On the back of yesterday’s exploration of the three key themes to watch for the US Big Tech / FAAMG stocks this earnings season, we wanted to add a bit more color to the individual shares and their technical outlooks. Below, we outline the key dates, expectations, and technical trends to watch on each of these behemoths:

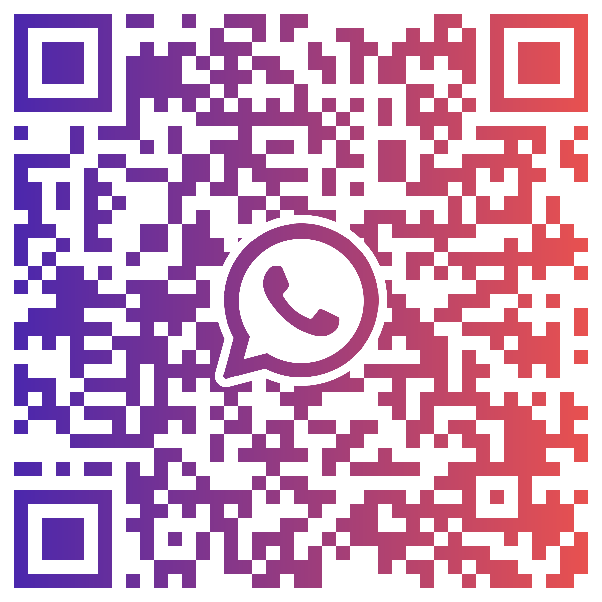

Facebook (FB) earnings technical analysis

Report date: October 25 after the close

Expectations: $3.16 of EPS on $29.5B in revenue

Unlike most of its FAAMG rivals, Facebook (FB) has seen a notable pullback from its early September record highs. As of writing, FB is in the midst of a -15% dip but finding some support at its rising 200-day EMA. Moving forward, that will be a critical level of support to watch, with a break below that zone (currently around $320) opening the door for a deeper pullback if earnings disappoint.

Source: StoneX, TradingView

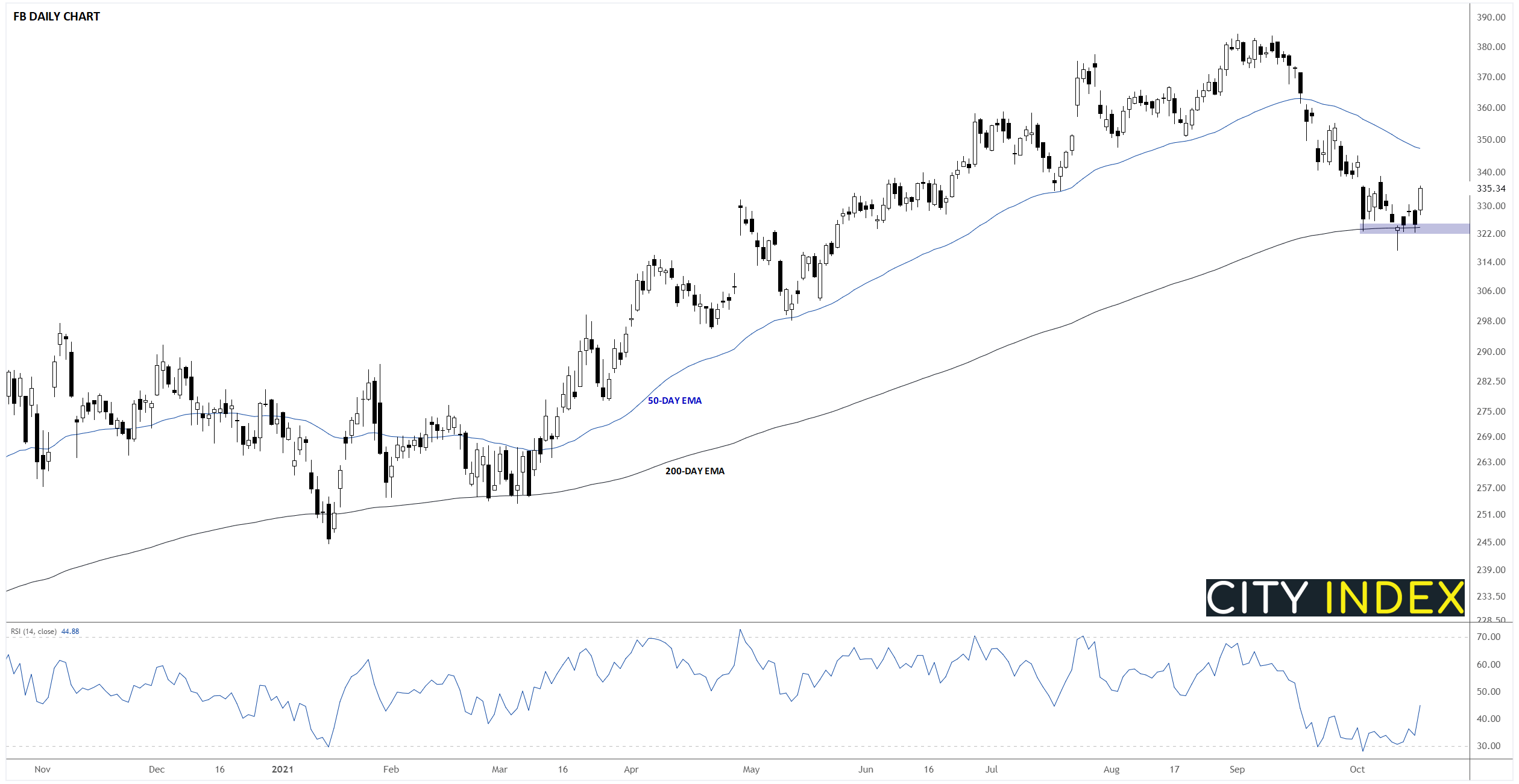

Microsoft (MSFT) earnings technical analysis

Report date: October 26 after the close

Expectations: $2.06 of

EPS on $44.0B in revenue

For its part, the stock of Microsoft (MSFT) is arguably the strongest in the sector. Prices are at record highs as we go to press and the company sports a staggering $2.3T market capitalization, trailing only Apple (AAPL) among all publicly traded companies. From a purely technical perspective, the path of least resistance remains to the topside, especially as long as prices can hold above $305, after a sideways consolidation over the last couple months has alleviated any concerns about short-term overbought trading conditions.

Source: StoneX, TradingView

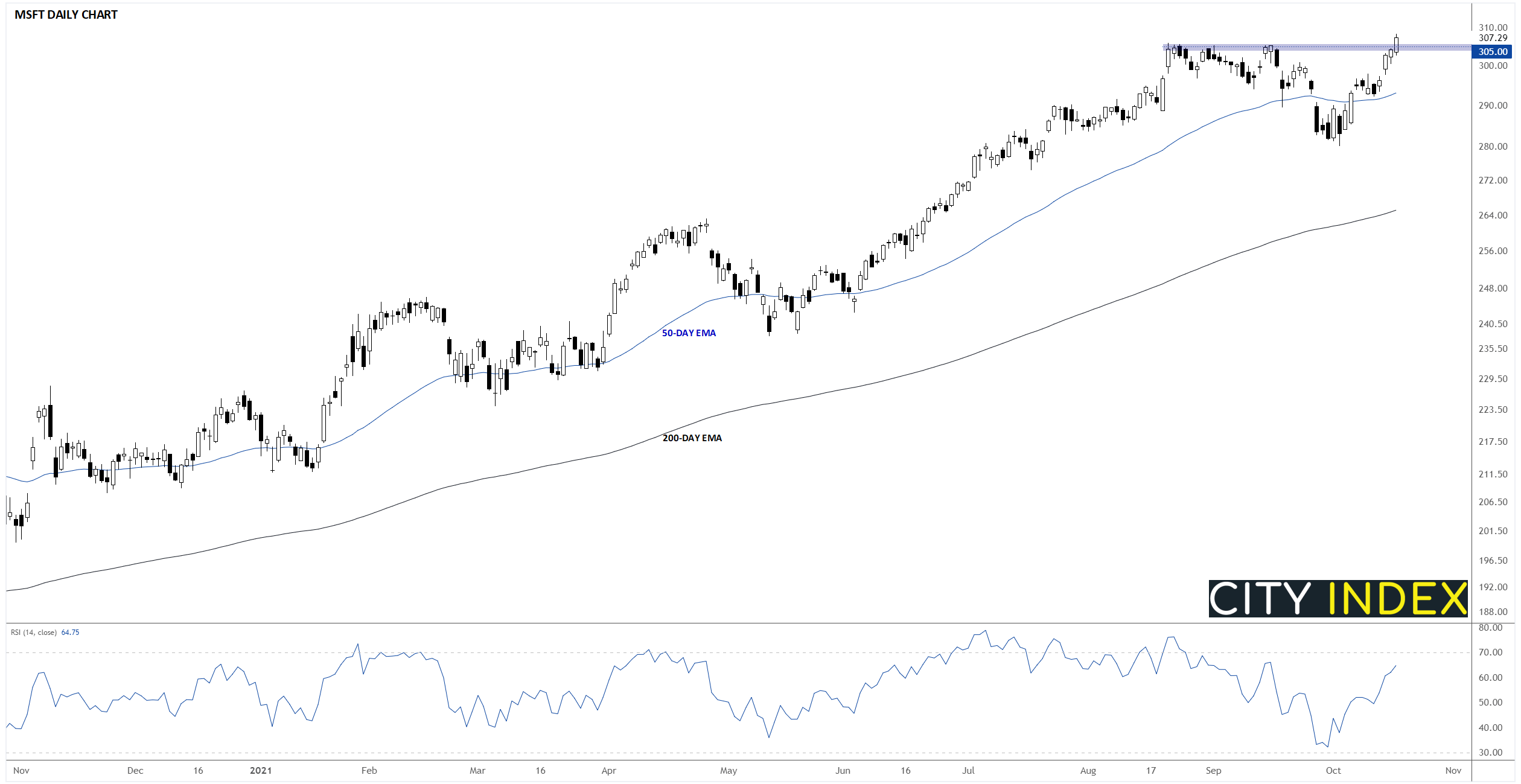

Alphabet (GOOG) earnings technical analysis

Report date: October 26 after the close

Expectations: $23.13 of EPS on $63.4B in revenue

The stock of Alphabet (GOOG), the parent company of Google, never seems to get particularly perturbed regardless of what’s happening in the global economy. Not surprisingly, GOOG remains in a clear longer-term uptrend and has regained its 50-day EMA after seeing a -9% dip through the month of September. Moving forward, traders will key in on the previous record close near $2920, with a break above that level on a strong earnings report clearing the way for continued gains heading into the holiday season.

Source: StoneX, TradingView

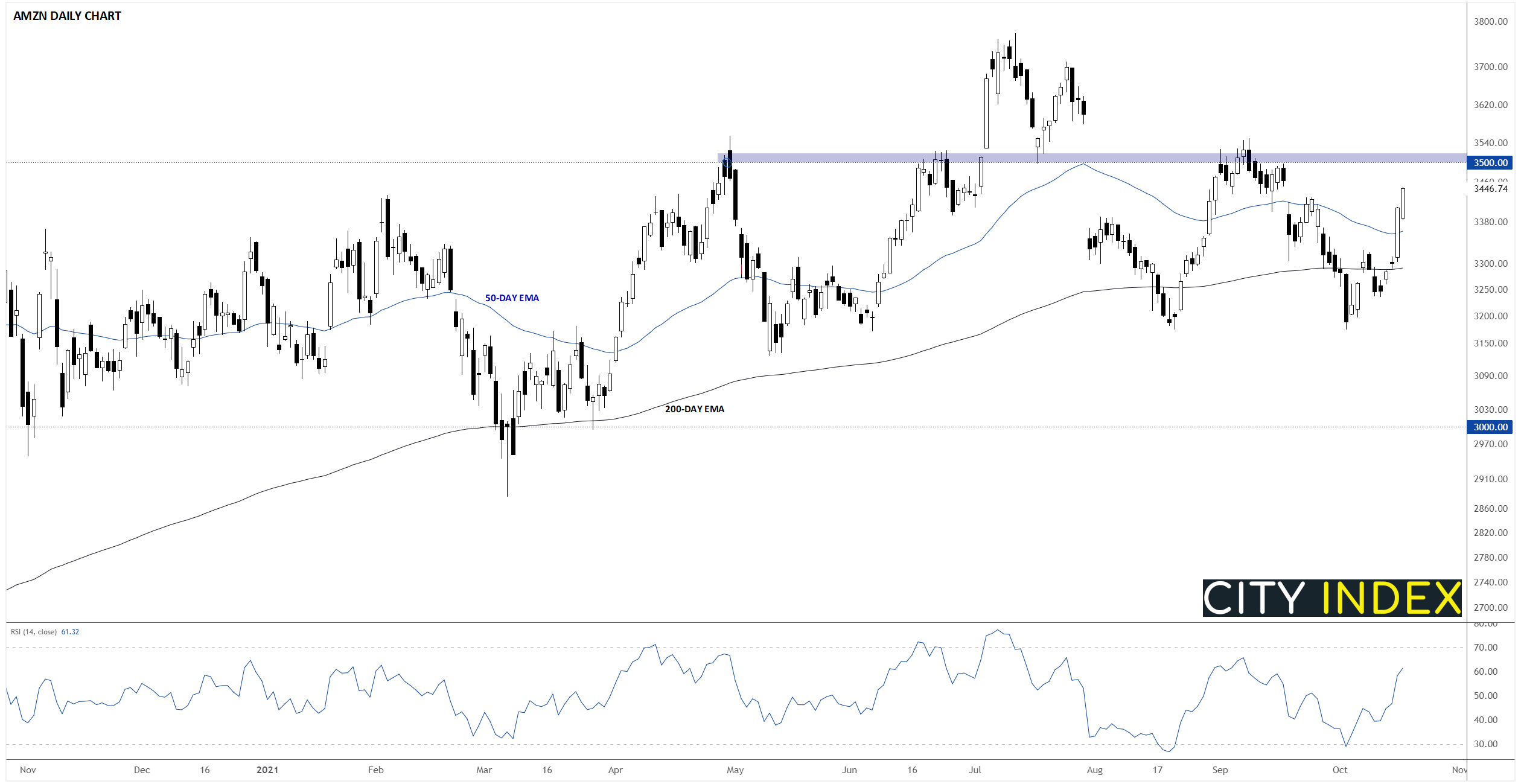

Amazon.com (AMZN) earnings technical analysis

Report date: October 28 after the close

Expectations: $8.72 on $111.6B in revenue

Despite its ubiquity in the day-to-day lives of millions, if not billions, of consumers Amazon.com’s stock (AMZN) has spent the majority of the last year simply treading water in the $3,000-$3,500 range. A July foray above that resistance level was short-lived and the longer-term moving averages are relatively flat, so it will take a sustained break and hold above $3500 for bulls to feel comfortable that the stock is regaining its mojo.

Source: StoneX, TradingView

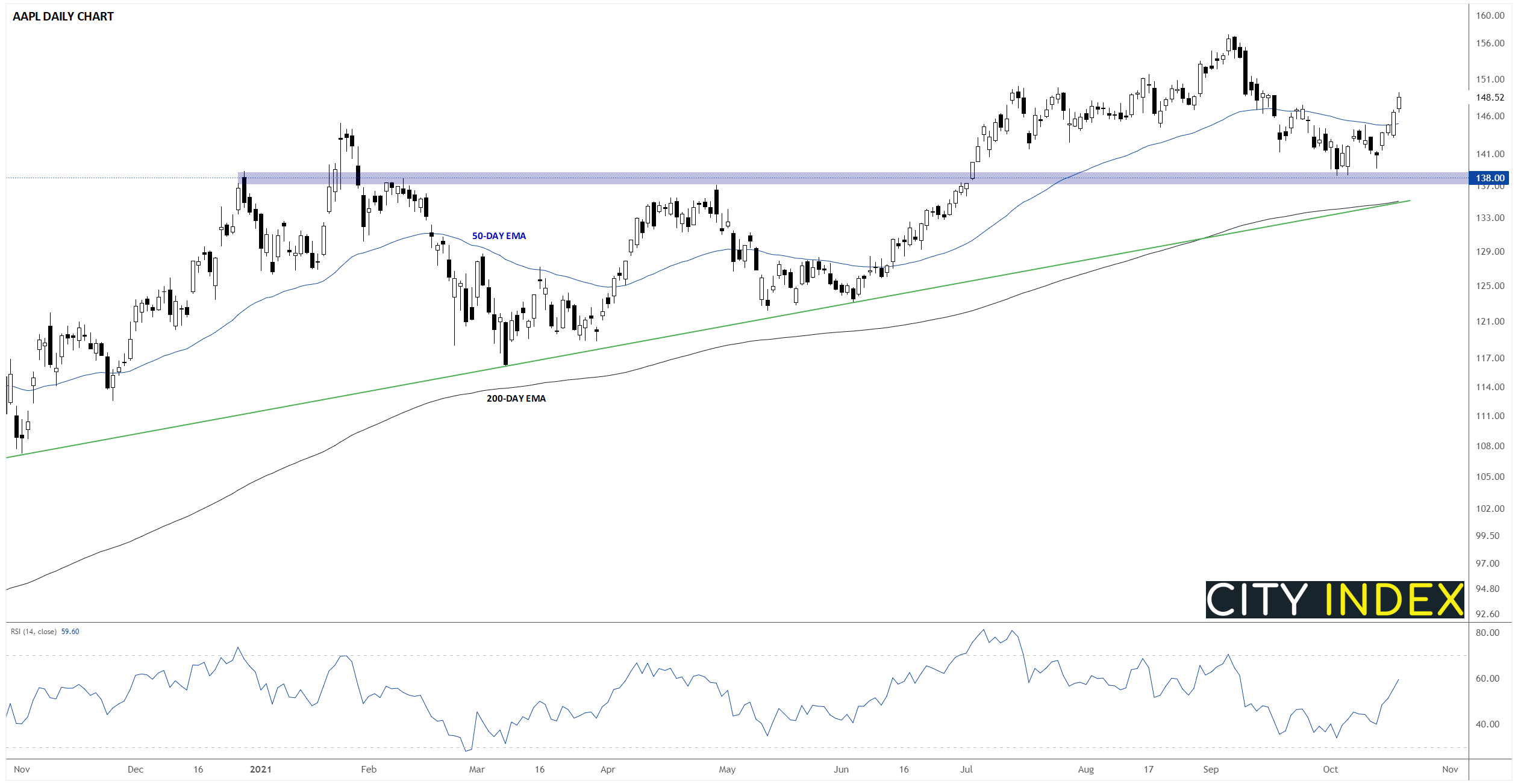

Apple (AAPL) earnings technical analysis

Report date: October 28 after the close

Expectations: $1.23 of EPS on $84.8B

Last but certainly not least (in fact, it’s the “most” valuable publicly-traded company on the planet with a market capitalization in excess of $2.4T), Apple (AAPL) reports earnings on Thursday the 28th. From a technical perspective, the stock is in the midst of a -11% correction, though the recent price action suggests that the longer-term bullish trend remains intact. Moving forward, previous-resistance-turned-support in the $138 area will be critical to watch, with bulls comfortable adding to positions and awaiting new record highs as long as that level holds as a floor.

Source: StoneX, TradingView

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade