In all honesty, this week which includes an FOMC meeting, U.S Q2 GDP data, and a slew of earnings reports from U.S mega tech stocks, is not one we would normally look to add new positions to trading portfolios.

Additionally, the S&P500 has just about reached 4050, a level we have been calling for since late June as the target for a countertrend rally. While the rally may still extend another 1 or 2%, the so-called “easy money” from the rally is now gone.

Nonetheless, if there were a stock that I was looking to buy, Tesla would be front and centre after its stellar earnings beat last week.

As outlined by my colleague Joshua Warner here, Tesla delivered strong double-digit growth in sales and profits during the second quarter despite facing supply chain problems and Covid-19 disruptions in China.

The result was a 42% rise in revenue from last year to $16.9 billion in the second quarter, just below the $17.2 billion forecast by analysts. Adjusted EPS jumped 57% to $2.27 and smashed Wall Street’s estimate of $1.85.

With two new factories in Texas and outside of Berlin in Germany, Tesla has kept its soft guidance for “50% average annual growth in vehicle deliveries” over a “multi-year horizon.”

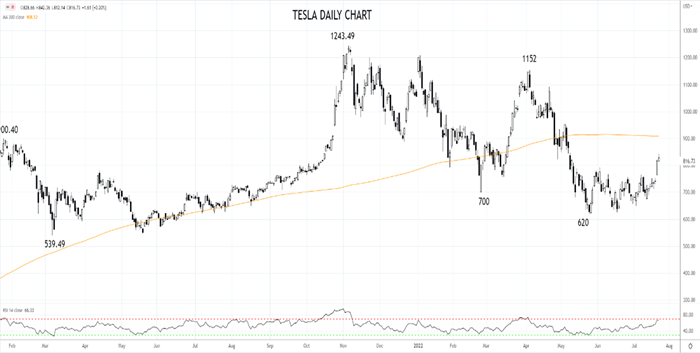

Following the earnings report, Tesla shares gapped higher and are now trading 10% above where they were pre the earnings report. Providing the Tesla share price remains above the $750/40 support area, there appears to be upside to the 200-day moving average at $900.

To take advantage of this, consider buying Tesla on dips towards $800 with a stop at $740. The target is the 200-day moving average at $900.

Source Tradingview. The figures stated are as of July 25th ,2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade