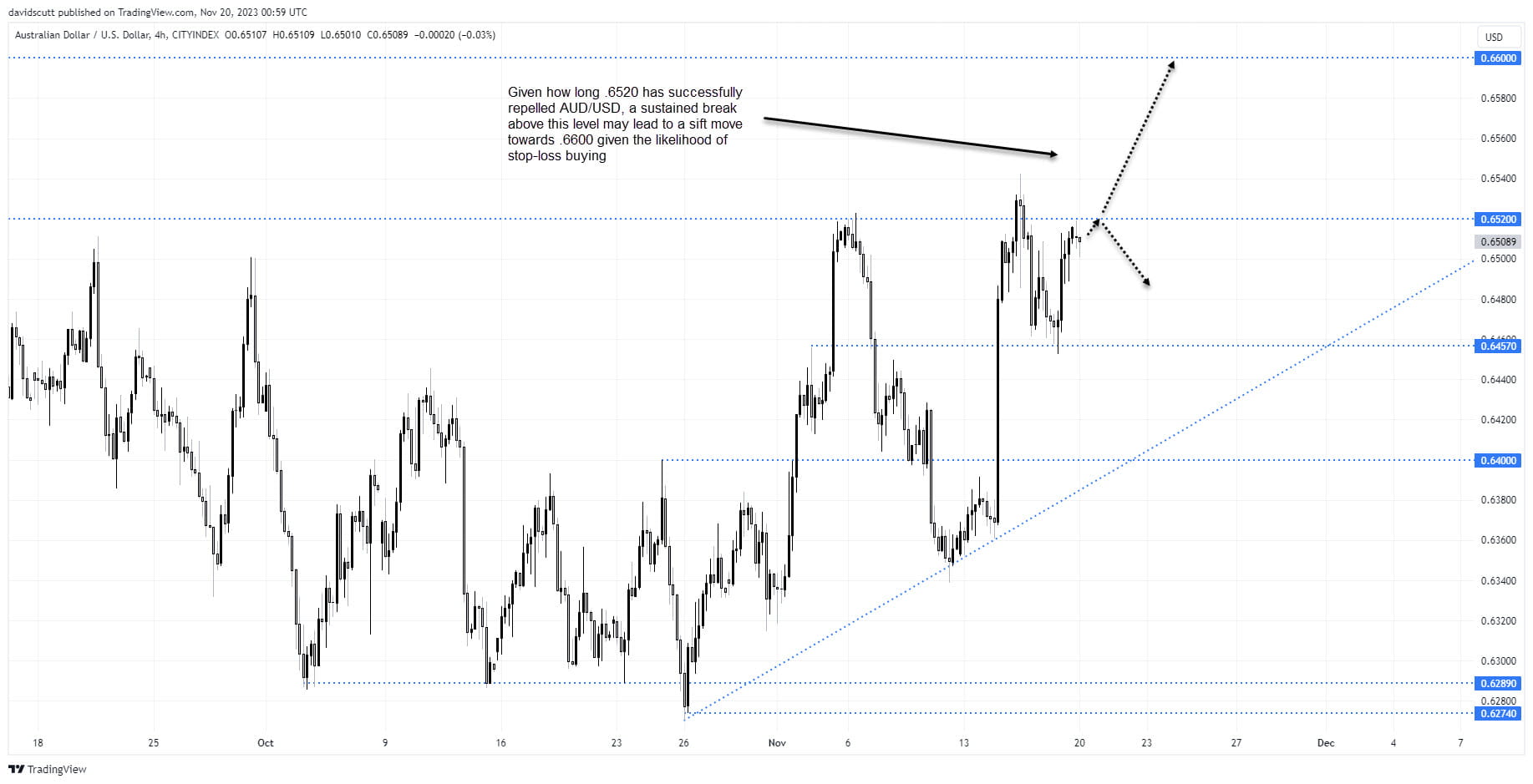

With two of Asia’s FX heavyweights looking more constructive, that may also flow through to AUD/USD. Unlike USD/CNH, it has yet to break out of the sideways trading range it’s been stuck in since August, running into sellers parked around .6520. While there’s some key RBA events during the week, you get the sense AUD/USD is more likely to be driven by offshore considerations rather than domestic factors, making movements in other Asian FX pairs potentially important.

A sustained break of .6520 could lead to a push towards .6600 given the likelihood of sizeable stop-loss buying. On the downside, minor support is located around .6457 with .6400 the next downside stop after that.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade