- USD/CAD analysis: NFP, Powell and FOMC all paint a bullish US dollar story

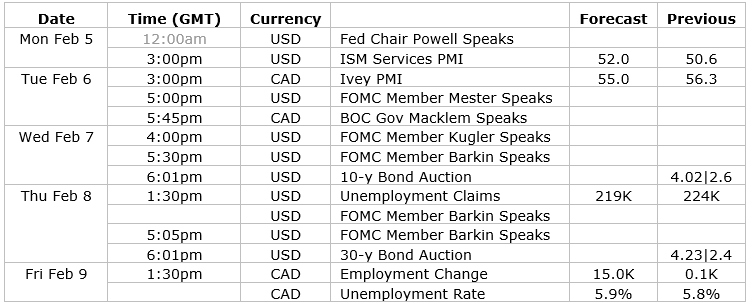

- Data highlights are ISM services PMI and monthly jobs report from Canada

- USD/CAD technical analysis point to bullish break above 1.35 handle

The USD/CAD is among the major currency pairs to watch this week, with the US dollar likely to remain in sharp focus after Friday’s strong US jobs report. With crude oil falling sharply last week, this could pressurise the oil-sensitive Canadian dollar ahead of the nation’s own employment report on Friday. Will we see a clean breakout above the 200-day average and key resistance at 1.3500 this time?

NFP, Powell and FOMC all paint a bullish US dollar story

There is little justification for investors to start selling the US dollar at this early stage following a robust jobs report that practically put an end to discussions about an early rate cut. Despite expectations that investors would refrain from selling the dollar after a hawkish Fed meeting last week, they did so. Now, the focus is on whether there will be genuine commitment from dollar bulls this time. Early indications suggest there might be, with Powell admitting on Sunday that the Fed is wary of cutting interest rates too soon.

In an interview that was aired Sunday evening, Powell said that the “danger of moving too soon is that the job’s not quite done, and that the really good readings we’ve had for the last six months somehow turn out not to be a true indicator of where inflation’s heading.” He added that “the prudent thing to do is to, is to just give it some time and see that the data continue to confirm that inflation is moving down to 2% in a sustainable way.”

US jobs report was super-hot

Powell’s interview was conducted a day before the January jobs report was released. The data demonstrated widespread strength in the labour market, leading investors to shift from bonds to the dollar on Friday as the headline jobs growth came in well above expectations at 335K while average hourly earnings grew at a sharp pace of 0.6% month-over-month. The bullish dollar trend is unlikely to reverse unless there is a significant deterioration in US data now. The prevailing belief in an imminent Fed rate cut was dropped as the likelihood of a March trim was reduced to around 20% before falling to 15% on Monday.

The sustainability of these initial post-NFP moves remains to be seen. Fundamentally, there is little reason to oppose these shifts. However, there was an intriguing reaction after the FOMC meeting last week when US bond yields fell despite Chairman Powell downplaying the chances of an early rate cut. In response, the US dollar weakened as falling yields supported foreign currencies and gold.

Investors had convinced themselves that interest rates would decrease this year, and accordingly, yields should not remain high just because the Fed sounded somewhat cautious. While this perspective is understandable, with a couple of recent data misses fuelling such beliefs, but that jobs report provided a strong counter argument. With Friday's data release, there is potential for a new bullish trend for the US dollar to have emerged.

US ISM services PMI up next

Contrary to the post-FOMC reaction, Friday’s post-NFP price movements have shown some follow-through in the early European trade. Looking ahead, today's key data is the ISM services PMI, anticipated to improve to 52.0 from 50.5. A robust report should satisfy the dollar bulls, and even a moderately soft report is unlikely to reverse Friday's moves. I would imagine a sub-50.0 reading would be quite bearish for the dollar.

USD/CAD analysis: key data highlights to watch for Loonie

Considering the relatively light calendar week for US data, the renewed strength in the USD is expected to keep dollar bears at bay, keeping the USD/CAD supported. The key data releases relevant to the USD/CAD for this week are listed below, with the key highlight being the ISM PMI from the US and monthly jobs report from Canada.

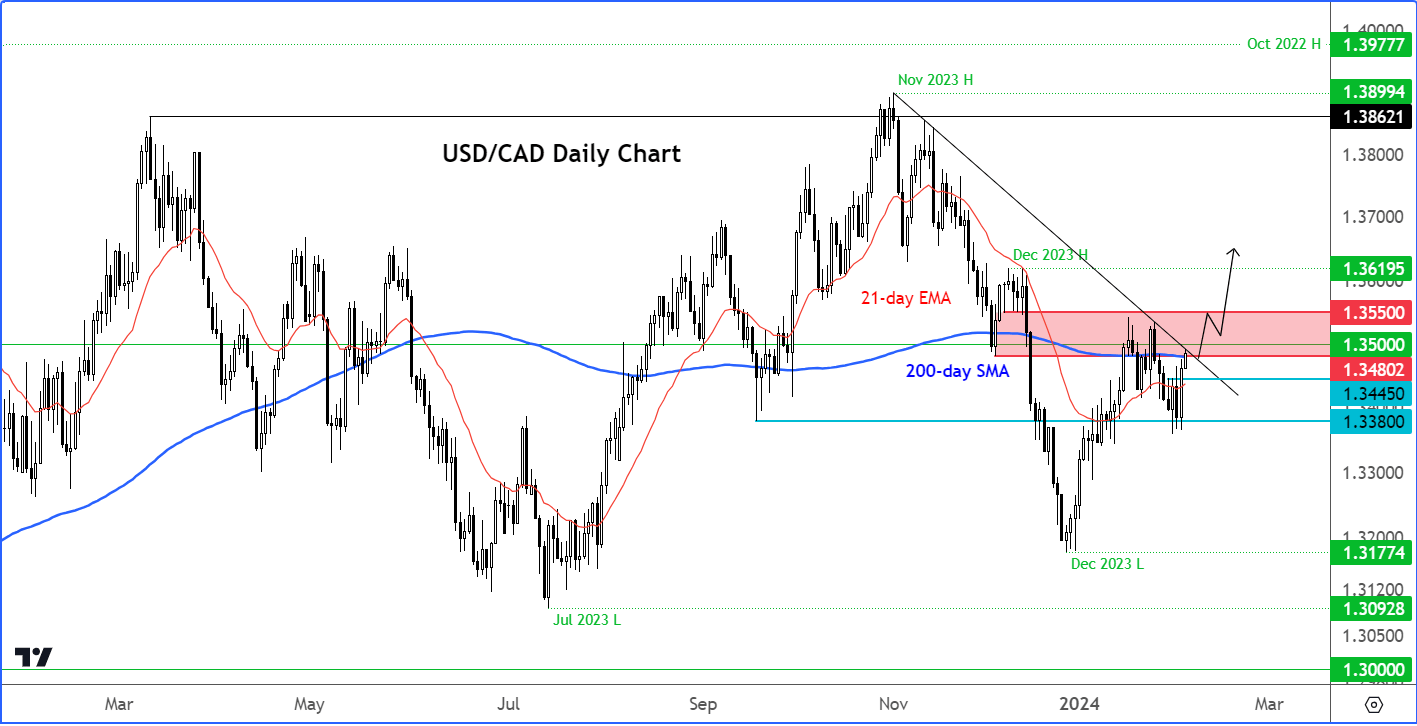

USD/CAD technical analysis

Source: TradingView.com

The USD/CAD closed Friday’s session with a bullish engulfing candle, similar to many other USD pairs. The rally means that the USD/CAD is now back within the previous resistance area around 1.35 handle, or more specifically in the range between 1.3480 to 1.3550. Here, prior support and resistance meets the 200-day average and a bearish trend line.

In light of Friday’s price action, a bullish breakout looks the more likely outcome this time around, than another sell-off. If we see a clean move above 1.3500 in the coming days, then this could set the stage for a rally towards the December high of 1.3620, and potentially beyond.

In terms of support, 1.3445 is now the first line of defence for the bulls after 1.3380 was defended again. However, in the event of a bullish no-show, and if these levels break down, then at that point you will have to drop any bullish bias you have on this pair. So, the line in the sand is around 1.3380 for me.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade