Last week the tech-heavy Nasdaq dived 5.77% after hotter-than-expected inflation data and a profit warning from FedEx that fuelled concerns over a recession. Despite the widespread carnage, Tesla finished last week 1.22% higher at $303.35.

Tesla’s outperformance began as outlined in our last trade idea on Tesla in July here, after it delivered strong double-digit growth in sales and profits during the second quarter reporting season, despite facing supply chain problems and Covid-19 disruptions in China.

On August 24, the company executed a 3-for-1 stock split, which further helped support the stock. A stock split generally brings down the stock’s price, attracting a broader range of buyers.

Finally, the recently approved Inflation Reduction Act has placed more attention on the electric vehicle (EV) industry. The law is the most significant investment into addressing climate change in the history of the US and is expected to help the U.S reduce its greenhouse gas emissions by 50% below 2005 levels by 2030.

Ahead of the much-hyped FOMC meeting this week, we would not usually look to add new positions to trading portfolios. However, if there were a stock I was looking to buy, Tesla would again be front and centre.

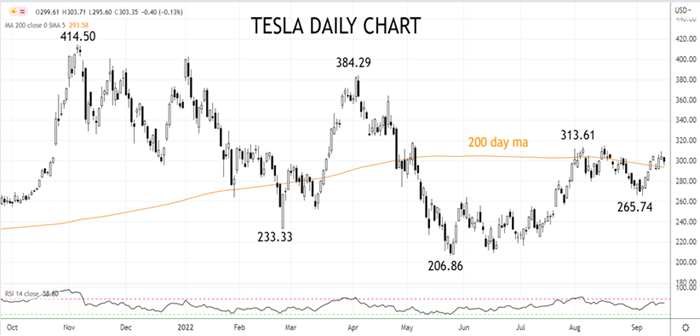

The share price of Tesla is trading above the 200-day moving average, currently at $293, but below the recent double top $314 area.

To take advantage of expected continued outperformance, use dips back to the 200-day moving average at $293 with a stop loss at $263, below the September low. The target is a push to $350, providing a trade with a 2:1 risk-reward ratio.

Source Tradingview. The figures stated are as of September 19th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade